Quants Are Getting Ready to Pounce on China’s Commodity Boom

(Bloomberg) — Trend-following hedge funds in Europe and the U.S. are waiting in the wings as China opens up its futures markets in everything from coal and soybeans to silver.

These quantitative traders are looking to ride the momentum of hard and soft commodities in the world’s second-largest economy after policy makers eased access for foreigners in November.

So-called Commodity Trading Advisors who are actively considering the move include AlphaSimplex Group LLC in the U.S., Transtrend BV in the Netherlands and Aspect Capital Ltd. in the U.K.

While individual contracts still have to be approved for trading, speculative investors see new opportunities to generate big returns in assets hitched to the Asian nation’s business cycle.

Chinese managed futures strategies overall have returned 71% over the past five years, according to Shenzhen PaiPaiWang Investment & Management Co. That’s a world away from the well-documented struggles that have lashed CTAs in developed markets.

Since November, the government has given the green light to overseas funds qualified for two existing programs known as QFII and RQFII to trade mainland futures including bonds and commodities. Previously, global hedge funds typically had to use swaps or set up local units. Man Group, Winton Group and GAM Systematic are among trend followers already active in the country.

“We are exploring to become QFII licensed to actively participate in these markets and contribute to liquidity, risk transfer and price discovery,” said Andre Honig, executive director at $4 billion CTA Transtrend.

Hugely Liquid

China has been gradually opening up its capital markets in a bid to project its economic strength and lure fresh capital. Officials have also introduced a growing list of yuan futures to boost the country’s pricing power over commodities like crude oil and palm olein.

Caution remains the guiding principle for regulators, however. For instance, foreign investors can only trade stock-index futures for hedging rather than speculative purposes — a requirement that hasn’t yet been officially lifted.

But with trillions of dollars worth of futures contracts changing hands every month, systematic investors in U.S. and Europe see plenty of opportunities.

“They’re hugely liquid,” said Chris Longworth, senior scientist at GAM Systematic. “They’ve had strong trends. It’s everything we look for in an asset.”

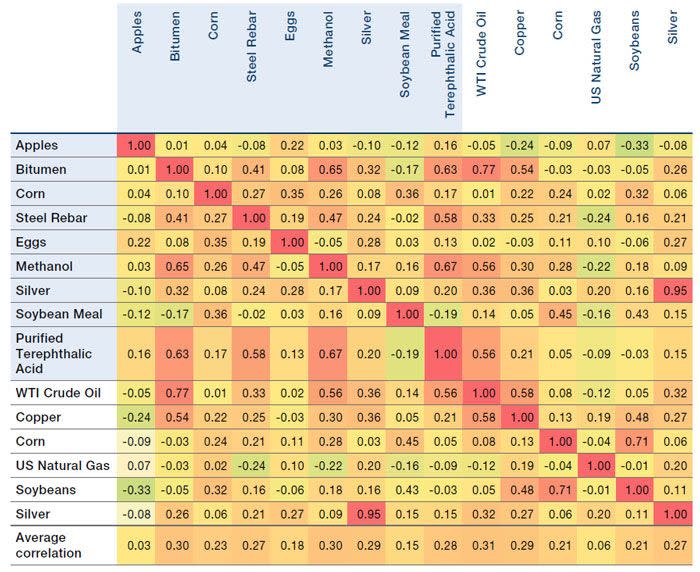

China was home to five of the most-traded contracts globally in 2020, according to a recent report from Man: steel rebar, soybean meal, silver, methanol and purified terephthalic acid, an ingredient needed for polyester.

The country also offers a handful of commodity futures found pretty much nowhere else such as eggs, glass and even red dates.

All that means after years of underperformance CTAs are looking to the Asian nation to revitalize their strategies.

The Man report provides encouragement on that front, estimating that a momentum portfolio in Chinese commodities would have beaten a similarly designed strategy in global markets in 13 of the last 15 years. Chinese futures tied to the business cycle from steel rebar to coking coal have staged an especially strong rally in recent months as demand bounced back, with the former up 22% just this year.

The domestic futures also have a tendency to be relatively insulated from the ebbs and flows of developed-market price swings.

Chinese and U.S. corn contracts, for instance, only have a 0.24 correlation — less than that between global copper and soybeans, or WTI crude and silver, according to Man which has been trading Chinese futures since 2014.

That’s partly because mainland derivatives haven’t been easily accessible to foreign investors to-date and the fact that commodities in the country are subject to different economic and environmental factors.

“In one word, it’s diversification,” said Giuliana Bordigoni, director of specialist strategies at Man AHL, the systematic unit at Man Group. “You can find quite a wide range of markets that have low correlation with the rest of the world.”

(Updates first chart and adds commodity move in fifth-last paragraph)

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.