A 10% drop or at least a pause could be looming for the S&P 500. Take shelter in these sectors, says veteran strategist

Legendary investor Warren Buffett told his faithful over the weekend that the U.S. economy is “red hot,” suggesting money in an index fund is better served than picking stocks. That advice comes as investors face what could be a seasonally weak period for equities.

The “sell in May and go away” adage dictates that from now to October is often a less profitable and more bumpy time for stocks, partly as the weather warms up and big traders spend more time vacationing, leaving behind junior traders and opening the door to volatility.

A stock hiatus doesn’t seem like a crazy idea right now. Hovering near all-time highs, the S&P 500 SPX,

But instead of selling, “curb your enthusiasm” may be better advice to follow for the next six months, says our call of the day from Stifel’s head of institutional equity strategy, Barry Bannister. He predicts the S&P 500 is headed for flat to down 5% to 10% for the next few months.

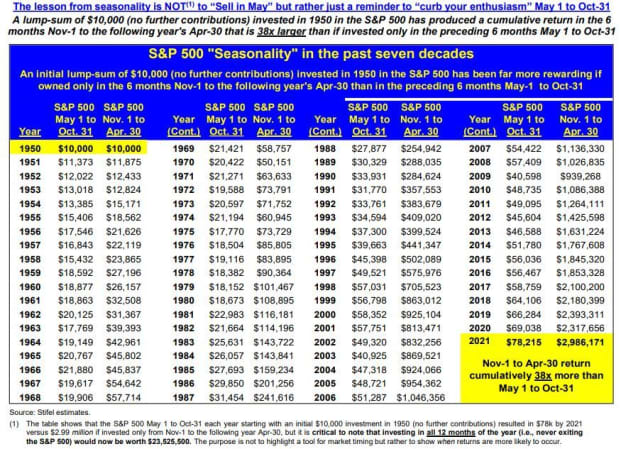

He bases that on the “usual seasonality math” that predicted a 26% gain from November to April 30, 2021, while we got a 28% bump. Others have been chiming in on seasonality, such as UBS and LPL Financial who both urge investors to stick around. Here’s Bannister’s chart:

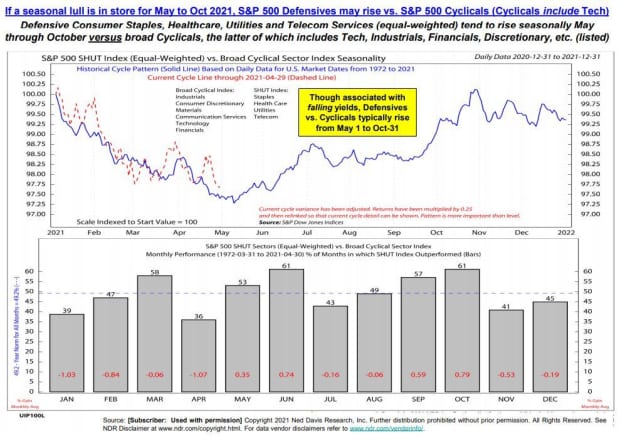

Bannister’s next chart shows how

His next chart shows this: “A lump-sum of $10,000 (no further contributions) invested in 1950 in the S&P 500 has produced a cumulative return in the 6

months Nov-1 to the following year’s Apr-30 that is 38 times larger than if invested only in the preceding 6 months May 1 to Oct-31.”

And if things turn out as Bannister expects, he said investors should get investors to get selective about sectors, says Bannister.

“If May through Oct-2021 is seasonally weak, we note that S&P 500 defensives (staples, healthcare, utilities, telecom services) do typically outperform cyclicals (note cyclicals include technology) in the same period, albeit usually with

falling yields. S&P 500 seasonal strength the six months since Nov-1, 2020 also appears to have front-loaded returns, diminishing May-Oct 2021,” he said.

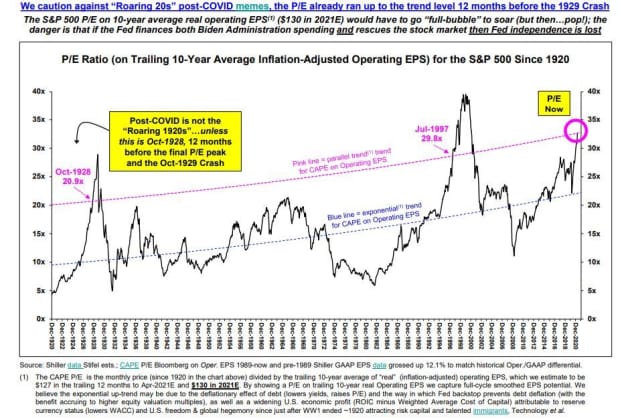

Bannister says if he’s wrong, the “only bubble path” is a much higher price/earnings ratio based on yield repression.” And as for those who “see post-COVID-19 as a ‘Roaring 1920s’ meme,” he noted the market P/E has already reached the Oct-1928 trend-adjusted level, which came just 12 months before the Oct-1929 crash.

Ethereum is red hot and more data is coming

Taking your eyes off the screens this summer may be less advisable if you’re hot on cryptocurrencies. Ethereum ETHUSD,

Elsewhere, U.S. stock futures ES00,

President Joe Biden’s massive proposed spending plan won’t spark inflation, argued Treasury Secretary Janet Yellen on NBC’s “Meet the Press” on Sunday. Federal Reserve Chairman Jerome Powell will be speaking at the Just Economy conference on Monday, discussing community development.

The Markit final April manufacturing purchasing managers index is on tap, with the Institute for Supply Management’s April manufacturing index and construction spending also ahead, along with auto sales.

Another busy week for earnings kicks off with do-it-yourself home retailer Lowe’s LOW,

Shares of Tesla TSLA,

Multinational conglomerate Berkshire Hathaway BRK.A,

Telecoms giant Verizon VZ,

Epic Games and Apple AAPL,

Read: If you missed out on the SPAC craze you’re probably better off

The EU is urging the lifting of restrictions on non-essential travel to the region by vaccinated foreign nationals who hail from a country that has a good epidemiological situation.

Random reads

Manchester United soccer fans invaded the pitch on Sunday to protest the club’s owners, who had backed the failed Super League.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.