Here’s where investors see a market bubble — and it isn’t stocks, says Bank of America

A lull in the news lately has been broken early Tuesday by news that U.S. regulators want Johnson & Johnson’s COVID-19 vaccine suspended over blood-clot concerns (see below). That has hit stock futures as investors wait for inflation data.

Stay tuned to that story. In the meantime, our call of the day comes from Bank of America’s monthly fund manager survey, which pinpoints where investors see a bubble right now. That is as stocks have been hovering at all-time highs.

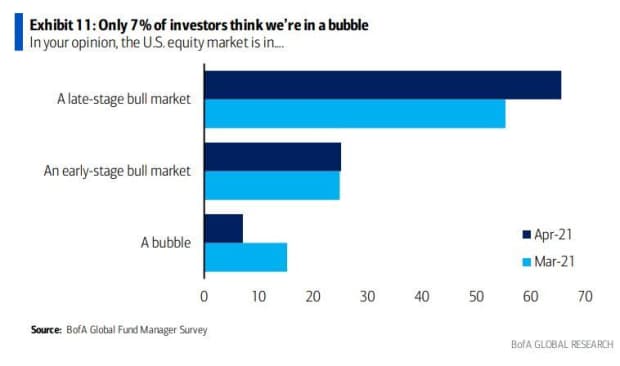

“Only 7% of investors think the U.S. equity market is in a bubble, 25% think early-stage bull market, and 66% late-stage bull market,” said Bank of America chief investment strategist Michael Hartnett and his team in the April survey. Both macro and market optimism among global investors is running high, with prospects of a taper tantrum, inflation and higher taxes seen as more pressing risks, they found.

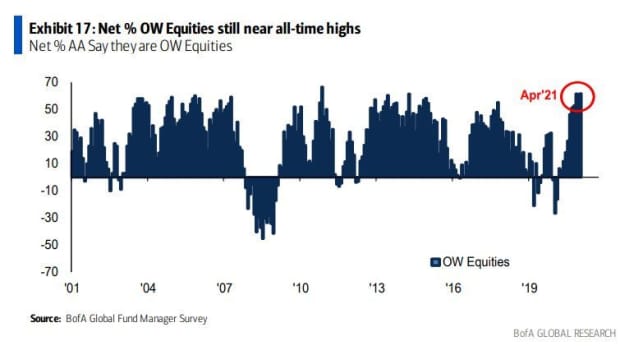

And investoprs have been pouring more money into equities, with the net overweight at 62% and near all-time highs.

And put hardly any money in cash:

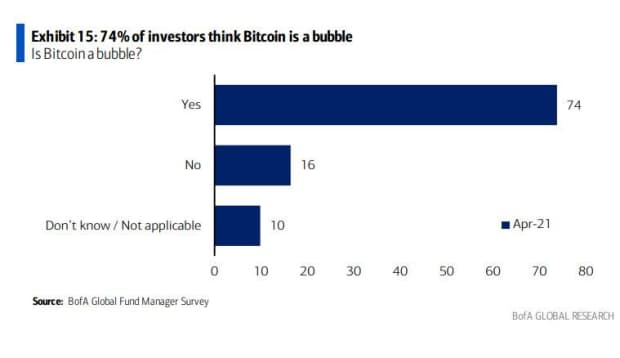

So where’s the danger, then? According to 74% of those global fund managers, bitcoin BTCUSD,

Read: Should you buy Coinbase? The valuation is ridiculous, based on this math

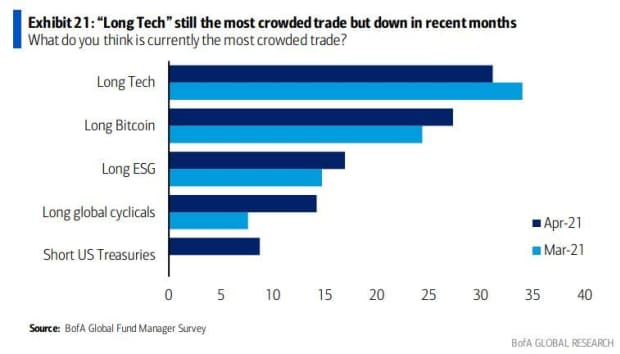

This next chart shows how a long, or bullish, bitcoin position is the second-most crowded trade behind long tech.

The last word from Hartnett and the team? “April FMS [fund manager survey] uber-bullish, but no more bullish than Q1: we say positioning is peaking = cautious risk asset returns.”

Vaccine news rattles investors as CPI looms

Dow and S&P 500 futures ES00,

The Labor Department said its consumer-price index (CPI) for March rose 0.6% and 0.3% for core prices. That follows the biggest annual gain since 2011 for producer prices last week.

The U.S. Food and Drug Administration and Centers for Disease Control and Prevention has recommended a pause in Johnson & Johnson’s JNJ,

As India’s COVID-19 cases soar, the global vaccine supply could be strained. And a new study says the U.K. variant doesn’t make hospitalized patients more sick or cause more deaths.

Singapore-based Grab Holdings announced on Tuesday a deal to go public through a merger with special-purpose acquisition company Altimeter Growth worth nearly $40 billion.

Shares of OrganiGram OGI,

China reported slower-than-forecast exports on Tuesday, but imports went the other way. Treasury Secretary Janet Yellen will reportedly spare China the currency manipulator label in her first twice-yearly foreign exchange report.

The chart

Is this chart trying to tell us something right now? Spotgamma, which makes model-driven forecasts based on the open interest in S&P 500 options, has charted out the increasing popularity of short put bets — an options strategy that wagers an asset won’t fall, in this case the S&P 500.

Random reads

Prince Philip will be back, says this South Pacific tribe.

An authentic piece of Old Blighty is up for sale. Get your red telephone box right now.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.