Verizon sees huge demand for $25 billion debt deal, market breathes sigh of relief

The airwaves were abuzz with talk of Verizon Communications Inc.’s new $25 billion jumbo bond deal on Thursday, the biggest of its kind so far this year.

Orders for Verizon’s VZ,

“It’s a very good sign that people rose to the occasion, stepped up and were ready to participate in this market in a big way,” Lon Erickson, portfolio manager at Thornburg Investment Management, told MarketWatch.

“But I also say that with a little hesitance, because we don’t know how real that order book was,” Erickson said, adding that massive order books can saddle some investors with more bonds than they actually wanted, and lead to poor trading performance thereafter.

But for Verizon, it was a clear win. Bankers were able to size the deal at about half of Verizon’s record $48.9 billion financing in 2013, which serves as the biggest U.S. investment-grade corporate bond ever sold.

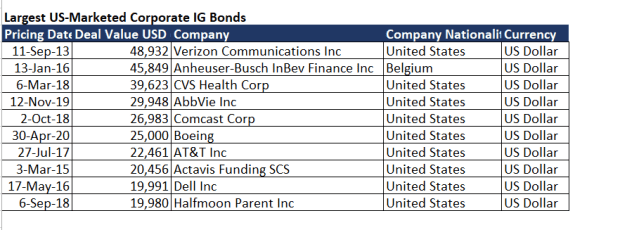

Here’s a chart from Dealogic showing the biggest investment-grade U.S. bond deals sold to date (in billions):

Biggest U.S. investment-grade bond deals.

Dealogic

Corporate bonds are priced at a spread, or premium, above the risk-free Treasury rate, that helps compensate investors for the added risk of potential default.

Earlier in the week, debt investors were feeling skittish due to concerns about potential disruptions from a combination of large U.S. Treasury actions on tap and the deluge of new corporate-bond supply from Verizon — all while yields had been on the climb.

Read: Treasury auctions this week may add kindling to bond-market turbulence

“There were concerns that the market was going to be pulling back and that demand might wane amid rate risks,” said Matt Brill, Invesco Fixed Income’s head of North America investment-grade credit.

“This shows that the bond market hasn’t gone away,” he told MarketWatch. “The pig went through the python and now it can go back to normal.”

Longer-dated government bond yields have climbed sharply this year, particularly in the past few weeks, putting pressure on equities in the high-growth and technology sectors, but also modestly increasing borrowing costs for big corporations.

On Thursday, the benchmark 10-year Treasury yield TMUBMUSD10Y,

The yield in the ICE BofA U.S. Corporate Index was near 2.23% at last check, down from a dip as low as 1.79% in early January.

“A bit more stability in Treasury yields certainly would be helpful to investor sentiment,” said Jon Duensing, Amundi Pioneer’s director of investment-grade corporates. “We are seeing some of that today.”

The Verizon financing comes on the heels of it spending $52.9 billion on its “C-Band” spectrum effort, a push CreditSights senior analyst Davis Herbert called akin to the company going “for the win” as it looks to “further entrench its leadership position” in the next “G” of the wireless era.

“Verizon said it will be using the substantial C-Band spectrum to accelerate its growth profile this year and beyond,” Herbert wrote in a note Thursday.

C-Band is a “mid-band” 5G frequency that provides customers with faster speeds and good transmission distance. Verizon on Wednesday said it expects to reach another 100 million customers over the next 12 months, as a result of its C-Band expansion, and eventually to reach more than 250 million customers. The company didn’t immediately respond to a request for comment for this article.

The pandemic has exposed big potholes across the U.S. in terms of a lack of fast and affordable internet, a service increasingly viewed as essential to everyday life in the digital age.

Read: Why remote work, schooling in rural America need Biden’s infrastructure plan

AT&T Inc. T,

“Ultimately, the question will be: Did Verizon grease the wheels for AT&T, or did it suck the oxygen out of the room?” said Erickson at Thornburg. “But that’s going to be a story for another day.”