Tech stocks are under pressure. Don’t buy the dip, sell the bounces, strategist says

The U.S. Senate finally passed a $1.9 trillion COVID-19 relief bill over the weekend and stocks are broadly moving higher at the start of the week.

However, technology stocks are once again under pressure as bond yields continue to rise — with investors rotating from assets perceived as having stretched valuations. The yield on the 10-year Treasury TMUBMUSD10Y,

After its biggest intraday comeback in a year at the end of last week, the tech-heavy Nasdaq Composite COMP,

In our call of the day, Miller Tabak & Co’s chief market strategist Matt Maley said investors need to be “very careful” about buying the dip when it comes to the tech-laden index and should instead be selling the bounces.

Maley said that despite a “nice bounce” on Friday, the index still closed the week below 13,000 and said any more downside in the near-term would be “very negative on a technical basis.” Miller Tabak stressed it wasn’t calling for a repeat of the Nasdaq’s slump in 2000, but said it was clear the trend had changed following last week’s losses.

Therefore, Maley recommended investors sell on any bounces for now and look for “some capitulation before they get more aggressive on the buy side of things.”

The trend may have reversed for the Nasdaq Composite but there is still some hope for the broader tech sector, Miller Tabak noted.

“The reason for this is that the biotech group has also been weighing on the Nasdaq and the extra negative jolt this group has given the Nasdaq has been a catalyst for a more meaningful break down in this index than we have seen in some of the tech ETFs,” Maley said. Key tech exchange-traded funds and indexes are yet to break below key support levels, he added, which should be closely watched in the coming days.

For example, the FAANG Index — which includes Facebook FB,

The same can be said for the XLK Tech ETF XLK,

Despite the tech slump, it wasn’t all doom and gloom for the broader market, with the S&P 500 SPX,

The markets

The price of Brent crude BRNK21,

The chart

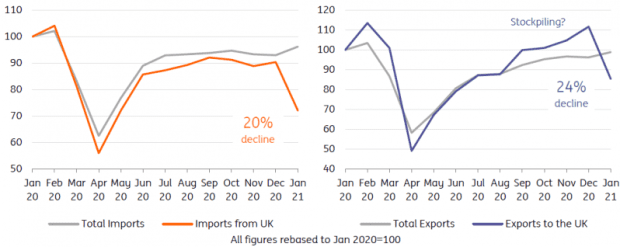

French trade data shows a clear “Brexit effect” in January, ING analysts said, noting a 20% decline in imports from the U.K., while imports from the rest of the world increased.

Source: Macrobond, ING

The buzz

U.S. public health officials have warned another coronavirus surge could be around the corner and that now isn’t the time to relax restrictions.

President Joe Biden said he anticipated relief checks and deposits for Americans to be sent out this month, after Senate passage of the COVID-19 stimulus bill. He added the bill will speed up the availability of vaccinations.

MacKenzie Scott, the philanthropist formerly married to Jeff Bezos, has married a Seattle schoolteacher following her 2019 divorce from the Amazon.com founder, according to a person familiar with the matter.

Prince Harry and his wife Meghan opened up to Oprah Winfrey in an explosive interview late on Sunday.

General Electric GE,

Random reads

Meghan Markle revealed she worked at Humphrey Yogart. The internet is over the spoon

Shoe shop chain Shoe Zone replaces Peter Foot with Terry Boot as finance director. It’s not a joke.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.