How to make money from stocks — while you sleep

The early bird doesn’t just get the worm. It also gets the bulk of the stock market’s profits.

That’s because most of the S&P 500’s SPX,

That’s the finding of a recently updated study entitled “Market Return Around the Clock: A Puzzle.” Its authors are Oleg Bondarenko of the University of Illinois at Chicago and Dmitriy Muravyev of Michigan State University.

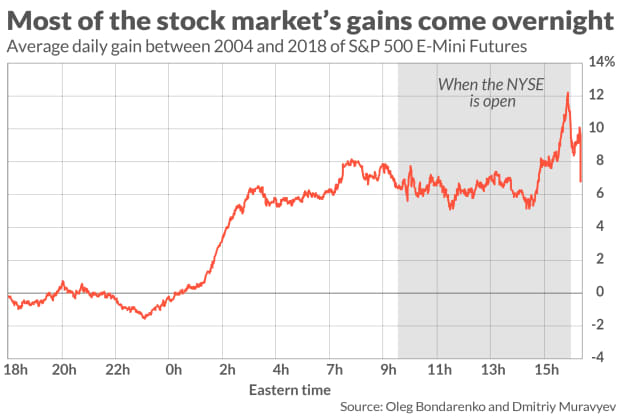

The professors analyzed tick-by-tick trade data for S&P 500 E-mini futures between 2004 and 2018. Crucially, their data reflected trades outside the normal trading hours in which the NYSE is open. They therefore were able to measure the proportion of the stock market’s return since 2004 that was produced while the NYSE was closed.

The chart below illustrates what they found: Over the study period, all of the S&P 500’s net return was produced between 11:30 p.m. and 3:30 a.m. (Eastern time), during which its average return was 7.6% annualized. On average the rest of the time, the market produced a 0.8% annualized loss.

This overall result is based on a 14-year average, and — needless to say — the pattern did not hold up in each and every trading session. Still, Muravyev told me in an interview, the pattern has been remarkably consistent. One indication of this consistency: even if you remove the 10 of these 14 years in which the pattern was the strongest, the pattern still remains statistically significant in the remaining four.

Last year posed a real world test for this market pattern, and that’s what the professors analyzed in their recently completed update of their original study. Not only did they find that the pattern held up in 2020, it actually was a lot stronger than the 2004-2018 average.

Why should this overnight pattern exist?

Muravyev said he believes that the primary cause of this night-versus-day pattern traces to the stock market’s reaction to uncertainty. He and his co-author obtained tick-by-tick histories for CBOE Volatility Index VIX,

This inverse relationship between the stock market and the VIX makes theoretical sense, of course. Investors react negatively to increases in uncertainty, just as they tend to react positively when volatility falls.

But why should uncertainty fall around 11:30 p.m.? Muravyev said that’s when European investors begin to make trades in their portfolios, and their collective actions help to reduce the uncertainty that has built up since the NYSE closed the previous trading day.

To be sure, he added, at all hours of the clock there will be some investors who are just waking up, looking at their terminals, and adjusting their portfolios. But a critical mass of investors is required to ease uncertainty, and it appears as though Europe is the only non-U.S. region around the world which provides that critical mass.

One confirmation of this explanation comes from the S&P 500’s overnight performance before a holiday in Europe. Many European traders will be less focused on the stock market, and, sure enough, on average the overnight pattern in the S&P 500 does not exist on those days.

Investment implications

The most obvious investment implication of this research is for traders to buy S&P 500 E-mini futures at 11:30 p.m. Eastern and sell at 3:30 a.m. “Despite trading twice a day,” the professors report, this trading strategy “remains profitable net of conservative estimates of trading costs — exchange fees, commissions, and the bid-ask spread. Its after-cost Sharpe ratio exceeds that of the buy-and-hold alternative.”

Futures trading is not for amateurs and can be especially risky for those unfamiliar with it. So even if you were otherwise tempted by this strategy, a good idea would be to first consult with a qualified financial professional. You also should trade on paper for at least a month or two before risking any of your money.

Finally, know that this overnight pattern manifests itself on average over many trading sessions. So either be prepared to follow this trading strategy with consistency and discipline over a long period or don’t bother.

Given these qualifications, you may decide that getting a good night’s sleep is worth more than profits from overnight trading. Still, this research shows why you shouldn’t be surprised the next time you see the S&P 500 perform so much better overnight than during the day.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: What history tells us about the future performance of international stocks

Plus: Stock investors can only hope the post-COVID 2020s aren’t like the ‘Roaring ’20s’