Here’s how the stock market and bond yields have responded to the last 17 Fed decisions

One of the most eagerly anticipated Federal Reserve decision days since the depths of last year’s pandemic-induced market chaos has finally arrived.

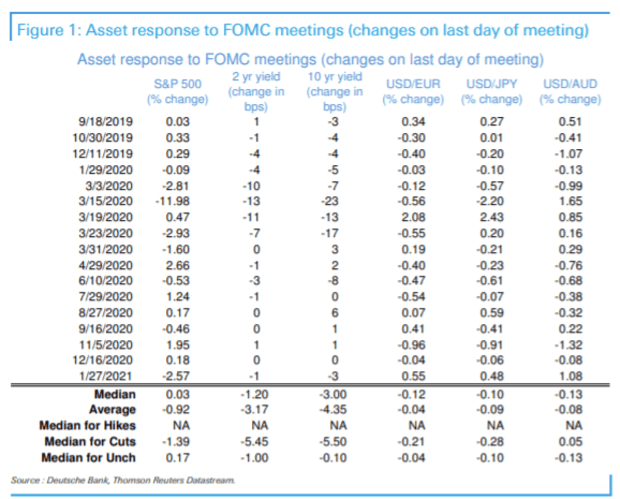

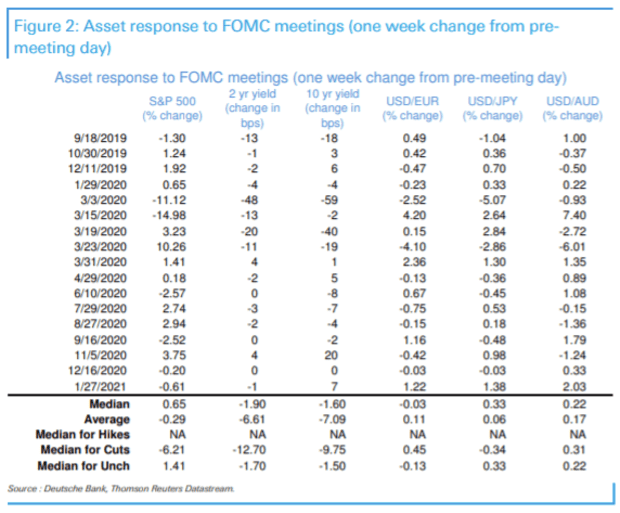

Deutsche Bank’s top macro strategist, Alan Ruskin, offered a pair of tables in a Tuesday note recapping how the S&P 500 SPX,

Context and expectations are crucial to how the market responds to Fed action or inaction, of course. Several of the dates in the table correspond with the Fed’s reaction itself to gyrations in the credit markets that were sending shockwaves through the financial system.

But with the Fed expected to make no changes to interest rates or asset purchases, it’s interesting but probably unsurprising to see that the S&P 500 has tended to show little reaction on days when the central bank stands pat, rising a median 0.17%. In the following week, the index rose a median 1.41%.

Read: What would cause the Fed to take a U-turn? Hint: a lot more than some high inflation readings

Treasury yields, meanwhile, have tended to retreat, which would likely be a welcome development at the Fed.

See: Powell to be ‘nonchalant’ in the face of rising bond yields

A renewed bond selloff was pushing yields higher Wednesday, with the 10-year rate rising to a 14-month high above 1.67%. A march higher by yields over the past six weeks initially unnerved stock-market investors fearful that rising inflation expectations would see the Fed begin to rein in monetary policy support earlier than expected, despite assurance the central bank intends for the economy to run hot and to hold off on tightening until inflation moves above its 2% target.

Rising yields on Wednesday saw renewed pressure on the tech-heavy Nasdaq Composite COMP,

The Fed likely has a tough job ahead of itself in attempting to reassure the market that it won’t be unnerved by rising yields. Ruskin said market participants are likely to believe that if the Fed doesn’t pivot now, it will shift soon.

“These are the kind of expectations which suggest that any relief Powell provides working against higher bond yields will be short-lived,” he wrote. “This also presumes that Powell puts up little resistance to higher yields, because these yields are still historically low; reflect desired stronger growth and inflation expectations; and, so far have been received as remarkably benign for risky assets, that have the strongest growth in at least seven decades to look forward to.”