Oil Bursts Higher as Pivotal OPEC+ Meeting Looms, Dollar Eases

(Bloomberg) — Oil demonstrated its resilience in the week’s opening session, rebounding from the biggest slump since November ahead of a key OPEC+ production-setting meeting.

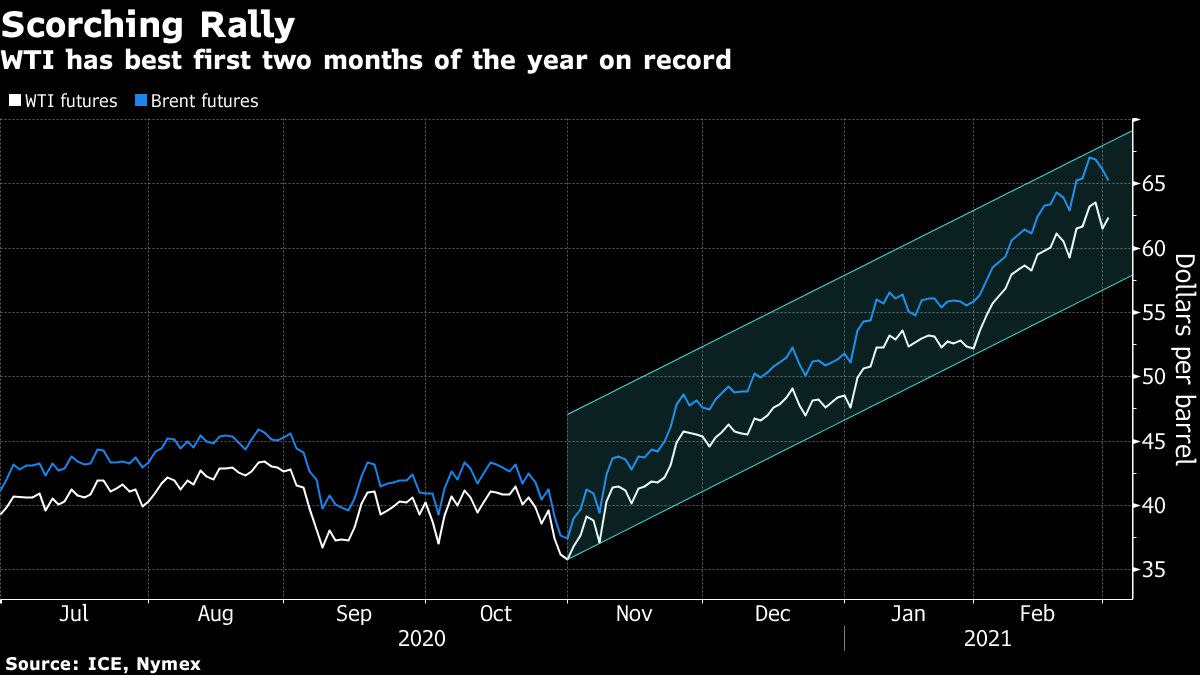

Futures in New York rose toward $63 a barrel after losing 3.2% on Friday. The alliance gathers on Thursday and is expected to return some barrels to a market off to its quickest ever start to a year. But it’s unclear how vigorously the group will act, with the Saudi Arabian energy minister calling for producers to remain “extremely cautious.” A weaker dollar also supported oil prices.

See also: OPEC+ Faces Calls to Cool Oil Market Frenzy With Extra Barrels

In addition to OPEC+ cuts, crude’s recovery from the impact of the pandemic has been driven by Asian demand, as well as fiscal and monetary stimulus in top economies. Data on Monday showed most key manufacturing economies gained ground last month, with China remaining in expansionary territory. In the U.S., President Joe Biden’s $1.9 trillion Covid relief package moved a step closer to realization after it passed the House of Representatives.

Saudi Arabia’s output reductions, the improving demand outlook, and growing popularity of commodities as a hedge against inflation have pushed oil higher this year. There has been a raft of bullish calls in recent weeks predicting crude’s rally will continue as the producer response trails consumption, while maintenance in North Sea fields is set to reduce supply.

“The OPEC+ meeting is very important,” said Michael McCarthy, chief markets strategist at CMC Markets Asia Pacific. The “market could remain easily positive in the face of a modest increase in OPEC+ production. If there is a large increase, then it could dampen the outlook in the short term,” he said.

Oil has staged a strong rebound as a recovery in demand coincided with deep output cuts by OPEC+, amounting to just over 7 million barrels a day, or 7% of global supply. This week, the Saudis will confirm if they’ll return as scheduled an extra 1 million barrels that was taken offline. A continuation of current curbs, however, could trigger a further surge.

Brent’s prompt timespread was 71 cents a barrel in backwardation, a bullish structure with near-dated prices above later-dated ones. That compares with 25 cents at the start of February and discount at the beginning of the year.

Crude sank on Friday as a strengthening dollar damped the appeal of commodities priced in the currency, and amid escalating concerns around inflation and ructions in the Treasury market. Yet, the American benchmark still managed to rally nearly 18% in February for a fourth monthly gain.

Investors are also tracking shifts in the Middle East as the Biden administration recalibrates the U.S. relationship with Saudi Arabia. In addition, an explosion struck an Israeli-owned cargo ship sailing out of the Middle East on Friday.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.