Oil Edges Higher as Saudis Say OPEC+ Can Be Nimble on Supplies

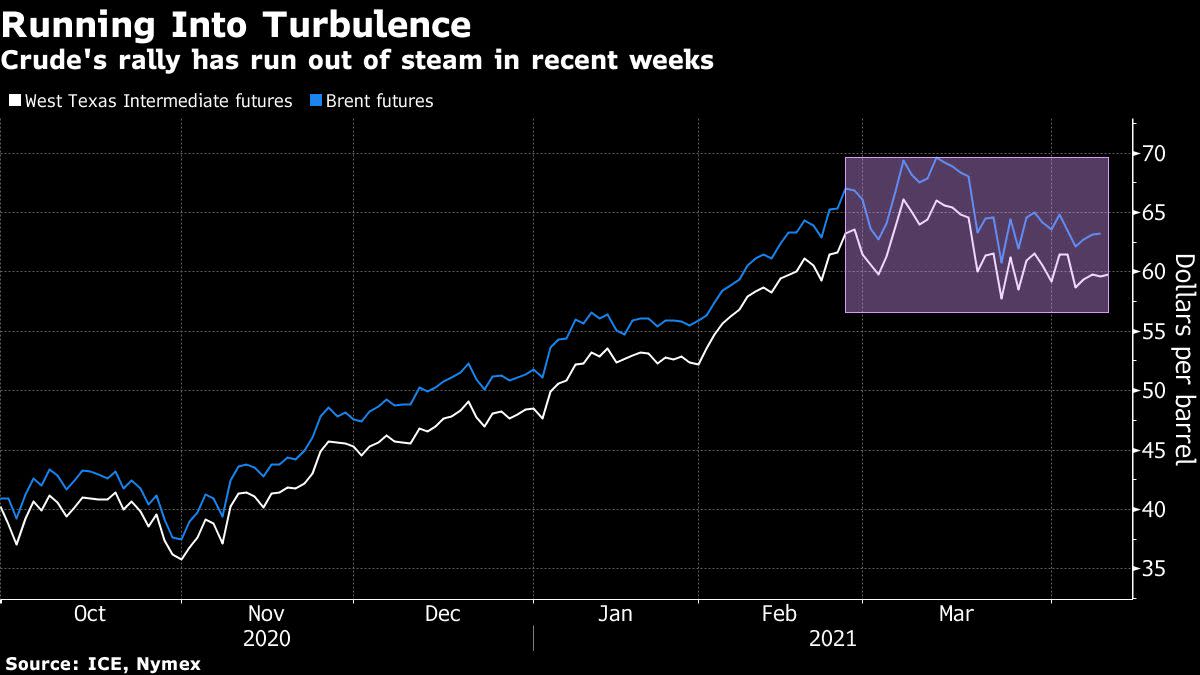

(Bloomberg) — Oil rose to trade near $60 a barrel — but was headed for a weekly drop — as Saudi Arabia defended the OPEC+ plan to increase output and said the alliance was nimble enough to change course if necessary.

West Texas Intermediate added 0.3% after a small decline Thursday, paring its weekly loss to less than 3%. Saudi Energy Minister Prince Abdulaziz bin Salman said there’s nothing yet in the market “that disturbs us”. The group will continue to meet monthly and it can adjust plans, he said in an interview.

Crude has been hemmed into a narrow range around $60 a barrel since mid-March as investors weigh the roll-out of vaccines and increased activity against Covid-19 flare-ups in some countries. The Organization of Petroleum Exporting Countries and its allies plan to reintroduce more than 2 million barrels a day of supply over the coming months. Against that backdrop, Brent’s curve remains backwardated, a bullish pattern marked by higher near-term prices.

“The signals are still very mixed,” said Daniel Hynes, a senior commodities strategist at Australia and New Zealand Banking Group Ltd. “Rising infections and renewed lockdowns are keeping the market on its toes. However, the curve is in backwardation, premiums are rising, and inventories falling.”

The plan from OPEC+ envisages a phased return of production over the three months to July, with the alliance easing collective curbs and Saudi Arabia phasing out an additional, unilateral cut. The cartel will update its global supply-and-demand forecasts in a monthly report next Tuesday.

California provided further evidence that the lifting of anti-virus curbs is helping to stoke energy consumption, even as outbreaks worsen in Brazil, India, and parts of Europe. Gasoline prices in the most populous U.S. state are nearing $4 a gallon, a level that was last seen in November 2019.

The picture across Asia is varied. In India, cases are running at a record daily pace, while China’s vaccination roll-out is hitting nearly 5 million doses a day. Japan is set to reimpose curbs in Tokyo, Kyoto and Okinawa aimed at curbing a rapid spread, three weeks after ending a state of emergency in the capital.

As highlighted by ANZ’s Hynes, Brent’s underlying structure has shown signs of strength. The global benchmark’s prompt timespread was 51 cents a barrel in backwardation on Friday, up from 6 cents at the start of last week. That’s a positive pattern, with near-term prices trading above those further out.

There was further support for financial markets from the Federal Reserve. Chair Jerome Powell told a virtual panel the U.S. central bank will go on providing the support the world’s largest economy needs to bounce back fully from the pandemic. That stance was echoed by Fed Bank of San Francisco President Mary Daly in an interview with Bloomberg Television on Friday.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.