Sovereign Bonds Gain; Stocks, Equity Futures Climb: Markets Wrap

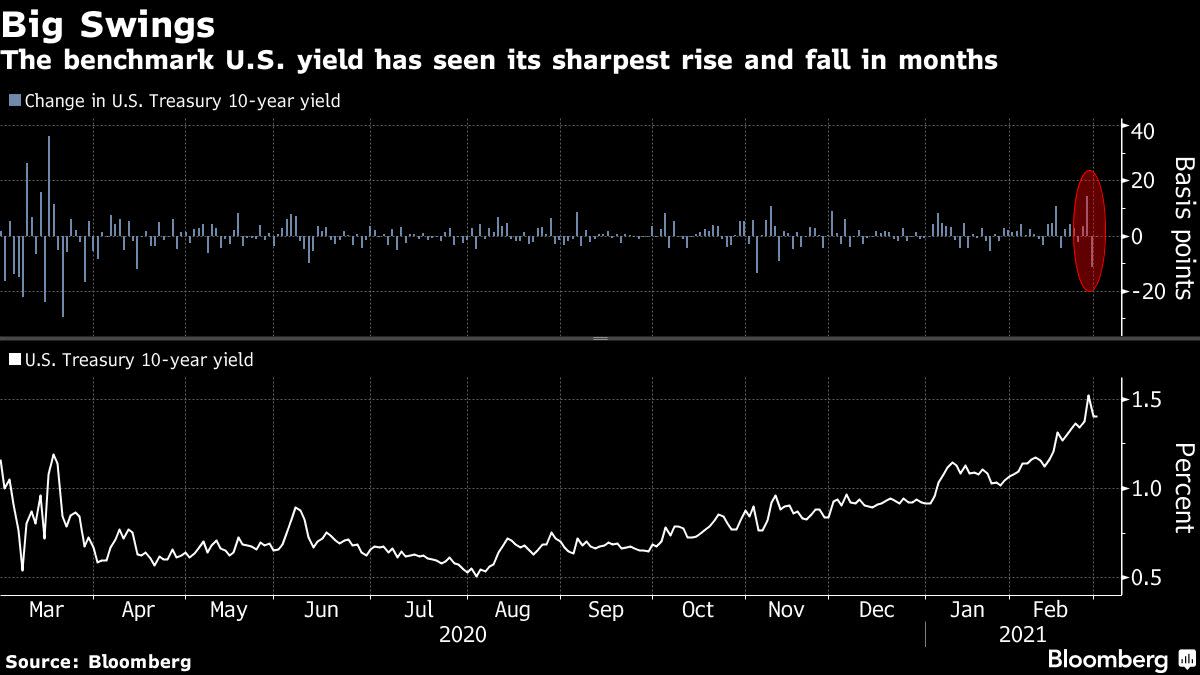

(Bloomberg) — Sovereign bonds extended a rebound, U.S. and European equity futures rose and the dollar dipped Monday, signaling calmer markets after the turmoil sparked last week by a slide in government debt.

Benchmark Treasury yields fluctuated around 1.40% and Australian and New Zealand debt rallied. Australia’s 10-year yield slid the most in a year after the central bank doubled down on bond purchases to pacify fixed-income markets.

S&P 500 and Nasdaq 100 equity futures advanced, while Japan led a bounce back in Asian stocks. On Friday, the S&P 500 slipped and tech stocks staged a modest rebound as Treasuries recovered from a pronounced selloff. Most Group-of-10 currencies climbed. Commodities rose as oil topped $62 a barrel.

Bonds and equity markets have stabilized after central banks from Asia to Europe sought to reassure investors that policy support remains in place. The prospect of faster growth and inflation amid a stimulus-fueled recovery from the pandemic led to concerns that officials will eventually have to contemplate tightening monetary conditions.

“With a lot of the move in yields due to the improving growth outlook and reopening prospects, risk appetite is holding up,” said Esty Dwek, head of global strategy at Natixis Investment Manager Solutions. “The pace and scale of the move in yields is more important than the absolute level, suggesting that as long as the move is gradual, risk assets should be able to absorb them.”

In the U.S., President Joe Biden called on lawmakers to quickly approve his $1.9 trillion Covid-19 fiscal aid package, which passed the House of Representatives early Saturday and heads to the Senate. Stimulus and positive vaccine news, including U.S. approval for Johnson & Johnson’s one-shot inoculation, are driving so-called reflation bets.

Elsewhere, most base metals rebounded following Friday’s slump. Bitcoin was trading at around $46,000, nursing losses after its worst weekly plunge in almost a year.

There are some key events to watch this week:

Reserve Bank of Australia sets monetary policy Tuesday.U.S. Federal Reserve Beige Book is due Wednesday.OPEC+ meeting on output Thursday.Fed Chair Jerome Powell to discuss the economy at a Wall Street Journal event on Thursday.The February U.S. employment report on Friday will provide an update on the speed and direction of the nation’s labor market recovery.

These are some of the main moves in markets:

Stocks

S&P 500 futures rose 0.9% as of 7:05 a.m. in London. The S&P 500 Index fell 0.5%.Japan’s Topix index gained 2%.Australia’s S&P/ASX 200 index rose 1.7%.Hong Kong’s Hang Seng index climbed 1.5%.Euro Stoxx 50 contracts jumped 1%.

Currencies

The yen traded at 106.54 per dollar.The offshore yuan was at 6.4692 per dollar, up 0.2%.The Bloomberg Dollar Spot Index fell 0.3%.The euro was at $1.2086, rising 0.1%.The Aussie dollar rose 0.7% to 77.62 U.S. cents.

Bonds

Australia’s 10-year yield fell 25 basis points to 1.67%.The yield on 10-year Treasuries was steady at about 1.40%.

Commodities

West Texas Intermediate crude rose 2% to $62.70 a barrel.Gold rose 1.2% to $1,754.69 an ounce.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.