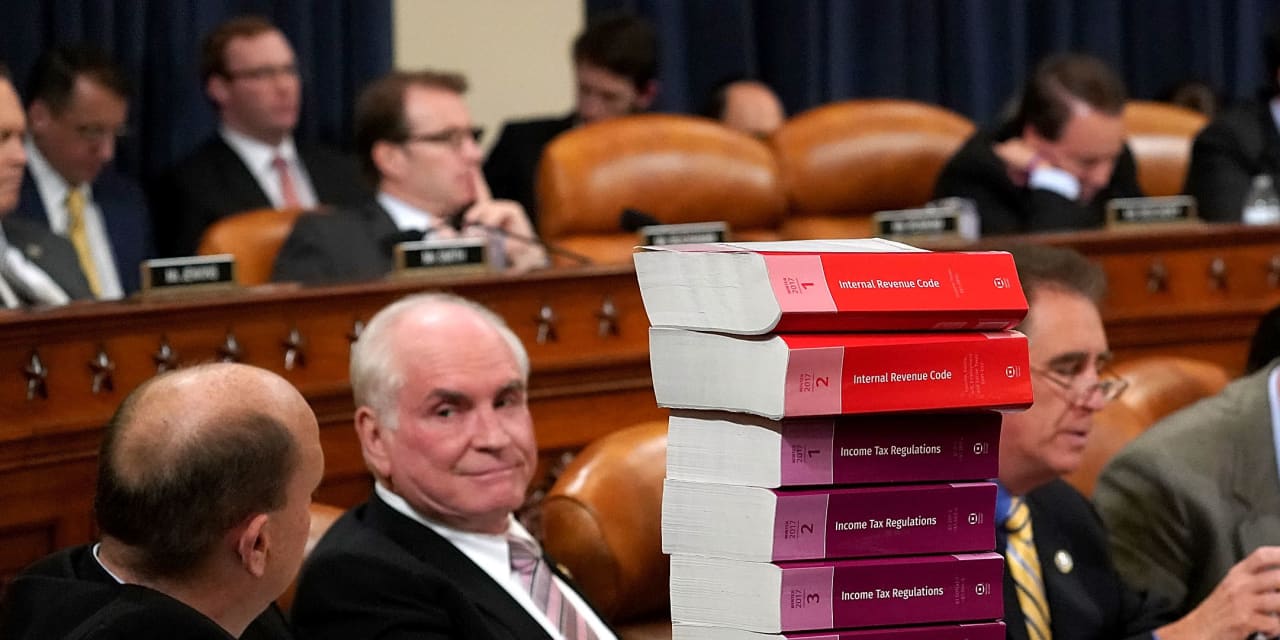

It’s time to toss the unwieldy income tax and replace with it something far simpler

Financing President Joe Biden’s agenda will require substantial tax increases for corporations and wealthier Americans. In a tightly divided Congress, tinkering with the terribly complex tax code is even more difficult and would create unintended consequences. For example, it could encourage more corporate inversions, and reinstating state and local tax deductions would help mostly well-off taxpayers.

It may be time to throw out the income tax in favor of a whole new approach to financing our government—a value-added tax, or VAT.

Not enough reform

The Trump tax reform didn’t reform enough—the old system of high marginal rates and voluminous deductions and credits largely continues. Although nearly 90% of individual filers take the new, larger standard deductions, we now have two parallel systems.

“ A VAT would make more transparent how much new government programs cost and let voters decide whether bumping up the rates are worth their benefits. ”

Many folks who itemized before keep the same records and enter the same information into tax software that determine whether they are better off itemizing or taking the $12,400 standard deduction for individuals or $24,800 for married couples.

Compiling and providing so much detail about our activities and expenses to the federal government and tax professionals is an unconscionable intrusion on privacy. And the system has been abused under several presidents for political purposes.

The whole system favors wealthy individuals and businesses, who can afford expensive accountants, lawyers and K Street lobbyists, to work the tax code’s insane details and obtain special treatment during the complex processes of perpetually rewriting the tax law and translating it into IRS rules.

Businesses are making decisions for reasons of tax avoidance, not sound economics. Democrats in Congress, and left-leaning think tanks assert U.S. businesses enjoy too many tax incentives to move activities offshore.

How a VAT works

The most effective reform would be to simply replace the $2.2 trillion that the Treasury collects annually through income taxes with a VAT on all private purchases and payments.

Businesses and institutions would pay a fixed tax rate on receipts less their outlays for materials, software and equipment, rent and so forth. This subtraction would avoid the double taxation of intermediate goods and services used to make other products as they move through the supply chain to final users.

By taxing goods and services instead of individual income, a VAT would end forever the requirement that ordinary citizens—even those with investment income—keep tedious records and file income-tax returns.

For businesses, it would eliminate headaches with valuing inventories, depreciating buildings and machines and qualifying for special breaks, and save billions in accounting costs and legal fees.

By taxing goods and services at the point of sale, it would end the problem of finding ways to tax activities that U.S. firms park offshore to avoid U.S. taxes.

Overall, businesses and institutions would file much simpler tax returns.

What rate would be required

To replace the revenue that individual and corporate taxes currently generate, the VAT rate could be set at about 10% but two problems remain. A VAT would tax rich and poor consumers at about the same rate. The elderly, who generally rely on savings, already paid taxes on the income that generated those savings during their working years and would be taxed again.

An effective response would be to raise the rate to 13%, and award $4,000 to parents for each child under 19 and to seniors 65 and older. A working single mother with two children, who earned just $7.25 an hour would have a family income above the poverty line.

Under World Trade Organization rules, the VAT would apply to imports, providing additional resources to lessen inequality.

Going a step further, the Social Security and Medicare taxes could be eliminated by raising the rate to 19%.

Such a sales tax might seem high but businesses and individuals would no longer be paying a 15.3% payroll tax on most wages plus income taxes. And businesses would no longer be passing through corporate taxes on the prices they charge.

Biden proposes about $430 billion in new revenue to pay for his policy agenda—that would raise the proposed VAT rate to about 22%. He would have the opportunity to explain why his priorities are worth such a visible increase in taxes.

A VAT would make more transparent how much new government programs cost and let voters decide whether bumping up the rates are worth their benefits.

Peter Morici is an economist and emeritus business professor at the University of Maryland, and a national columnist.

More insights from Peter Morici

Guaranteed income for children could define the midterm elections

The one thing Biden misses with his semiconductor war with China