Chile output falls for 10th consecutive, adding fuel to copper price rally

Copper topped $10,000 a tonne for the first time since 2011 on Thursday, nearing the all-time high set that year as rebounding economies stoke demand and mines struggle to keep up.

Copper for delivery in July was down 0.7% midday Friday, with futures at $4.4560 per pound ($9,8032 a tonne) on the Comex market in New York.

Chile’s sprawling mines have fared far better than those of many neighbors, as mining companies adjusted quickly to the pandemic, ratcheting up health restrictions and slashing on-site staff. But some copper mines, including BHP’s Escondida, the world’s largest, have seen production slide in recent months as fatigue mounts.

Falling ore grades and maintenance work at some large mines have also slowed output, the agency said.

Chile’s copper production fell 2.2% year on year, to 1.4 million tonnes, in the first quarter of 2021, according to INE’s statistics.

Overall manufacturing output in Chile, however, rose 3.9% in March, bolstered by the production of beverages, the agency said.

China

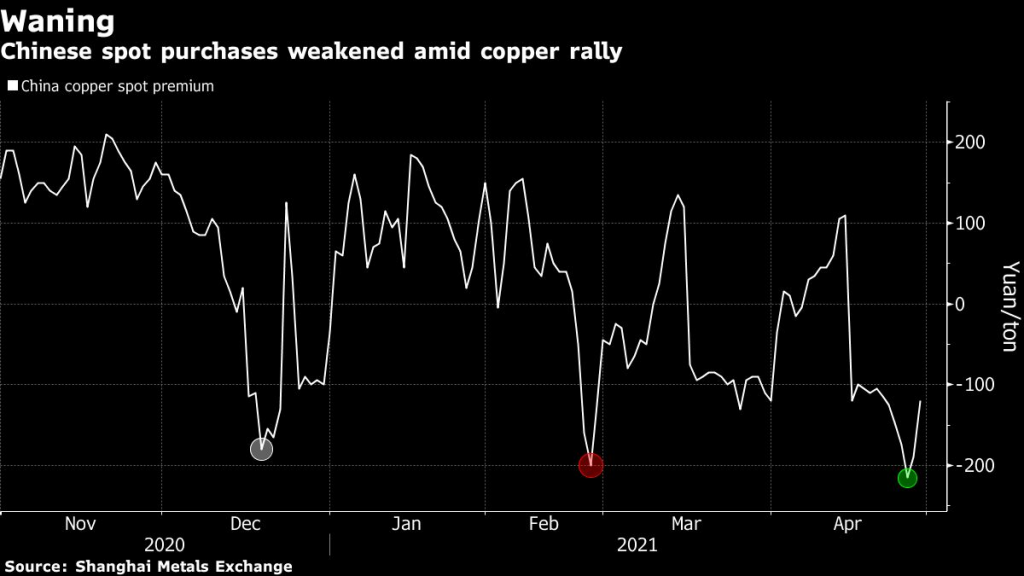

Copper’s surge toward a record high is starting to cause stress for industrial consumers in China, the world’s largest market for the metal.

Some Chinese manufacturers of electric wire have idled units and delayed deliveries or even defaulted on bank loans, according to a survey by the Shanghai Metals Market. End-users such as power grids and property developers have also been pushing back delivery times, while producers of copper rods and pipes saw orders slump this week, said the researcher.

“Domestic copper users are feeling the pain right now after the recent surge caught them off guard,” Fan Rui, an analyst at Guoyuan Futures Co told Bloomberg.

“Electric wire producers are being hit the most, with smaller plants keeping run rates low as the spike is seen slowing the pace of investment by power grids.”

A gauge of China’s manufacturing industry slipped in April and the services sector also weakened, suggesting the economy is still recovering but at a slower pace. To be sure, analysts at banks including Goldman Sachs Group Inc. are predicting further gains for the metal as the global economy picks up pace.