Value of top 50 mining companies surges $600 billion from covid lows

Measured from the height of the pandemic in March-April the index has now recovered by an astonishing $636 billion thanks to a boom in spending on green infrastructure – not only in China, but across Europe and the US.

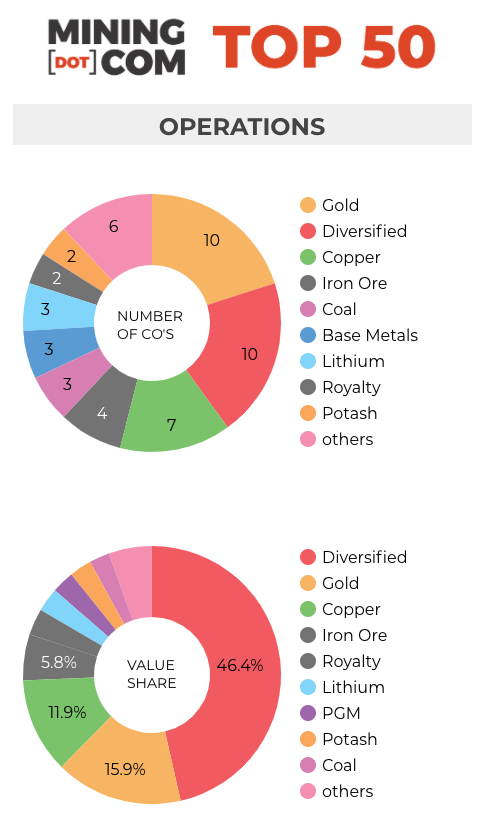

An indication of how widespread the rally in mining stocks was the past year is the fact that a year ago a valuation of just over $4 billion secured a company a spot in the Top 50 while today, number 50 on the list, Tianqi Lithium, is valued at more than $8.5 billion. Companies around the $4 billion market cap mark now sit in the mid-60s.

Iron ore IPO

Iron ore prices back above $170 a tonne lit a fire under the top producers, boosting BHP, Rio Tinto, and Fortescue’s value this year and (with help of roaring platinum group metals) lifted Anglo American to position number four, the highest rank in years for the company with roots stretching back more than a century to Johannesburg.

One of the biggest mining IPOs since Glencore in 2011 came on the back of the steelmaking raw material’s performance with Brazil’s CSN Mineração debuting at 47 with a market value of over $9 billion as at 31 March. The mining unit of steel giant Companhia Siderúrgica Nacional currently produces about 33 million tonnes of ore per year, but with ambitious plans to triple that over the next decade.

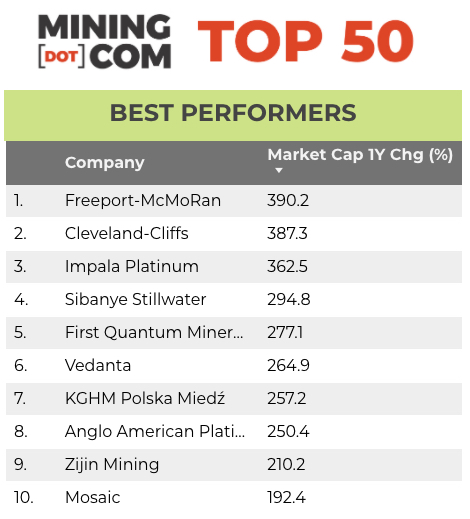

US iron ore producer Cleveland Cliffs managed to climb 35 spots over the past year, entering the top 50 for the first time after a nearly 400% rise over the past year.

Gold tarnished

Gold and silver’s relative underperformance saw a handful of gold companies including B2Gold, Yamana, Kinross and streamer Royal Gold fall out of the top 50.

The combined value of gold, silver and streaming companies in the ranking now make up 16% of the index, down from 26% when gold prices were peaking in the third quarter of last year and the sector has lost over $50 billion in value since its peak, lead by Barrick Gold, which bled more than $14 billion since end-September 2020.

That’s in stark contrast to platinum group metal producers which have jumped in the ranking – Impala is up 27 spots after a 360% jump and Anglo American Platinum has added 250% in value in US terms and now sits just outside the top 10. The Johannesburg-listed counters not only benefited from soaring PGM prices but also a strengthening rand.

Freeport McMoRan is up nearly 400% from its covid-lows in March, joined by other base metal miners in the top performers list. KGHM briefly dropped out of the Top 50 at the end of the first quarter but is now back at no 42 and Vedanta returns to the ranking at 34 from 53 a year ago.

First Quantum Minerals added nearly $10 billion in value over the past year and like Vedanta climbed 19 spots over the past year, only bested by PGM specialists.

Another indication of how broad-based the rally from pandemic lows a year ago is that among the worst performers only two companies – Shandong Gold and Coal India – actually showed a decline in value in US dollar terms over the past year.

Click on the image for the full-size table:

*NOTES:

Source: MINING.COM, Miningintelligence, Morningstar, GoogleFinance, company reports. Trading data from primary-listed exchange where applicable, currency cross-rates at time of publication.

Percentage change based on US$ market cap difference, not share price in local currency.

Market capitalization calculated at primary exchange, where applicable, from total shares outstanding, not only free-floating shares.

As with any ranking, criteria for inclusion are contentious issues. We decided to exclude unlisted and state-owned enterprises at the outset due to a lack of information. That, of course, excludes giants like Chile’s Codelco, Uzbekistan’s Navoi Mining, which owns the world’s largest gold mine, Eurochem, a major potash firm, Singapore-based trader Trafigura, and a number of entities in China and developing countries around the world.

Another central criterion was the depth of involvement in the industry before an enterprise can rightfully be called a mining company.

For instance, should smelter companies or commodity traders that own mostly minority stakes in mining assets be included, especially if these investments have no operational component or warrant a seat on the board?

This is a common structure in Asia and excluding these types of companies removed well-known industry names like Japan’s Marubeni and Mitsui, Korea Zinc, Chile’s Copec and China’s Tsingshan.

Levels of operational or strategic involvement and size of shareholding was another central consideration. Do streaming and royalty companies that receive metals from mining operations without shareholding qualify or are they just specialized financing vehicles? We included Franco Nevada, Royal Gold and Wheaton Precious Metals.

Vertically integrated concerns like Alcoa and energy companies such as Shenhua Energy where power, ports and railways make up a large portion of revenues pose a problem as do diversified companies such as Anglo American with separately listed majority-owned subsidiaries. We’ve included Angloplat in the ranking as well as Kumba Iron Ore.

Many steelmakers own and often operate iron ore and other metal mines, but in the interest of balance and diversity we excluded the steel industry, and with that many companies that have substantial mining assets including giants like ArcelorMittal, Magnitogorsk, Ternium, Baosteel and many others.

Head office refers to operational headquarters wherever applicable, for example BHP and Rio Tinto are shown as Melbourne, Australia but Antofagasta is the exception that proves the rule. We consider the company’s HQ to be in London, where it has been listed since the late 1800s.

Please let us know of any errors, omissions, deletions or additions to the ranking or suggest a different methodology.