Six ‘reopening’ stocks, including Bumble and Wayfair, that company insiders absolutely love

With vaccine rollouts progressing and personal savings rising to record highs, “reopening” plays in the stock market are all the rage. Even Jim Cramer has jumped aboard.

As a contrarian, I’ve been suggesting reopening plays in this column and my stock letter (the link is in the bio below) for upwards of a year. They’ve doubled, or more, in many cases. Now it makes me nervous to see the crowd come in. Often that’s a sign a theme is on its last legs.

Wait, how could the reopening theme be spent even before reopening happens? That’s easy. Often markets price events in six months in advance.

But I think this one has more to go for a simple reason. I watch corporate insiders closely, and in the past few weeks they have been huge buyers of quintessential reopening plays in dating, travel and retail.

Here’s a roundup of the purchases that tell me the theme still has legs. The insider buying also suggests these six stocks could extend their outperformance.

Dating is making a comeback

Millions of people cut back on dating because of fears about contracting Covid-19. That’ll change big time during the reopening, providing a boost to the dating app company Bumble BMBL,

We’re already seeing early signs that singles really want to mingle — and not only in the huge spring break gatherings in Florida. Fourth-quarter revenue at Bumble increased 31% compared to a more sluggish 10% growth for all of 2020, weighed down by peak Covid-19 fears during the second and third quarters. Users paying for premium versions of the service increased 32.5% in the fourth quarter, compared to 22.2% growth for the full year.

Bumble is a dating app with a twist in that only women can initiate contact after parties both indicate an interest by swiping right on profiles. Premium features on the company’s Bumble and Badoo apps allow users to see who swiped right on them, post more personal information and spotlight profiles. Online dating apps are now the most common way for new couples to meet in the U.S., according to a study published in Proceedings of the National Academy of Sciences of the United States of America (PNAS).

Director Pamela Thomas-Graham bought $498,000 worth of stock at $76.23 in mid-February as Bumble came public, and CEO Whitney Wolfe Herd bought $21 million worth at $43.

Wanderlust returns

I’ve been suggesting Avis Budget Group CAR,

Avis did a commendable job of reducing costs during the pandemic by cutting its fleet by 19%. So even though revenue fell 41%, it was not a bankruptcy risk.

The big buyer who first got me interested in this stock was director Karthik Sarma. His SRS Investment Management bought steadily in size last May-December at $18.57 to $39.20. Avis now represents 11.4% of his portfolio. More recently, CFO Brian Choi took over as the big buyer, purchasing $1.64 million worth of stock at $46-$56 a share in February. Insiders don’t buy for short-term trades so this purchase — along with the reopening travel craze ahead — tells me the stock remains a hold.

Fast-food binge

As the second-largest fast-food burger chain in the U.S., Wendy’s WEN,

From small beginnings in Columbus, Ohio, in 1969, Wendy’s has grown into the third-largest burger chain in the world, with over 6,800 restaurants. Most of them are franchises, which boosts profit margins. Despite the pandemic, Wendy’s opened 35 restaurants last year, net of closings. That was down from 77 net openings in 2019. But it’ll make up for lost ground in 2021 with around 170 new restaurants, net, to take the total over 7,000.

Last year, Wendy’s new breakfast menu was a hit, and it expects this to be a growth driver again in 2021. It projects the breakfast business will grow 30% this year, and that it will hit 10% of overall sales by the end of 2022, up from 7% last year.

Wendy’s expects same-restaurant sales to grow 10% this year, driving 19% earnings growth to $0.67 to $0.69 per share, and 12.5% operating cash flow growth to $320 million at the midpoint of guidance.

All of this no doubt helps explain why chief legal officer E.J. Wunsch recently bought $142,300 worth of stock at $18.98.

The housing boom isn’t over yet

With interest rates going up, the home sector is supposedly going to cool off, according to another popular meme these days. But insiders disagree. Recently there was large insider buying at two of the biggest home-related retailers, Wayfair W,

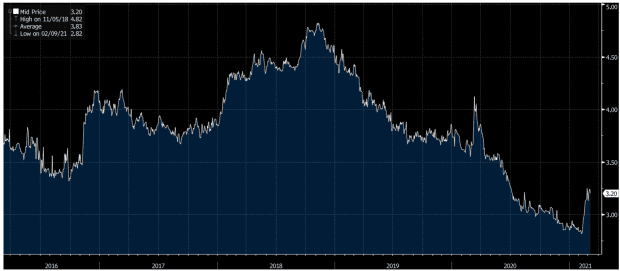

Here’s the 30-year mortgage rate. As you can see, it’s still very low compared with historical averages.

The bullishness makes sense because mortgage rates remain historically low, points out Jim Paulsen, market strategist at the Leuthold group. That means ongoing interest in home buying and related retailers.

Insiders certainly buy into this thinking. There was recently a mega-purchase of $13.6 million worth of stock at the home retailer Wayfair, by director Michael Andrew Kumin at around $287 per share. Wayfair has done a great job of connecting with consumers. Sales grew 55% last year in the U.S. and 65% abroad. Customer count grew 54% to 31.2 million in the fourth quarter. Repeat purchases represent more than 70% of its business. Wayfair also works closely with suppliers, helping with logistics, merchandising and marketing, to keep them happy.

At Lowe’s, director David Batchelder recently bought about $1 million worth of stock at $159.47. The second-largest home-improvement retailer globally after Home Depot HD,

The big get bigger

As the nation’s largest retailer, Walmart WMT,

Walmart is also investing heavily in automation, which should improve productivity and profit margins.

Morningstar analyst Zain Akbari forecasts low-single-digit sales growth this year, and over the next decade.

Walmart is so big that it negotiates favorable terms with vendors to stay competitive, supporting the retailer’s wide moat, says Akbari. If a national $15-an-hour minimum wage ever gets passed, it won’t be devastating to Walmart. It already pays sales associates more than that, on average. And Walmart offers investors a 1.6% dividend yield.

Michael Brush is a columnist for MarketWatch. At the time of publication, he had no positions in any stocks mentioned in this column. Brush has suggested CAR, LOW, WMT, and T in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.