Asian Stocks, U.S. Futures Drop on Inflation Angst: Markets Wrap

(Bloomberg) — Asian stocks and U.S. equity futures slid Tuesday after a technology-led tumble on Wall Street as surging commodity prices stoked concern about inflation. The dollar pared a decline.

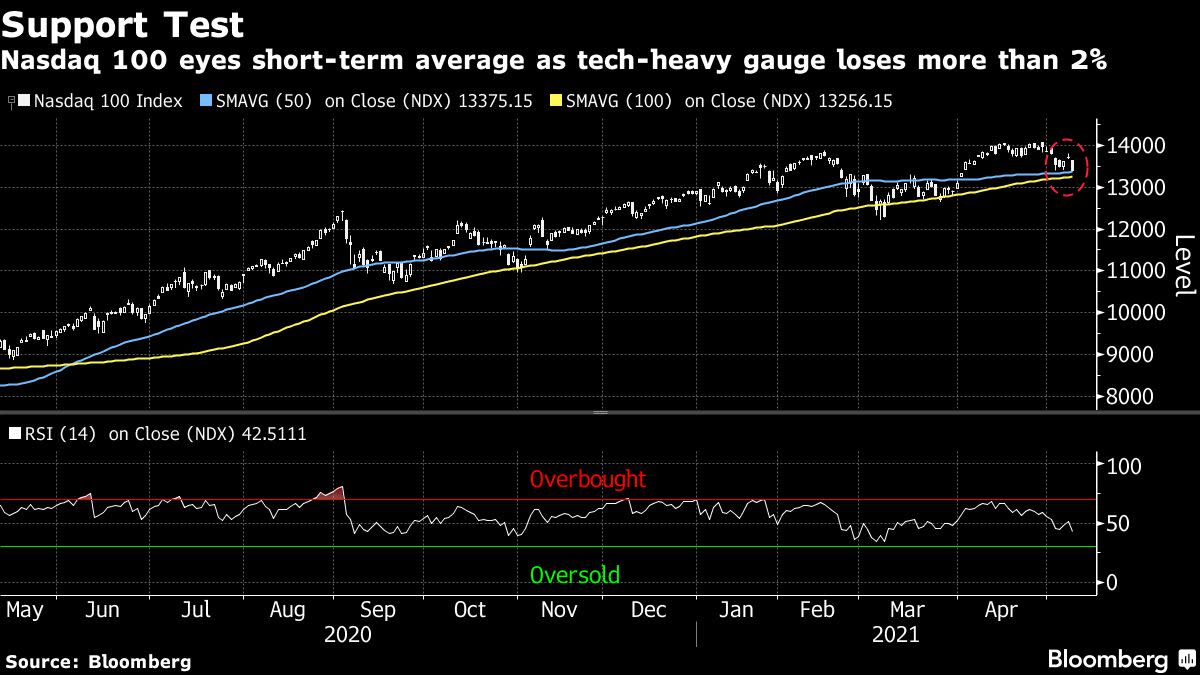

A gauge of Asian equities fell the most since March, with technology stocks underperforming amid a sea of red from Japan to Hong Kong. Nasdaq 100 contracts retreated more than 1% after the index tumbled on the growing anxiety over inflation. S&P 500 futures dropped after the gauge fell from an all-time high.

Oil retreated as traders monitored the worsening fallout from the closure of the largest U.S. oil-products pipeline. The spotlight remains on commodities generally and the market implications of recent jumps in materials like copper and iron ore.

Concerns about knock-on price pressures boosted a gauge of inflation expectations to the highest level since 2006. The benchmark 10-year Treasury yield slipped back after earlier rising to 1.60%.

The run-up in raw materials is intensifying debate ahead of a U.S. CPI report Wednesday that is forecast to show a strong gain in April. The year-on-year reading will be amplified by the pandemic shock a year earlier, but it plays into a broader market concern that the Federal Reserve may be forced to raise interest rates sooner than current guidance suggest to contain inflation.

“We’re going to see volatility definitely over the next couple of months” given uncertainty over the path of growth, Kristen Bitterly, head of capital markets in the Americas for Citi Private Bank, said on Bloomberg TV. “Cash and duration are punitive so you need to make sure that where you have that yield is non-rates sensitive parts of the market.”

In China, factory-gate prices surged more than expected in April, supported by gains in commodity prices and a low base of comparison from last year, while consumer inflation remained relatively subdued.

The Australian dollar was steady ahead of the federal budget. The government is expected to unveil a narrowing budget gap and more spending.

See here the MLIV Question of the Day: How Far Can Reflation Trades Go?

Here are some key events to watch this week:

A range of Fed speakers are due this week, including Governor Lael Brainard on Tuesday, among othersOPEC monthly Oil Market Report is published with global demand forecasts and production estimates TuesdayU.S. CPI report Wednesday is forecast to show prices continued to increase in AprilBank of England Governor Andrew Bailey speaks Wednesday

These are some of the main moves in markets:

Stocks

S&P 500 futures dipped 0.6% as of 11:31 a.m. in Tokyo. The S&P 500 Index shed 1%Nasdaq 100 contracts lost 1.1%. The Nasdaq 100 fell 2.6%Japan’s Topix index dropped 1.8%Australia’s S&P/ASX 200 Index fell 0.7%South Korea’s Kospi index lost 1.5%Hong Kong’s Hang Seng Index dropped 1.7%Shanghai Composite Index lost 0.7%

Currencies

The yen was at 108.93 per dollarThe offshore yuan was at 6.4250 per dollarThe Bloomberg Dollar Spot Index rose 0.1%The euro traded at $1.2132

Bonds

The yield on 10-year Treasuries dipped about one basis point to 1.59%Australia’s 10-year bond yield held at 1.71%

Commodities

West Texas Intermediate crude was at $64.40 a barrel, declining 0.5%Gold was little changed at $1,837.16 an ounce

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.