The soon-to-be standalone miner produced 16.5 million tonnes of coal last year and has assets worth $1.3 billion. It is close to an established rail network with secure access to export markets via the Richards Bay Coal Terminal.

The demerged company, Thungela Resources, will list on the Johannesburg and London stock exchanges

Thungela has 137 million tonnes of reserves and 756 million tonnes in resources, along with seven operations — four open-pit and three underground.

“As the world transitions towards a low-carbon economy, we must continue to act responsibly,” chief executive Mark Cutifani said in the statement. “Our proposed demerger of what are precious natural resources for South Africa allows us to do exactly that.”

Mounting pressure from investors, regulators and environmental organizations has pushed miners to either sell coal assets or to limit their exposure to the fossil fuel in recent years.

The world’s top miner, BHP (ASX, LON, NYSE: BHP), has also announced plans to exit thermal coal as part of its commitment to reduce emissions.

Rio Tinto (ASX, LON, NYSE: RIO), the second largest mining company, sold its last coal mine in 2018.

Anglo American has consistently been offloading coal operations since 2014. Last year it announced it intended to spin off its South African unit within the next three years. It also made the decision of selling Cerrejón, its thermal coal subsidiary in Colombia.

The strategy, quite obviously, won’t affect the emissions caused by the thermal coal produced from the mines, which will continue running under Thungela. But Anglo said I wanted to give investors the choice to whether or not support the coal industry.

“The proposed demerger recognizes the diverse range of views held by Anglo American’s shareholders in relation to thermal coal,” the company said. The plan “provides the choice to act on such views and, following the implementation of the proposed demerger, to either retain, increase or decrease their interests in Thungela.”

Anglo, BHP and Rio’s decision leaves miner and commodities trader Glencore (LON: GLEN) as the last major company in the coal sector.

The Swiss firm does have an ambitious plan to reach net-zero emissions by 2050 through reducing its direct and indirect carbon footprint by 40% by 2035, compared to 2019 levels.

Not fully out

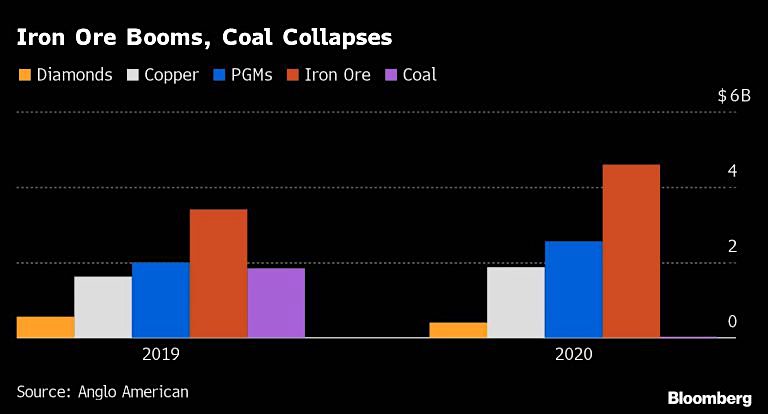

While Anglo American is moving away from the most polluting kind of coal, metallurgical or coking coal appears to be one of its key commodities moving forward.

The miner recently increased its medium-term guidance for the steelmaking ingredient to an estimated 26-28 million tonnes by 2022.

Its main customers are all in Asia, including India, all of whom rely on coal-fired power, Cutifani said. “You can’t just walk away from billions of people across the globe,” he noted.

Anglo said it would inject $170 million into Thungela and continue to market the company’s products to customers for three and a half years. In addition, it would provide “contingent capital support” until the end of 2022 if thermal coal prices drop below a certain threshold.

The spin-off will be subject to a vote by shareholders at Anglo’s annual general meeting in May and requires 75% approval.