Treasury Market’s Bears Are Set for a Reality Check From Fed

(Bloomberg) — The bond market is about to get a serious reality check, with traders leaning heavily toward higher long-term yields and also a scenario where the Federal Reserve starts lifting rates from near zero well before officials now envision.

The big test of the profitability of these wagers is set to come Wednesday, when the Fed wraps up a two-day meeting. The likely key for bond investors is the trajectory officials pencil in for their policy rate over the coming few years. In December, they projected holding rates near zero through the end of 2023.

But the market has a different take on things, with vaccinations accelerating and nearly $2 trillion in fresh stimulus ratcheting up expectations for both growth and inflation. Money markets have been moving toward pricing in the beginning of Fed tightening by the end of next year. Meanwhile, investors are bracing for more losses in long-term debt: Options bets are targeting a 10-year Treasury yield as high as 1.85% in the next couple months, from about 1.6% now, and Wall Street strategists seeing even higher levels ahead.

“The market has no patience for the Fed being patient,” said David Robin, a strategist at TJM Institutional Securities. If Chair Jerome Powell on Wednesday “pushes back on the current pricing, the markets will likely think he is in denial and therefore accelerate the timing and the magnitude of the Fed’s first rate increase.”

Eurodollar contracts reflect a full quarter-point hike by around March 2023. Some are even hedging against a move coming sooner, with about 18 basis points of tightening priced in by December 2022, or roughly a 75% chance.

In longer maturities, the 10-year Treasury yield — a benchmark for borrowing costs worldwide — touched 1.64% last week, the highest since February 2020. There was also a dramatic surge in five-year rates as traders pulled forward bets on when the central bank would exit its ultra-loose stance.

Officials on Wednesday are expected to upgrade their quarterly forecasts for growth and unemployment. Still, economists surveyed by Bloomberg say the central bank will continue to project that it’ll hold rates near zero through 2023. The forecasts will be published at 2 p.m. Wednesday New York time, alongside the Federal Open Market Committee’s policy statement.

In December, only five officials saw a hike in 2023. But now Goldman Sachs Group Inc.’s Jan Hatzius and his colleagues expect the median Fed forecast this week to show one increase in 2023. It would take four officials to shift projections higher to move the median expectation of the first hike into 2023.

Powell hasn’t pushed back against the bond market’s views. He’s acknowledged that the selloff had caught his attention, but he stressed that overall financial conditions are more important, and by that measure rising yields have yet to scare off investors. He also said he’d be concerned if the yield surge was accompanied by disorderly markets. He may have more to say Wednesday during his press conference after the central bank’s decision.

For the time being, investors are loading up on strategies that will profit if the increase in long-term yields gains more traction.

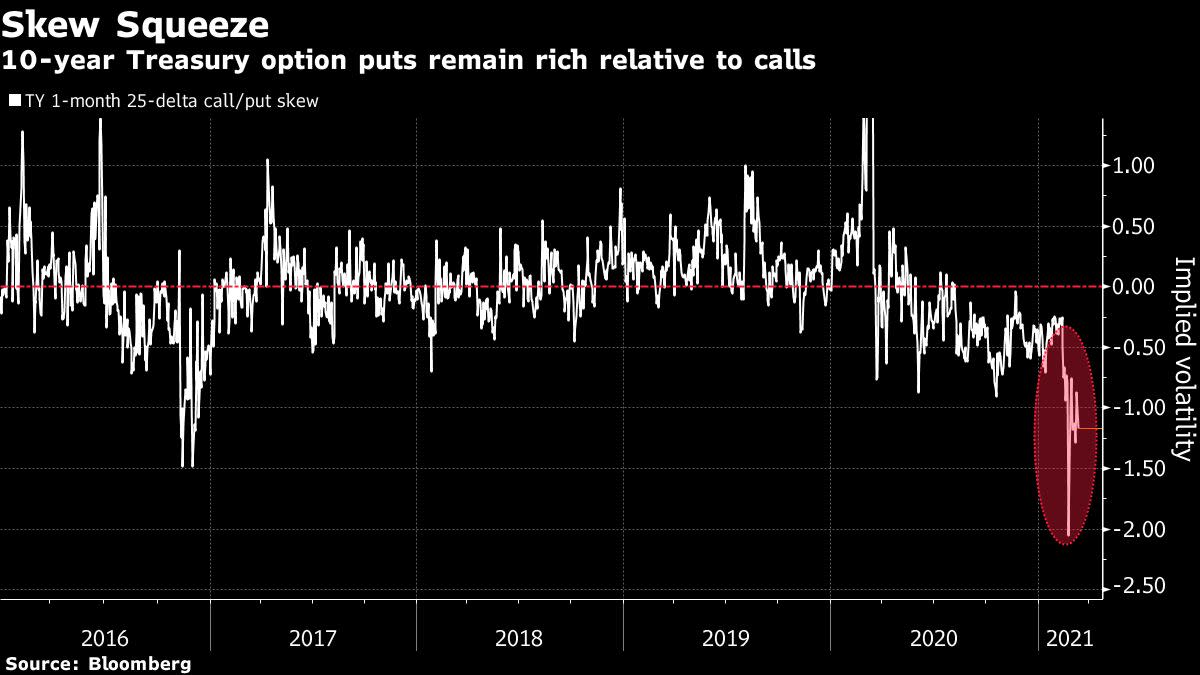

In options on 10-year futures, the most significant new position that emerged Friday was a wager that could reap over $4 million if the yield rises to between 1.70% and 1.85% before the contract expires in May. And the skew of puts — contracts that benefit if yields rise — to calls shows traders are favoring the former.

In the Treasury selloff at the end of last week, open interest — a measure of outstanding positions — surged across the curve, suggesting new shorts were being added. The largest moves were seen in 10-year Treasuries, where open interest jumped by almost 95,000 contracts, equivalent to around $9 billion in equivalent amounts of 10-year notes.

Helping drive long-term yields higher has been a surge in breakeven inflation rates — a market proxy for annual consumer price inflation. The 10-year breakeven at around 2.25% is near the highest since 2014. Investors are betting on quicker inflation in part as the Fed’s new monetary-policy approach will allow for inflation to run hot — over 2% — for some time.

“To protect ourselves from this rise in yields, we’ve been avoiding duration,” said David Norris, head of U.S. credit at TwentyFour Asset Management, meaning they aren’t investing in long-term maturities Treasuries and other fixed-income securities. “We are expecting a gradual rise in long-term rates from where we are are now.”

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.