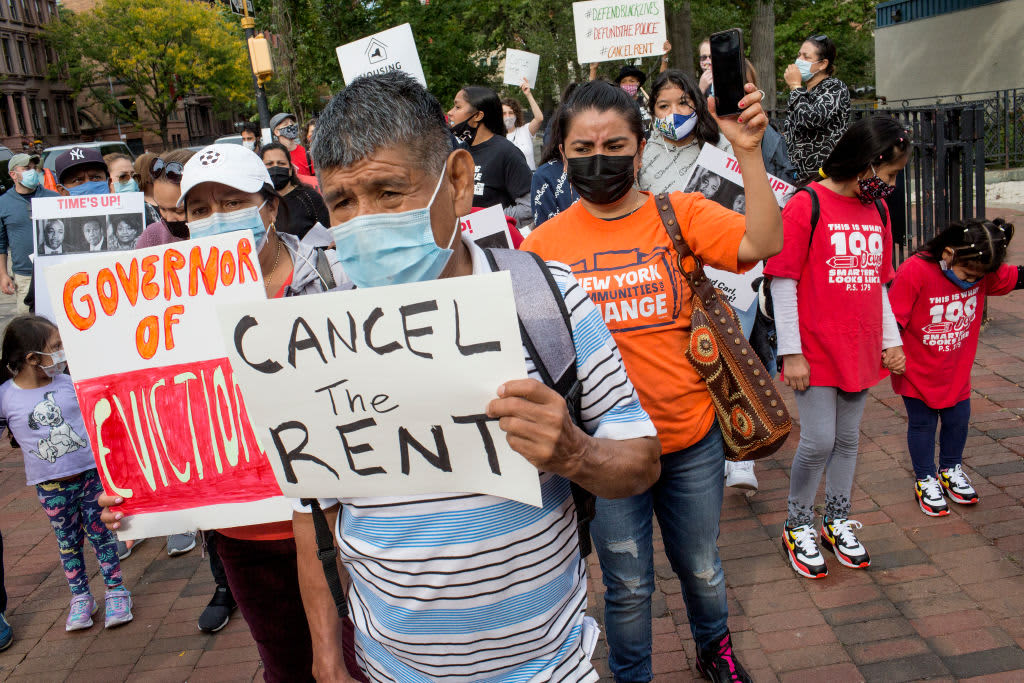

New York City housing advocates and tenants march to demand Gov. Andrew Cuomo cancel rent amid the pandemic on Oct. 10, 2020.

Andrew Lichtenstein | Corbis News | Getty Images

The new federal coronavirus relief bill that’s poised to be approved on Capitol Hill could put unprecedented sums of money into the hands of American families.

That includes new stimulus checks of up to $1,400 for adults and their dependents, as well as up to $300 per month per child through an enhanced child tax credit.

This week, some Democratic senators upped the ante, and called for recurring stimulus checks and indefinite expansion of unemployment benefits for the duration of the pandemic.

More from Personal Finance:

Covid is making it harder to get into a top college

Here’s how delaying college may impact your future earnings

College can cost as much as $70,000 a year

To some experts, the move shows the idea of guaranteed income, where a certain floor of money is provided to a targeted set of people, could be gaining momentum in the U.S.

The idea of direct checks to Americans has become more popular. Former Democratic presidential candidate Andrew Yang brought national attention to the concept when he proposed direct payments to individuals on the debate stage in 2019.

Around that time, cities like Jackson, Mississippi, and Stockton, California, started running tests to see exactly how these kinds of programs could work.

Now, even more places are embracing the concept, with 42 cities having signed on to Mayors for a Guaranteed Income, a program that helps them to follow Stockton’s lead and run their own pilots.

Those developments come as the coronavirus has further exposed the economy’s flaws, particularly with regard to income inequality, according to Amy Castro Baker, assistant professor at the University of Pennsylvania’s School of Social Policy and Practice. She is also working as a co-principal investigator of the Stockton Economic Empowerment Demonstration, or SEED.

“It has pulled the curtain back on the fact that most communities and most households, especially working-class households, have not recovered from the wealth loss of the Great Recession,” Baker said.

Now, the pandemic has exacerbated that situation for a lot of individuals and families. The Pew Research Center recently found that 1 in 10 Americans say they will never recover from the current crisis.

“Something is broken,” Baker said.

‘Give families the support that they need’

Aisha Nyandoro, founder of Magnolia Mother’s Trust

D’Artagnan Winford

Springboard to Opportunities, a Jackson, Mississippi-based organization that helps connect families who live in affordable housing to resources to help improve their lives, has witnessed the devastation Covid-19 has brought on the community.

“It’s going to take years, if not a generation, for families to get back to that foothold that they had,” said Aisha Nyandoro, CEO of Springboard.

Nyandoro is also the founder of Magnolia’s Mother’s Trust, a program that provides African-American mothers who are living in extreme poverty in the city with $1,000 per month for a year.

In 2018, the trust ran its first one-year program with 20 mothers. Magnolia finished its second round of $1,000 payments to 110 mothers last month. Now, the program is preparing to launch a third program for about 100 mothers.

Preliminary research shows the program has helped 40% of participants to avoid borrowing money. Meanwhile, 27% were more likely to go a doctor when necessary and 20% were more likely to have children performing above their grade levels in school.

“You can trust Black moms to do what is they need for their families,” Nyandoro said of the results. “We don’t have to have all of these layers of bureaucracy in order to just give families the support that they need.”

$500 per month as a ‘financial vaccine’

Michael Tubbs, former mayor of Stockton, California.

Nick Otto | AFP | Getty Images

This week, Stockton’s SEED program also released the preliminary results from its program, which started in 2019. It gave 125 of the city’s residents $500 per month for 24 months.

The results showed that program participants were twice as likely to find full-time work compared to people who were not part of it. Furthermore, participants also said they were better able to handle emergency expenses and saw improvements in their physical and mental health.

The money was mostly used for food, sales and merchandise such as home goods or clothes, utilities and car costs, according to the data. Alcohol and tobacco represented less than 1% of the spending.

“What stuck out to me was how right we were when we talked about how no $500 would replace work, but allow people who choose to do so to work more stable jobs,” said Michael Tubbs, founder of Mayors for a Guaranteed Income and former mayor of Stockton.

The data released this week show the effects of the first year of the program. Full results due in 2022 will show how the program impacted participants during the pandemic.

“We know that the $500 acted as a financial vaccine for folks who received it,” Tubbs said.

“I’m sure their outcomes during Covid-19 will be far better, sadly, than folks who weren’t able to be part of the program.”

Guaranteed income vs. universal basic income

A sign supporting Democratic presidential candidate Andrew Yang’s plan for a $1,000 monthly universal basic income at a May 14, 2019, rally in New York.

Drew Angerer | Getty Images

Both Nyandoro and Tubbs hope to see the concept of guaranteed income embraced on a federal level.

To be sure, these kinds of policies have attracted fierce criticism as well as support.

Baker remembers how people told her she was crazy when she first started working with the Stockton project.

“I was told I was risking my career as a researcher,” Baker said. “The amount of pushback we got was unlike anything I’ve ever experienced in my career.”

Now, the pandemic has only shed light on the urgent need for these kinds of programs, Baker said.

Mayors are acting first because they don’t have the luxury of time, she said. But there could be bipartisan interest in providing more aid to families on the federal level.

Yet it’s still unclear whether that would be in the form of guaranteed income or universal basic income, according to Baker.

Universal basic income, whereby everyone receives a certain amount of money, has its share of critics.

One of the problems is that the support based for universal basic income is divided, said Daron Acemoglu, institute professor at Massachusetts Institute of Technology’s department of economics.

Some want substantial universal basic income on top of the government aid programs that already exist. Meanwhile, others want to eliminate those benefits in favor of flat payments to everyone.

“That inconsistency, I think, is dangerous,” Acemoglu said.

To date, the experiments taking place in the U.S. are guaranteed income. The advantages of those is that they are targeted, and therefore cost less.

“The world has changed,” Acemoglu said. “We haven’t updated our safety net, fiscal policy.”

Before a national policy is adopted, more testing should be done, he said.

“I think we need a lot more knowledge about what works, what will be effective, what will help poor families most effectively, so experimentation is great,” Acemoglu said.