US coal prices will remain subdued in 2021, even with consumption and demand on the rise. Exports will rise modestly on stronger pricing in 2021, Moody’s predicts.

Moody’s expects domestic coal production will rebound in 2021 across all grades of coal, to 550 million-575 million short tonness—up slightly from our previous forecast of 525 million-550 million tonnes. The firm’s forecast is more conservative than the US Energy Information Administration’s (EIA) expectation of 581 million tons of production in 2021.

Moody’s assumes the electric power sector will consume less thermal coal than the EIA forecasts, and that power generation demand will short of the EIA’s forecast of 505 million tons of consumption in 2021—still up from 437 million tons in 2020—based on EIA’s expectation for benchmark natural gas spot prices near $3.00/MMBtu at the Henry Hub. By comparison, Moody’s expects natural gas prices will remain more volatile within our expected range of $2.00-$3.00/ MMBtu in 2021.

Rated coal producers, which make up a significant portion of US domestic thermal coal production, include Alliance Resource Operating Partners (Ba3 CFR), ArchResources (B2 CFR), CONSOL Energy (B2 CFR), Foresight Energy (B3 CFR) and Peabody Energy (Caa1 CFR). Given the expectation that production will increase only modestly, Moody’s expects some mines that were idled due to weak market conditions in 2020 will not restart production in the near term.

The Powder River Basin of Wyoming and Montana remains oversupplied, especially now that US regulators have rejected a proposed merger between Arch and Peabody

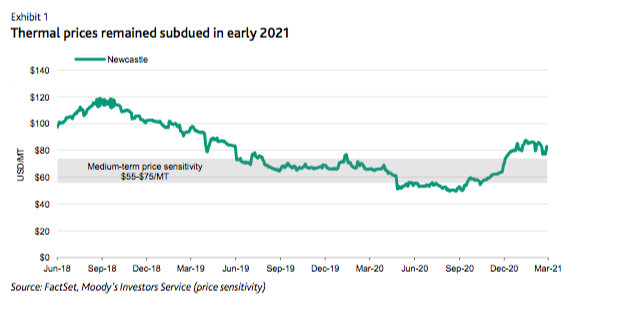

Seaborne thermal coal demand and prices in APAC have strengthened in recent months amid cold winter weather in China, the world’s largest thermal coal importer, which recently reiterated coal production targets, and supply constraints in coal exporting countries including Russia and Indonesia due to adverse weather.

Moody’s expects seaborne thermal coal demand in 2021 will continue to be supported by increasing economic activity, particularly in China. Lower coal imports by China from Australia as a result of geopolitical tensions benefit coal producers in countries such as Indonesia, Russia, Mongolia, and the United States.

Moody’s anticipates US thermal exports will increase to about 30 million-35 million tons in 2021, up from an EIA-estimated 27 million tons in 2020. Export pricing strengthened considerably in the second half of 2020, but export volumes in 2021 will still remain below the 38 million tons in US thermal coal exports in 2019, and well below the 54 million tons exported in 2018. US producers represent a small and swing position in the global traded market for thermal coal. Moody’s also expects that freight rates could become a more significant concern – both as demand recovers in the near term and as railroads continue to move away from coal over a longer horizon.

Despite higher US thermal coal demand and consumption in 2021, Moody’s expects that domestic coal prices will remain subdued. The Powder River Basin (PRB) of Wyoming and Montana remains oversupplied, especially now that US regulators have rejected a proposed merger between Arch and Peabody that would have consolidated a sizable fraction of PRB production.

The PRB’s minimal export volumes reflect the region’s difficult logistics, including social opposition to coal exports in the Pacific Northwest. Moody’s has highlighted repeatedly the challenges in the PRB, including a reiteration of those views following the FTC decision in February 2020. Arch and Peabody are the most significant players in the PRB.

Increased export volumes will be more beneficial to producers in eastern coal basins—the Illinois Basin and especially Northern Appalachia—but increased thermal coal production could more than offset exports’ influence on the Illinois Basin’s supply/demand balance. For example, Alliance has publicly guided to a 10% thermal coal production increase in 2021. Foresight Energy will likely boost its production enough to disrupt certain areas within the region, having emerged from bankruptcy with a much-stronger balance sheet and restructured commercial agreements that had limited its operating flexibility, Moody’s points out. Significant gains in domestic pricing would require additional factors such as operational disruptions or very cold weather.

No US-based coal producer completed an unsecured bond offering in 2020—despite significant issuance in other sectors with similar characteristics

While the researcher observed meaningful consolidation in other commodity-oriented industries experiencing secular decline, Moody’s anticipates minimal to modest consolidation among thermal coal producers despite the ongoing secular decline in domestic demand for thermal coal. The industry has limited access to capital that helps facilitate M&A transactions, with public companies controlling much of the industry’s production, and ESG-related issues making it more difficult for producers to pursue consolidation deals in light of substantive environmental liabilities and the need to obtain capital to complete deals.

No US-based coal producer completed an unsecured bond offering in 2020—despite significant issuance in other sectors with similar characteristics like cash consumption and an interest in building liquidity. Some producers, such as Alliance and CONSOL, successfully amended credit agreements for revolving credit facilities, Moody’s reports.

Arch, which is finishing a met coal project in West Virginia, raised capital through expanded equipment financing, issuance of convertible debt, and issuance tax-exempt secured debt. Peabody completed a debt exchange transaction as part of a more comprehensive agreement involving bank lenders, bondholders, and surety providers. Only Warrior Met Coal (B2 positive), which is not exposed to thermal coal, has unsecured bonds trading above par today.