GameStop Posts Longest Loss Streak in a Year as Skeptics Grow

(Bloomberg) — GameStop Corp. fell on Monday, wrapping up its longest losing streak in a year, amid growing skepticism over its long-term potential despite activist Ryan Cohen’s latest efforts to revitalize the company.

Shares fell 11% in New York to close at $141.09, their lowest level in more than two weeks, as Reuters reported the video-game retailer is seeking a replacement for the current Chief Executive Officer George Sherman, without naming sources.

GameStop didn’t immediately respond to a request for comment on the Reuters report.

News of the potential change at the company’s helm followed a warning by Ascendiant Capital Markets analyst Edward Woo, who downgraded the retailer to sell from hold, raising questions about the company’s long-term prospect as it faces growing competition from the likes of Microsoft Corp. and Sony Group Corp.

GameStop’s Reddit-trading surge is likely to fade and shares will tumble in the long run “to match its current weak results and outlook,” he wrote.

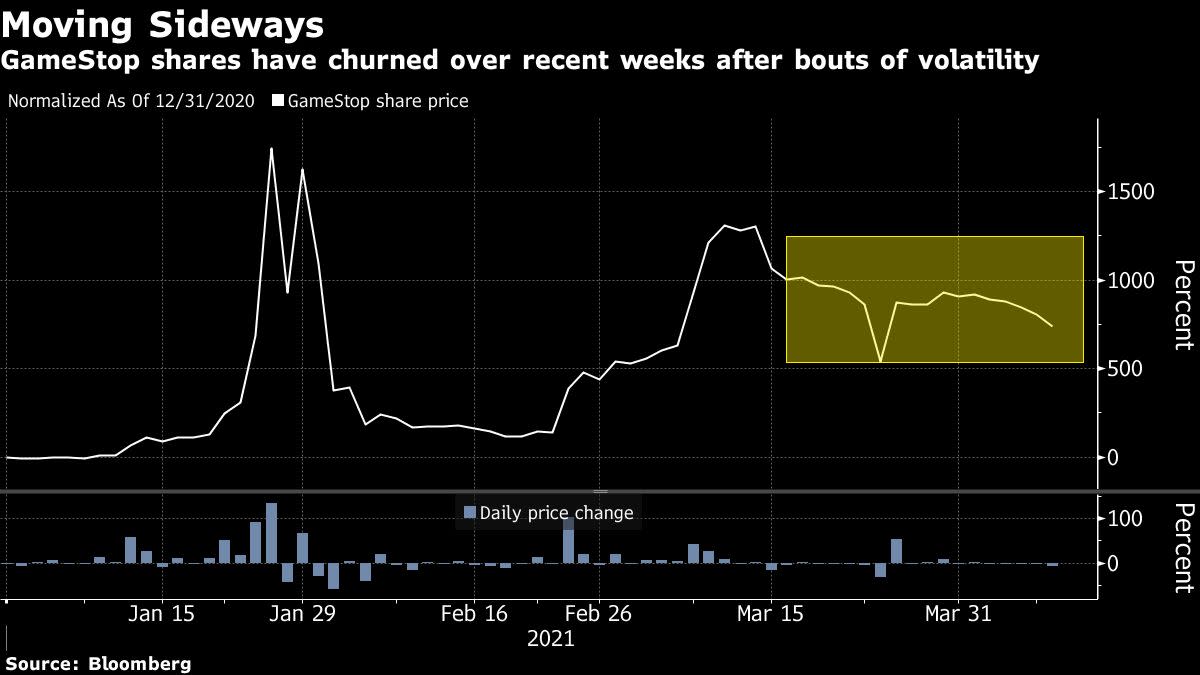

GameStop shares surged about 650% this year, pushing its market value to nearly $10 billion thanks in part to optimism over a Cohen-led overhaul. The activist investor has brought on a number of new executives and board members over the past few months as part of his turnaround.

Still, trading in GameStop, as with most stocks favored by traders using social platforms like Reddit, has fizzled recently as investors turn their focus elsewhere. The company’s announcement earlier this month that it plans to offer as much as $1 billion in additional shares added to the selling pressure.

Read more: Meme Stock Mania Fizzles, Wall Street Sees ‘Big Reckoning’

GameStop, based in the Dallas suburbs, has suffered with the video-game industry’s shift to online distribution. With gamers downloading more and more there’s less reason to make a trip to a physical store, analysts said. The company reported disappointing fourth-quarter earnings last month.

The stock now has five sell-equivalent ratings, compared to two hold ratings and zero buys, data compiled by Bloomberg show. An average price target of $46.50 implies shares will lose two-thirds of their value in the coming year.

(Close prices, updates with details throughout)

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.