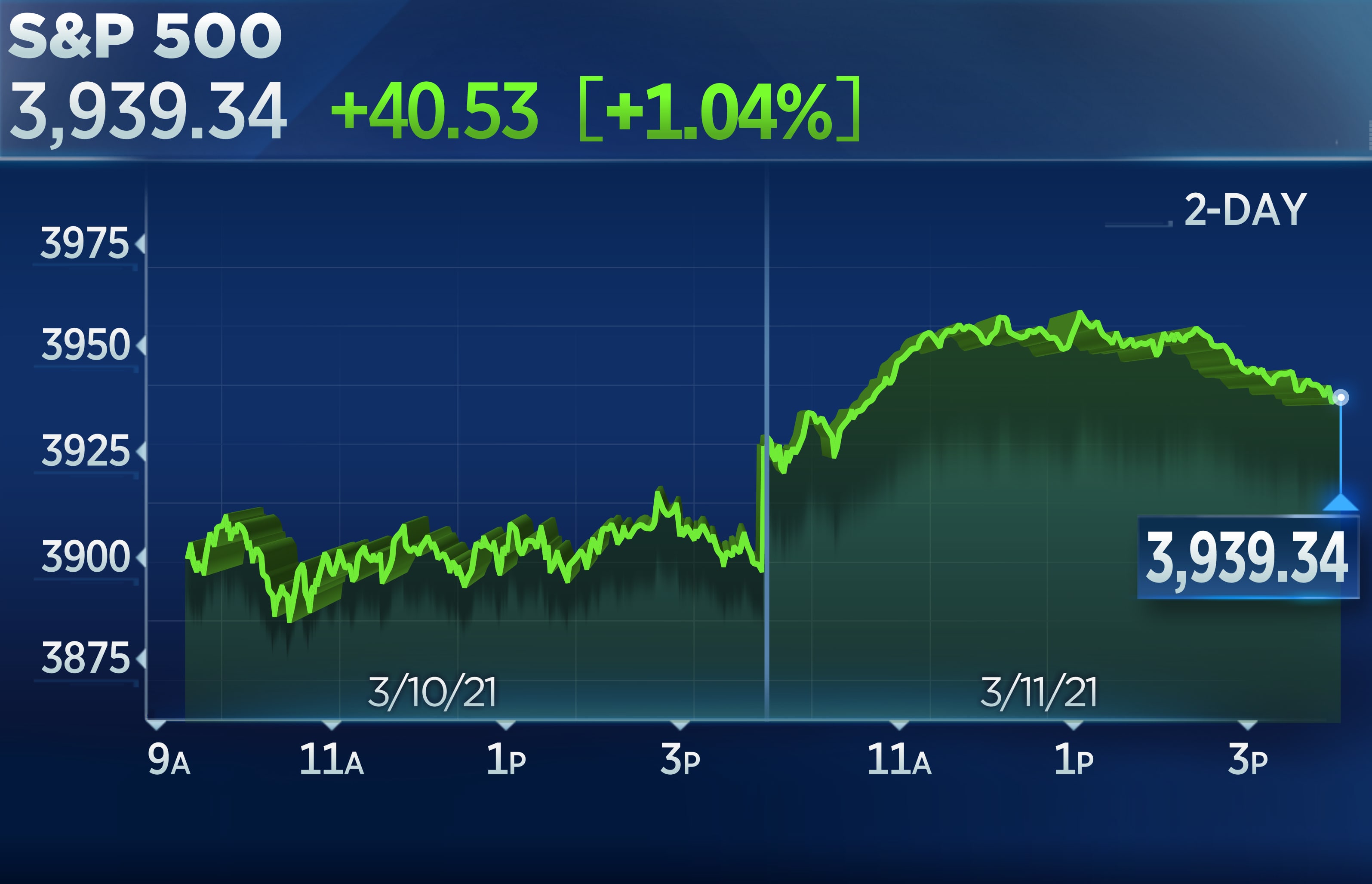

U.S. stocks climbed Thursday with major averages notching new records as investors flocked into their growth tech darlings again amid easing fears of inflation and rates.

The S&P 500 climbed 1.3% to reach an all-time high, its first record since Feb. 16. The Dow Jones Industrial Average added 350 points to hit another intraday record. The Nasdaq Composite jumped 2.5% amid a rotation back into tech shares. Tesla was up 4%. Apple, Facebook and Netflix all jumped at least 2%, while Amazon, Alphabet and Microsoft shares were also higher.

On the data front, investors cheered a slightly better-than-expected reading on weekly jobless claims. The Labor Department reported that first-time filings for unemployment insurance in the week ended March 6 totaled a seasonally adjusted 712,000, below the Dow Jones estimate of 725,000.

“The drop in jobless claims is another win for the week, and a solid sign that we’re making some strides toward pre-pandemic life,” said Mike Loewengart, managing director of investment strategy at E-Trade Financial. “Combined with stimulus relief in sight and a muted CPI read yesterday plus increased vaccinations and decreased business restrictions, there’s a pretty optimistic picture being painted.”

The 10-year Treasury yield, which had retreated from its recent high of 1.6%, inched up 1 basis point at 1.52% on Thursday.

Tech and growth stocks are rebounding from a swift correction triggered by rising interest rates. Higher rates make profits in far-off years seem less attractive to investors and can knock down stocks with relatively high valuations.

The Nasdaq Composite dipped into correction territory on Monday, falling more than 10% from its recent high. Now the tech-heavy benchmark is about 6% off its record high.

“The faster-than-expected acceleration of U.S. economic growth appears to be lifting inflation and longer-term interest rates,” Gary Schlossberg from the Wells Fargo Investment Institute said in a note. “The pace of these increases have been a recent concern to investors, but a recovery in interest rates and inflation is a typical occurrence early in a recover – faster this time, in our opinion, because of the unusually strong economic growth rebound.”

House Democrats passed a $1.9 trillion coronavirus relief bill Wednesday, sending it to President Joe Biden, who is expected to sign it into law Friday.

The economic reopening, coupled with additional fiscal stimulus, accelerated the rotation into more cyclical sectors, such as energy. The S&P 500 energy sector has been the biggest winner this year, up 40% so far.