Plug Power stock jumps after J.P. Morgan says it’s a good time to buy

Shares of Plug Power Inc. charged higher Monday, after the J.P. Morgan analyst Paul Coster turned bullish, citing an “attractively priced” stock of a company with many “long-term growth opportunities.”

Coster raised his rating to overweight from neutral. He kept his stock price target at $65, which was 34.4% above Friday’s closing price of $48.38.

The hydrogen fuel cell company’s stock PLUG,

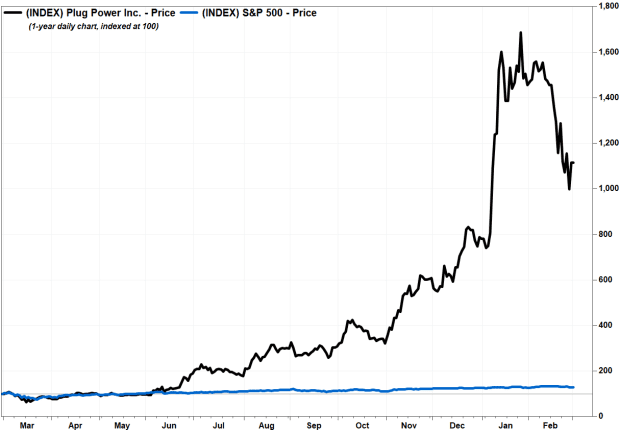

The rally comes after stock tumbled 23.4% in February. It has lost 33.9% since it closed at $73.18 on Jan. 26, which was the highest close since September 2005.

“We are taking advantage of recent volatility to upgraded Plug to overweight,” Coster wrote in a note to clients. “In the context of the firm’s many long-term growth opportunities, we believe the stock is attractively priced at present, ahead of potential positive catalysts, which include additional ‘pedestal’ customer wins, partnerships and JVs that enable the company to enter new geographies and end-market applications quickly and with modest capital commitment.”

Coster said Plug was currently a “story” stock, that appeals to investors looking for exposure to growth in renewable energy, and hydrogen in particular. And he expects the company to announce at least one additional “pedestal” customer, probably in Europe, in the coming months.

In a conference call with analysts following fourth-quarter results revealed last week, Chief Executive Andrew Marsh said Plug will doing its first large-scale stationary backup deployment with “one of the largest data center customers” in May.

“[T]hat customer could be one of our largest pedestal customers, and there are plans to how this business can roll out in 2022, 2023 and 2024 as that customer has come to the conclusion that fuel cells and hydrogen over the next few years will be very, very cost competitive with large scale on-site diesel generation,” Marsh said, according to a FactSet transcript.

As the overall market opportunity is expected to “easily exceed” $200 billion, Coster said he expects Plug to inflect into “meaningful profitability” in 2023 to 2024.

Despite the stock’s recent weakness, it still soared 97.7% over the past three months through Friday, while the S&P 500 index SPX,