Topps to go public through SPAC deal as baseball card company ventures into NFTs

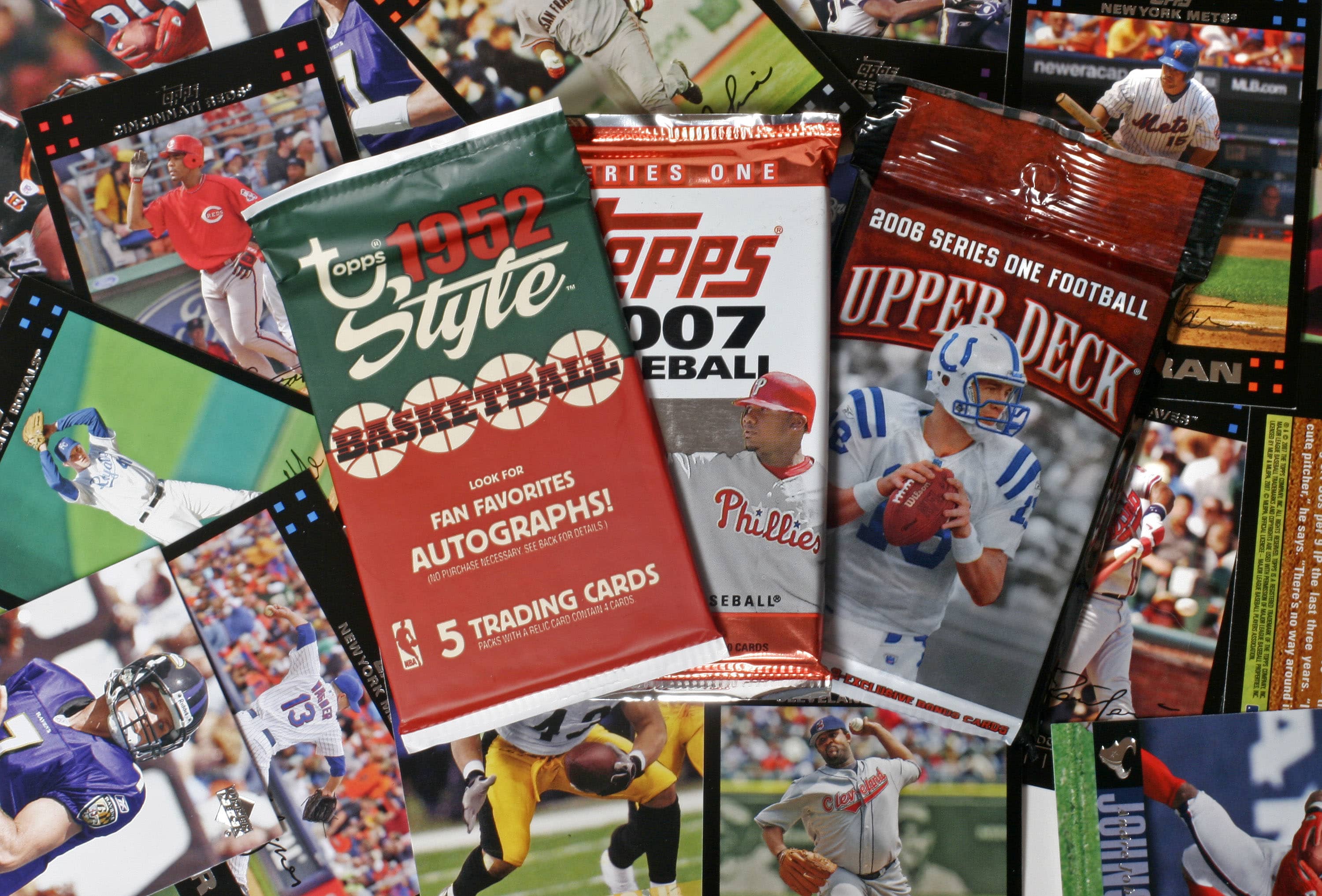

Topps trading cards are arranged for a photograph in Richmond, Virginia.

Jay Paul | Bloomberg | Getty Images

Topps, which is best known for its baseball cards and Bazooka candy line, has agreed to go public through a merger with Mudrick Capital Acquisition Corporation II, a special purpose acquisition company, that values Topps at $1.3 billion.

Former Disney CEO Michael Eisner will stay on Topps’ chairman.

The deal is expected to close in the late second or early third quarter. The combined company will be called Topps and will trade on the Nasdaq under the ticker “TOPP.” The New York Times’ Dealbook was the first to report the deal.

Topps’ net sales rose 23% in 2020 to $567 million, a record high for the company. While Topps is best known for its sports trading cards, it’s branched out into interactive mobile apps to connect collectors and recently expanded into nonfungible tokens, a new kind of digital asset. Ownership of an NFT is recorded on a blockchain, similar to the networks that underpin cryptocurrencies. Each NFT is unique and can’t be duplicated, just like owning an original painting or a rare baseball card.

Other companies, ranging from Taco Bell to Atari, have also jumped on the NFT bandwagon. Funko, which makes collectible vinyl figurines, recently bought an NFT startup to help it navigate the new trend.

Topps also has a gift cards business under the name Topps Digital Services, where it works with companies like Netflix, Airbnb and Nike. Its candy segment includes iconic brands like Bazooka, Ring Pop and Baby Bottle Pop.

Tune into CNBC at 8:15 a.m. ET for an interview with Michael Eisner, former Disney CEO and current Topps chairman, and Jason Mudrick, founder and chief investment officer of Mudrick Capital Management.

This is a breaking news story. Please check back for updates.