China’s Xi Jinping says regulations need to close ‘loopholes’ as Beijing cracks down on tech

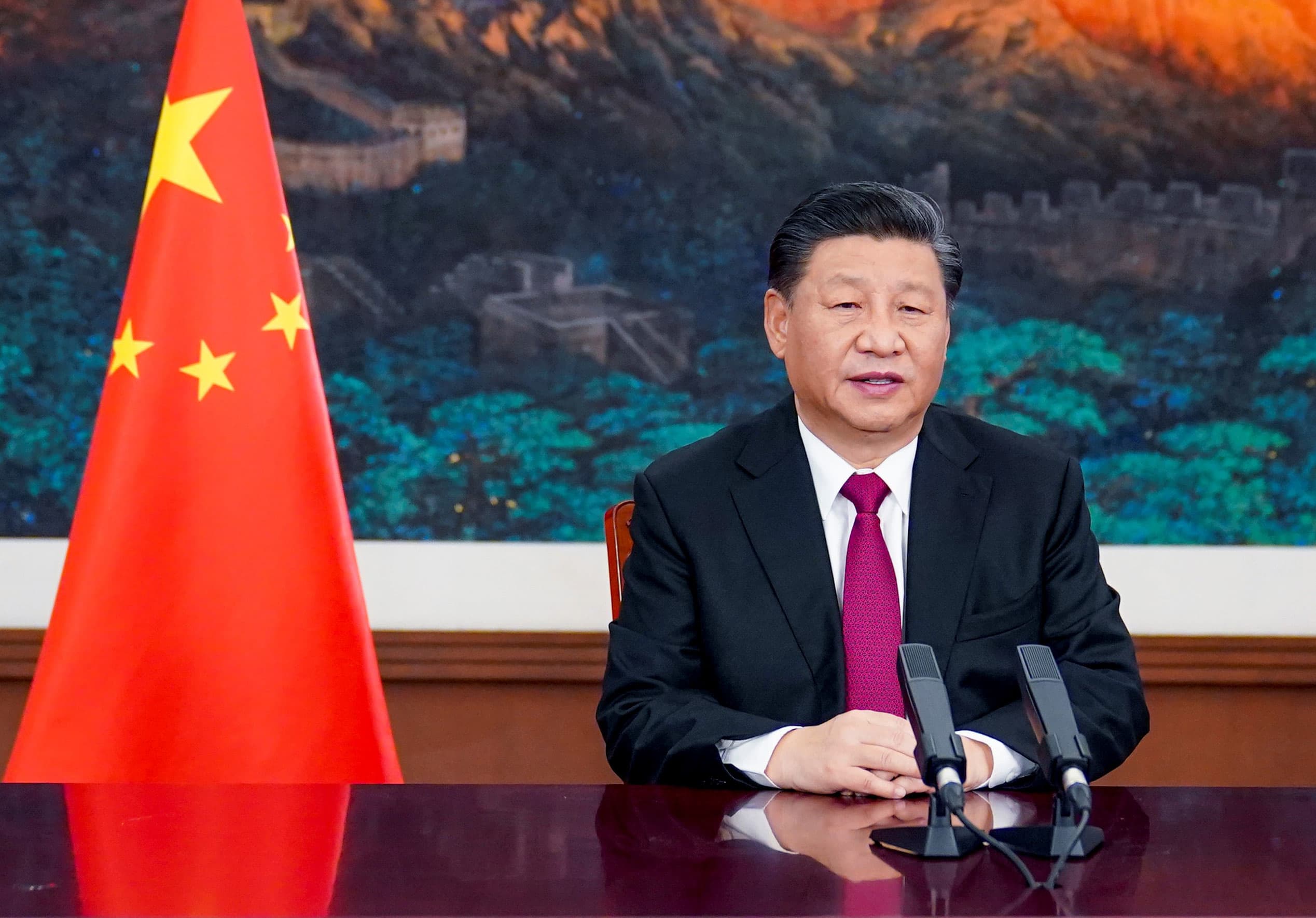

Chinese President Xi Jinping attends the World Economic Forum WEF Virtual Event of the Davos Agenda and delivers a special address via video link in Beijing, capital of China, Jan. 25, 2021.

Li Xueren | Xinhua News Agency | Getty Images

GUANGZHOU, China — Chinese President Xi Jinping called for the acceleration of laws and rules for so-called “platform” companies, a sign that Beijing will further crack down on the country’s technology giants.

“Some platform companies’ development is not standard and risks exist,” Xi said in an address to China’s top economic committee, according to state broadcaster CCTV.

The term “platform” is used as a broad brush label usually for technology companies operating anything from social media businesses to e-commerce and could include the likes of Tencent and Alibaba.

Xi said regulations need to “fill in gaps and loopholes in rules” for such platform companies.

He said that regulators need to step up oversight of these companies, prevent monopolies, promote fair competition and stop disorderly expansion of capital. Xi also said that regulators must create a “data property rights system.”

So far regulators have made a number of comments about rules on technology companies. But the latest focus comes straight from China’s top leaders, indicating there is likely to be further action taken against the private tech giants.

Beijing has so far cracked down on billionaire Jack Ma’s empire. Firstly, Ant Group, Alibaba’s financial affiliate, was forced to halt its $34.5 billion initial public offering in Hong Kong and Shanghai. Ant cited “significant issues such as the changes in financial technology regulatory environment” for the cancellation.

Alibaba was also slapped with a fine in December for not reporting previous deals properly to regulators.

There are now signs that regulators’ crosshairs could focus on other technology firms. Bloomberg reported on Monday that regulators could now turn their sights to Tencent’s financial technology business.