Biden’s EV plan would create strong bull conditions in energy transition metals – report

“It does not require so-called shovel-ready projects, and thus creates the potential for strong demand going forward several years.”

China sold roughly one million more EVs than the US last year

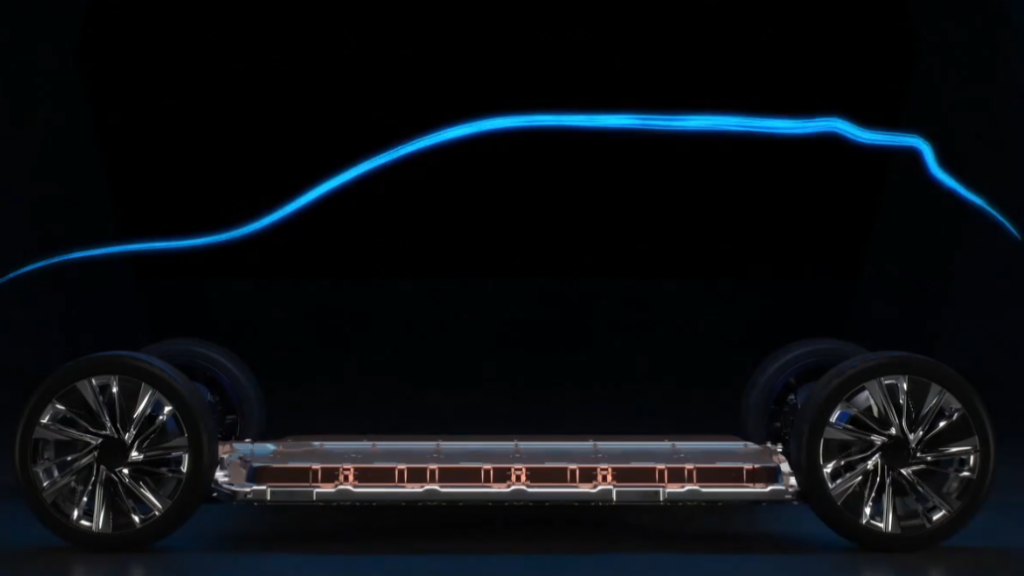

According to the analytics firm, Biden’s bill creates strong bullish factors not only in steel and scrap prices ($1 trillion equals a net demand for around 50 million tonnes of steel), but in the materials of the energy transition: cobalt, lithium and copper.

“Finally, the promised establishment of an office in the Commerce Dept to monitor and support domestic production of critical goods and materials would only be a boon to those with facilities in the US” said Schier.

But the bill faces pressure from a small group of Democrats led by West Virginia senator Joe Manchin trying to support coal jobs.

“A comparable threat comes from the unions that have supported Biden (as he has voiced his lifelong support for them) and may turn against the crucial green agenda, fearful of a smaller number of lower-paying, non-union jobs in a green energy economy,” said Schier.

It will also take not only money but policy and political guile to bring EV and battery manufacturing to the US rather than the booming markets of Asia, Fastmarkets analyst says.

China sold roughly one million more EVs than the US last year.

Fastmarkets forecasts that real growth in the EV industry in the US could strain a supply chain currently focused on Europe and Asia “in a way that would send prices to stratospheric levels, and tests both the elasticity of demand and the viability of the supply chain,”

RELATED ARTICLE: EV Metal Index doubles year-on-year as lithium, cobalt prices rally