It’s time to buy Norwegian Cruise’s stock, says Goldman Sachs

Shares of Norwegian Cruise Line Holdings Ltd. surged Wednesday after Goldman Sachs analyst Stephen Grambling said it was time to buy, citing exposure to “more aspirational consumers” amid stronger signs of pent-up leisure demand.

The stock NCLH,

Grambling raised his rating on Norwegian to buy, after being at neutral for at least the past three years. He boosted his stock price target to $37, which is about 30% above current levels, from $27.

He said he’s become bullish on Norwegian because the cruise operator has seen industry leading capacity growth, exposure to more aspirational consumers and the longest liquidity runway with the lowest leverage, amid stronger signs of pent-up leisure demand once sailings resume.

“Just as importantly, [Norwegian’s] smaller fleet size, greater focus on North American consumers and more limited passengers [younger than] 16 years old provide greater flexibility to adjusted to CDC guidelines and/or begin ‘vaccine only’ sailings,” Grambling wrote in a note to clients.

Norwegian said earlier this month that it plans to resume sailings from U.S. ports starting on July 4, while the Centers for Disease Control and Prevention (CDC) has only said that a summer restart of cruises is possible but didn’t specify a restart date. The CDC’s reluctance to set a resumption date amid COVID-19 pandemic-related uncertainties reportedly prompted the state of Florida to sue the government.

Don’t miss: White House pushes back on cruise industry’s efforts to restart in July, as Florida sues Biden administration.

“The bottom line is [Norwegian] is poised to see fundamentals inflect once sailings resume, with pent-up leisure demand driving a recovery in net yields beyond pre-pandemic levels at the same time that net cruise costs ex-fuel will be slower to bounce back,” Grambling wrote.

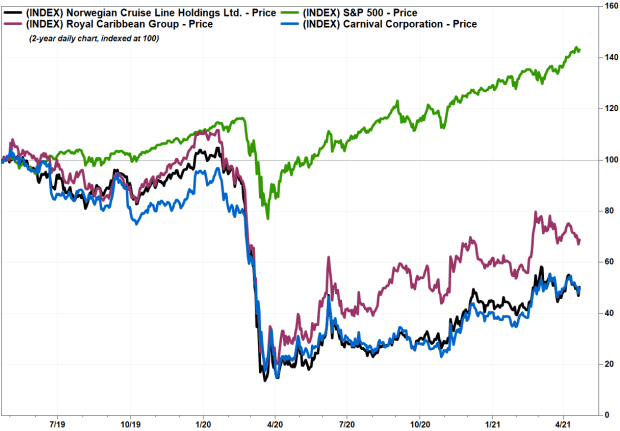

Grambling was also more upbeat on Norwegian rivals Carnival Corp. CCL,

Grambling reiterated the neutral rating he’s had on Carnival since March 2020, but raised his stock price target to $26 from $21. The stock rallied 3.8% in afternoon trading.

For Royal Caribbean, he maintained the neutral rating he’s had for at least the past three years, but lifted his stock price target to $95 from $76. The shares gained 2.5%.

Over the past 12 months, shares of Norwegian have soared 159.4%, Carnival have run up 125.5% and Royal Caribbean have rallied 141.4%, while the SPDR Consumer Discretionary Select Sector exchange-traded fund XLY,