Biden capital gains tax plan would raise $113 billion if ‘step up in basis’ is killed, says Wharton

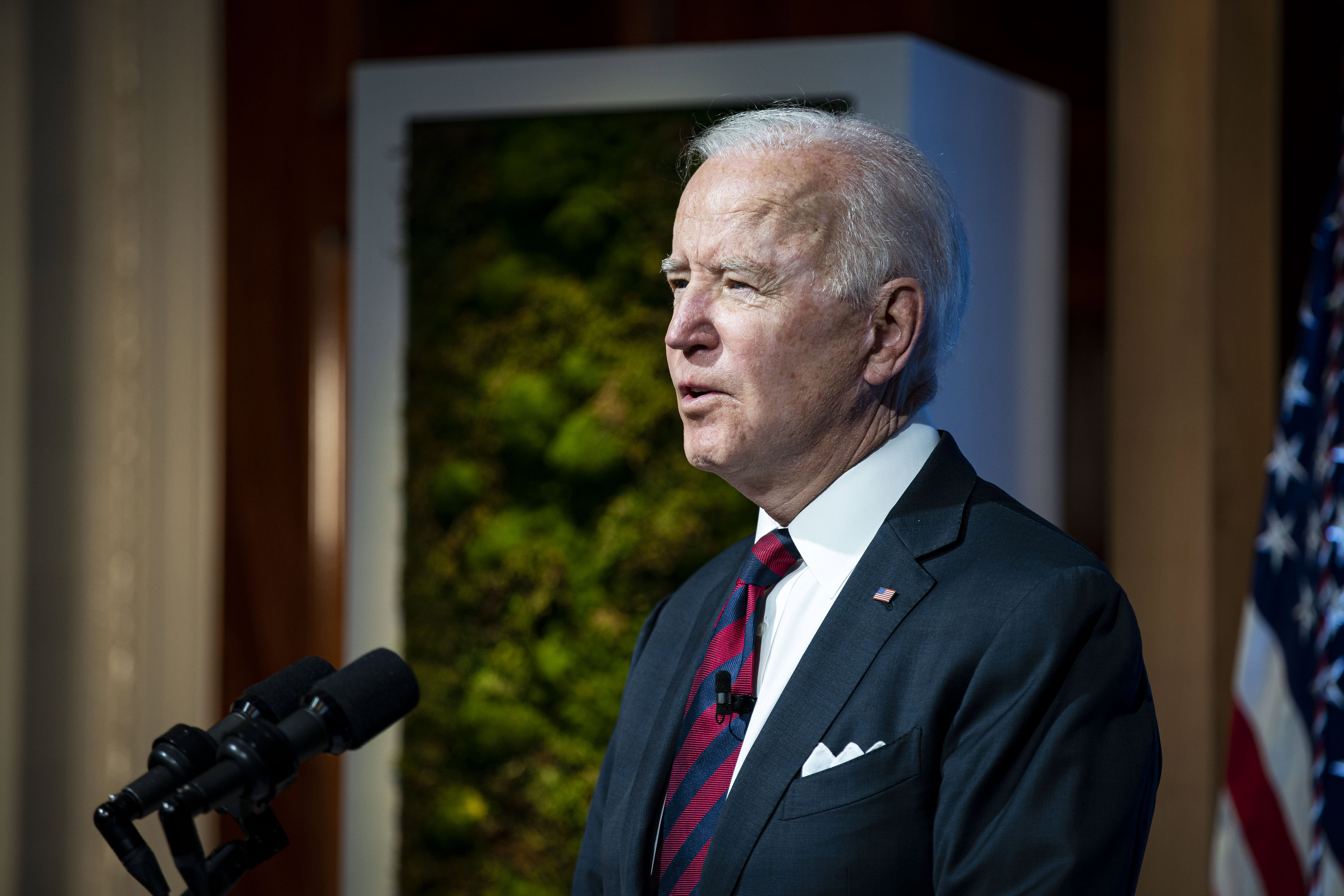

Al Drago | Getty Images

Biden capital gains tax proposal

They can do so by holding stocks and other assets until death. At that point, assets essentially transfer from an estate tax-free: Heirs get the asset at its current market value (thereby eliminating the gain on paper) and the estate doesn’t pay tax on the unrealized gain.

(Wealthy estates may still owe state or federal estate tax on the asset.)

Raising taxes on capital gains means people who earn more than $1 million a year may opt to hold investments longer — and bequeath them to heirs tax-free — as a tax-avoidance strategy.

It’s one reason Wharton projects a $33 billion loss from a higher capital-gains tax regime if it isn’t coupled with an end to the step up in basis.

“Reforms such as eliminating stepped-up basis … would restrict those avoidance opportunities, therefore increasing revenue raised per percentage point of capital gains tax,” according to the analysis, published Friday.

Roughly 0.3% of taxpayers (about 540,000 people) reported income over $1 million in 2018, meaning they’d be subject to the expected tax increase, according to the most recent IRS data.