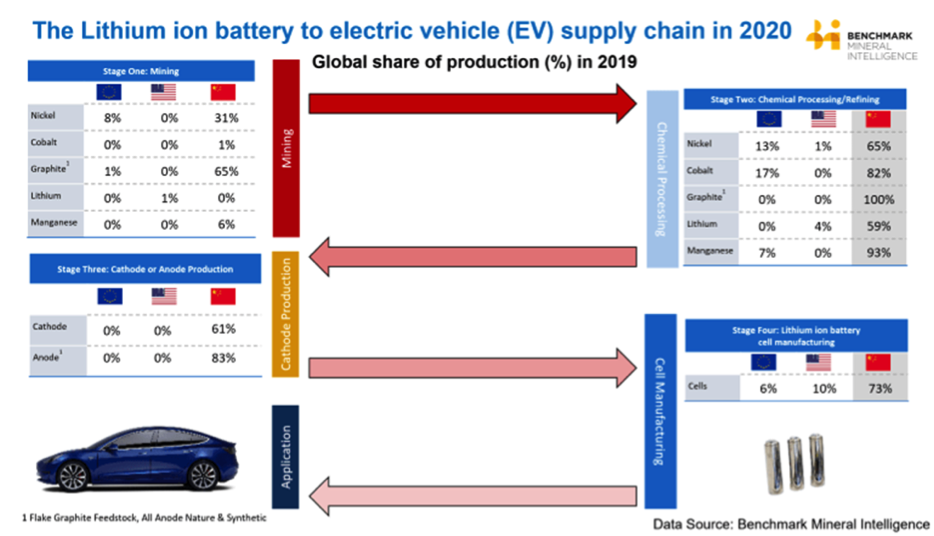

The problem is that China not only controls many of the critical materials necessary to produce these products but also tends to be the market leader in these industries. For example, China is by far the largest producer of EVs in the world – clocking in at close to 50% while the United States (US) is about one-third the market share of China. Adding insult to injury, nearly half of the EVs in the world are in China, with just over 20% in the US Regardless, you cannot make an EV without a battery and China makes most of the batteries. According to multiple sources, China accounts for 70% of all EV battery production in the world. China produces more than 60% of the world’s cathodes and 80% of anodes for batteries and intends to boost its market share at every point in the value chain. In fact, of the 143 lithium-ion battery plants in the pipeline to 2029, 107 are based in China.

Follow the progression of resource-control in the figur from mine to manufacture:

China is the leading battery producer for most of the worlds EV manufacturers, including Ford, GM, Tesla, Volkswagen, Daimler AG, BMW, Volvo, Honda and Toyota.

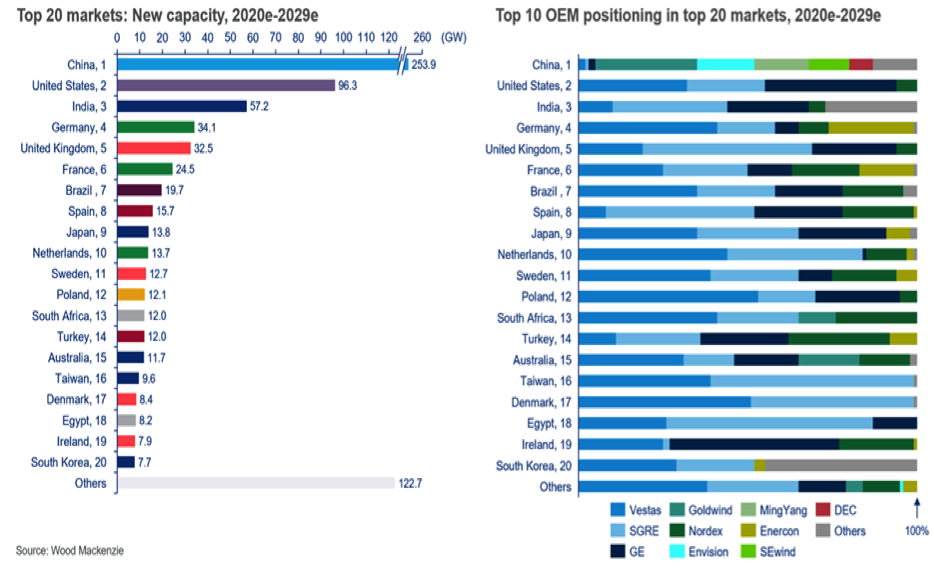

Things don’t look any better for wind

For example, the Chinese company Goldwind is tied with General Electric as the world’s largest manufacturer of wind turbines, but China’s wind turbine industry collectively represents about 50% of global wind turbine production. Furthermore, you cannot build a wind turbine without rare earth magnets. China produces over 85% of the magnets that go into its competitors wind turbines. China’s competitors don’t have a product without China’s RE magnets. As a final insult, China is by far the world’s largest producer of wind energy, at close to two times the US.

The story is the same for solar technologies

China produces 65% of the world’s polysilicon wafers, 70% of all solar panels and 75% of the world’s solar cells. In fact, China currently controls or is developing choke-point strategies to control technology materials at the most critical points of the downstream value chain. This strategy assures China a leadership position in all the world’s leading industrial, agricultural, and consumer markets which is outlined in their Made in China vision 2025.

Conversely, US policy relies on individual actors to challenge China’s multifaceted national industrial and defense strategies with private capital even though most large US corporations eventually migrate to China in pursuit of larger profits & markets. This US strategy has only lost ground to China. Continuing this strategy will not change the outcome.

How was China able to become so dominant?

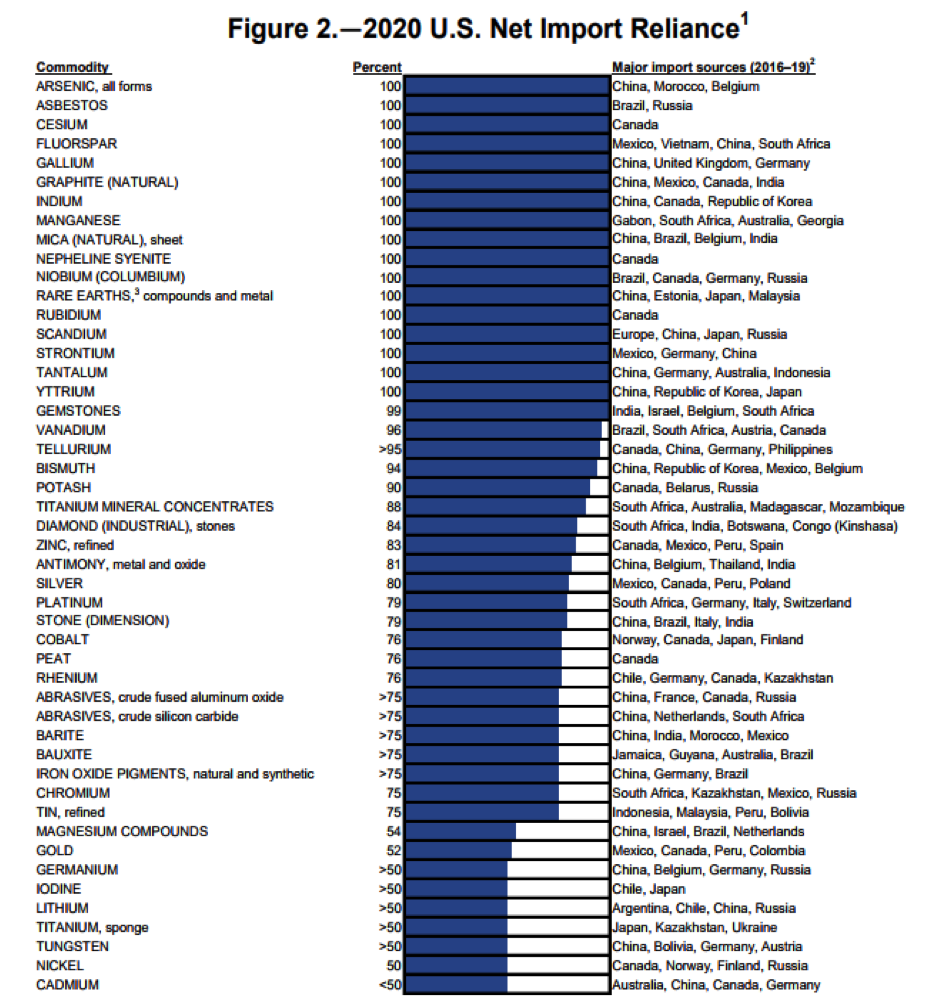

China strategically bought-up control over resources (sometimes at record high prices) and then built out global-scale refining and metallurgical facilities. For example, China controls over 80% percent of mined cobalt and controls over 85% percent of refined cobalt for EVs and other battery applications. China has done the same thing with Germanium, Tungsten, Lithium, Nickel, Antimony, Manganese, Indium, Gallium and Graphite. In fact, China controls 100% of the world’s spherical graphite production, a critical component in EVs and other energy storage applications. China is the market leader in all targeted growth markets and controls all key resources. This gives them the power to dictate our growth prospects: not the other way around. China’s not-so-secret secret is that China’s actions are based on nationalistic goals, not private profit motives. The ‘free market’ cannot overcome this. Period.

In 2019, Chinese chemical companies accounted for 80% of the world’s total output of raw materials for advanced batteries. The red arrows below indicates China’s control over post-mining, downstream, refined or metallic materials for green-technologies. The percentages are linked to sources.

2020 US net import reliance—source: USGS

China’s National Industrial & Defense policy is designed, organized & managed at the highest levels of government and coordinated and executed at all levels of the economy. China’s critical material strategy was never about making money. The strategy is about capturing Intellectual property (IP), boosting China’s technology portfolio and relocating manufacturing inside China. This was partially achieved through advantageous pricing & taxation strategies for Chinese-based manufacturers (the carrot) but also by withholding guaranteed access to these materials if product manufacturing was to happen outside of China (the stick).

By controlling access to these materials, China forced manufacturing inside China – first with RE dependent components, then entire industries. China’s long-term commercial and economic policies and goals were never a secret. They were published on-line and in English. China’s One Belt, One Road program, its Made in China 2025 program and String of Pearls strategy make it clear they are seeking total geopolitical, economic and technological supremacy.

The conversation continues in the next article with a quick history on how China’s success in gaining control over rare earths became the model for other critical materials.

Jamil Hijazi: Jamil is a Mineral Economist and Energy analyst who holds a Dual Master’s Degree from the University of Dundee Centre for Energy, Petroleum, Mineral Law and Policy (CEPMLP). His expertise and research interests are in Supply Security of Critical Raw Materials, Energy transition, Local Content and Development in the Extractives Industry.

James Kennedy is President of ThREE, a consultancy focused on the geopolitical, national security and economic, ramifications of China’s rare earth and critical materials monopoly. He currently consults private industry, the U.S. Federal government and other governments on macro issues and trends related to rare earths, critical materials, and thorium (waste and energy systems).