20 cybersecurity stocks Wall Street believes can rise up to 79% over the next year

Cybersecurity is more critical than ever, especially in a world already reeling from supply disruptions and bottlenecks caused by the coronavirus pandemic. The latest big ransomware attack, against Colonial Pipeline Co., is an eye-opener, as it has led to the shutdown of the 5,500-mile Colonial Pipeline system and could push up gasoline prices.

Beyond COVID-19, we are all threatened with the loss of personal data security as hackers continue to come up with new ways to exploit networks, software and the array of evolving technology services.

Below is a screen of 20 cybersecurity companies that Wall Street analysts like for big gains in the stock market over the next year.

Cybersecurity ETFs

Many information technology companies offer various services that may or may not include software or hardware meant to improve network security. There is no obvious industry group for a broad stock screen.

To screen for a list of favored cybersecurity/network security/internet security stocks, we began by listing all the stocks held by four large exchange-traded funds:

- The First Trust Nasdaq Cybersecurity ETF CIBR,

-0.51% has $3.58 billion in assets under management and annual expenses of 0.60% of assets. The fund holds 40 stocks, mainly software and networking companies, but has an “expanded focus” to include other industries, such as aerospace and defense, according to FactSet. It is concentrated; the 10 largest holdings make up 47% of the portfolio. The ETF is rated two stars (out of five) by Morningstar. - The ETFMG Prime Cyber Security ETF HACK,

-0.89% has $2.04 billion in assets with an expense ratio of 0.60%. The ETF holds 59 stocks in a modified equal-weight scheme, so it isn’t very heavily concentrated. The top 10 making up 28.5% of the portfolio. According to FactSet, HACK has “a unique, cybersecurity-focused take on the technology sector that gives it a small-cap tilt.” The ETF only has a one-star rating from Morningstar. - The Global X Cybersecurity ETF BUG,

-0.79% has $639 million in assets, an expense ratio of 0.50% and no Morningstar rating because it is less than three years old (it was established in October 2019). The fund holds 40 stocks globally, with weighting caps that limit its concentration on large-cap companies. But it is still heavily concentrated, with the 10 largest holdings making up 61% of the portfolio. Fortinet Inc. FTNT,-2.69% alone makes up 9.2%, followed by Palo Alto Networks Inc. PANW,+0.02% at 7.3% and CrowdStrike Holdings Inc. CRWD,+0.02% at $7.1%. - The iShares Cybersecurity & Tech ETF IHAK,

-0.94% has $458 million in assets, a 0.47% expense ratio and was established in June 2019. The fund holds 42 stocks of companies selected for having at least 50% of revenue derived from security-related hardware or services, weighted by market capitalization. It is concentrated, with the top 10 making up 44% of the portfolio.

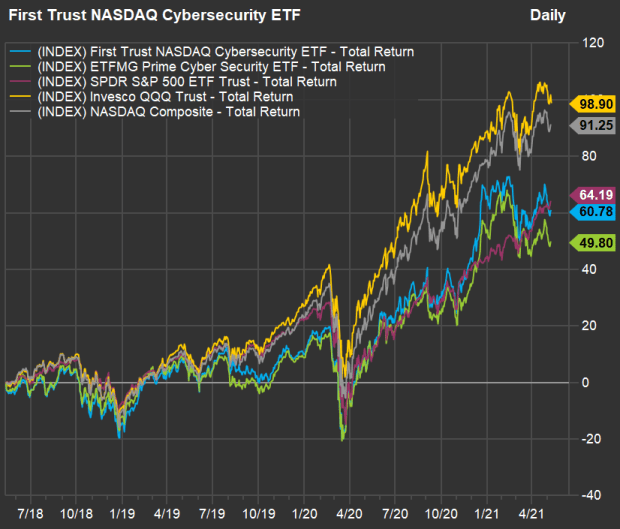

As far as the low ratings from Morningstar for CIBR and HACK, these funds have not been terrible performers over the past three years, but they have underperformed the SPDR S&P 500 ETF SPY,

Cybersecurity stock screen

Adding the four funds’ holdings and removing duplicates leaves a list of 56 stocks that are covered by at least five analysts polled by FactSet and have stock-market capitalizations of at least $1 billion.

Here are the 20 with majority “buy “or equivalent ratings that have the highest implied 12-month upside potential based on consensus price targets. You will need to scroll the table to see all the data:

Three of these stocks are especially popular with MarketWatch readers, based on traffic flow to their quote pages. All three have pulled back this year after incredible returns during 2020:

- Shares of DocuSign Inc DOCU,

-2.48% are down 13% in 2021 after tripling during 2020. - Cloudflare Inc. NET,

-3.59% has dipped 10% this year after last year’s 345% gain. - CrowdStrike Holdings is down 11% in 2021 following a 325% gain in 2020.

As always, a screen only highlights favored stocks. You should do your own research to form your own opinion about any investment before jumping in.