Dow attempts to snap 2-session skid as investors watch for Powell

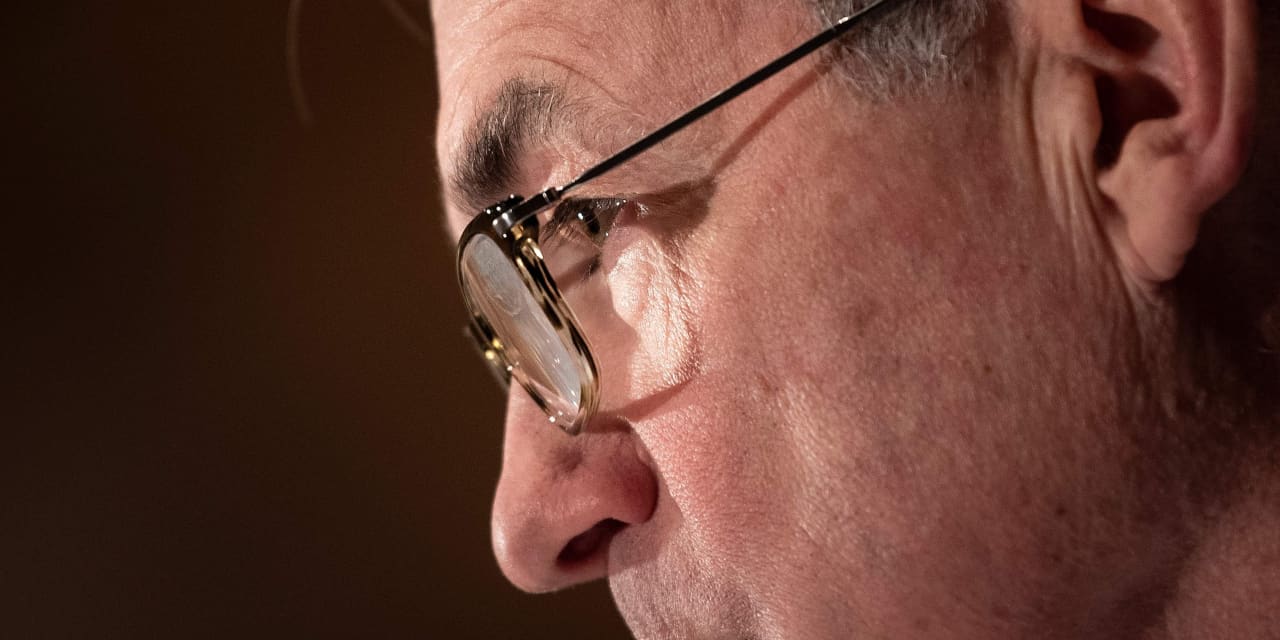

Stock benchmarks attempted to snap a two-day skid on opening on Thursday after a report on weekly jobless claims came in slightly better than expected. Investors, however, await a speech by Federal Reserve Chairman Jerome Powell at a noon Wall Street Journal conference, where he might provide further insights about the health of the longer-term health of the labor market and a recent rise in yields.

The three main equity benchmarks are trying to avoid to avoid a third day of losses, which have been attributed to the steady climb in bond yields in recent weeks.

How are stock benchmarks performing?

- The Dow Jones Industrial Average was trading 170 points, or 0.5%, at 31,439.

- The S&P 500 index picked up 17 points at around 3,836, an advance of 0.4%.

- The Nasdaq Composite Index rose 69 points, or 0.5%, to reach about 13,068.

On Wednesday, the Dow DJIA,

What’s driving the market?

Initial jobless claims in for the week ended Feb. 27 rose 9,000 to 745,000, a smaller rise than the 750,000-760,000 estimates expected by economists surveyed by Econoday and Dow Jones. And new federal jobless claims totaled 436,696 in the week.

The data come as the “great rotation” is under way as some analysts describe a shift out of highflying technology stocks, viewed as expensive by some measures, to other areas of the market considered undervalued, including energy and financials.

The move has been mostly precipitated by a recent selloff in government bonds, which has pushed yields higher as investors price in economic recovery and better times for stocks hit in the past year by the COVID-19 pandemic, after technology stocks did well from business lockdowns and social-distancing protocols last year.

The 10-year U.S. Treasury note TMUBMUSD10Y,

Worries stem from expectations that further fiscal aid from Congress will add fuel to an inflationary fire that some fear may cause a more rapid series of interest-rate hikes by the Fed.

Powell may touch on these growing concerns when he speaks at The Wall Street Journal Jobs Summit at 12:05 p.m. Eastern.

“We suspect Powell will once again try and calm the markets but todays macro news could be challenging for the bond market,” wrote Peter Cardillo, chief market economist at Spartan Capital Securities, in a research note, referring to the Fed chair’s semiannual testimony in front of congressional lawmakers last week.

“In other words, expect a choppy and volatile market,” the analyst said.

So far, central bank officials have said that they aren’t overly concerned about the move up in bond yields though they are monitoring it closely. Powell’s comments will mark the last from Fed officials before a self-imposed “blackout” period ahead of the next two-day policy meeting starting on March 16.

Meanwhile, investors are watching the progress of negotiations over the Biden administration’s $1.9 trillion COVID aid package, after Senate Democrats agreed Wednesday to narrow eligibility for some of the direct payments that are part of the proposal.

Beyond claims, a reading of productivity and costs showed that U.S. productivity tapered off less than previously estimated at end of 2020. A report on factory orders is set for 10 a.m.

Which stocks are in focus?

- Flipkart, the online Indian retailer mostly owned by Walmart WMT is considering a U.S. listing by merging with a special-purpose acquisition company, Bloomberg News reported, citing people familiar with the matter. Shares of Walmart were up 0.4%.

- BJ’s Wholesale Club Holdings Inc. BJ reported Thursday fiscal fourth-quarter profit, revenue and same-store sales that topped expectations as the COVID-19 pandemic provided a boost, while not providing a financial outlook given uncertainties related to the pandemic. The company’s stock was off 0.4% early Thursday.

- Discount retailer Burlington Stores Inc. BURL said Thursday it had net income of $155.9 million, or $2.33 a share, in the fourth quarter, down from $206.3 million, or $3.08 a share, in the year-earlier period. Burlington shares were tradin around 11% higher.

- Ciena Corp. CIEN reported Thursday fiscal first-quarter profit and revenue that beat expectations, with networking revenue falling less than forecast, while the company didn’t provide financial guidance. Its shares climbed nearly 5%.

- Kate Spade, part of the Tapestry Inc. TPR, said Thursday that Nicola Glass, the brand’s creative director, has stepped down from that role, effective April 1. Tapestry shares were off 0.4%.

How are other assets faring?

- The dollar was trading 0.2%, as measured by the ICE U.S. Dollar Index DXY.

- Oil futures were rising , with the U.S. benchmark CL.1 up $1.06, or 1.7%, to trade at $62.31 a barrel. Gold futures GC00 declined 0.1%, or $2.20, to hang around a nine-month low at $1,712.80 an ounce.

- Equities edged lower in Europe, with the pan-European Stoxx 600 index SXXP off 0.3% and London’s FTSE 100 UKX down 0.4%.

- Stocks pulled back in Asia: The Shanghai Composite SHCOMP shed 2%, giving up the previous session’s gains, Hong Kong’s Hang Seng Index HSI lost 2.2%, and China’s CSI 300 000300 tumbled 3.2%, while Japan’s Nikkei 225 NIK shed 2.1%.