Bitcoin at $250,000 in a year? This ‘rocket fuel’ will help it get there, says Goldman Sachs alum

After a lackluster start to the week, stock futures are pointing higher, with beaten-down technology names possibly taking the lead.

While the Nasdaq Composite COMP,

Monday’s crypto session in particular was brutal, wiping out over half a trillion dollars across the asset space.

The faithful need to hang in there, says our call of the day from former Goldman Sachs hedge-fund manager and cryptocurrency bull Raoul Pal. Not only does he see a big bitcoin catalyst coming this year, he is also sticking to a bullish price target.

“I think BTC goes well above $250,000 in the next 12 months and ETH [ethereum] well above $20,000,” the chief executive officer of Global Macro Investor and co-founder of Real Vision financial and Crypto TV, told MarketWatch.

The second most popular cryptocurrency behind bitcoin, ethereum ETHUSD,

Investors should remember that corrections come with the cryptocurrency territory, said Pal. “If you understand bitcoin, you understand its volatility, you understand that 35% pullbacks are normal,” he said, pointing to a chart he retweeted on Monday.

“[Bitcoin] is still currently producing 200% annualized returns, which is the highest return of any asset ever recorded in history,” Pal said.

And while that return is likely to cool over time, “the adoption rate of the entire cryptocurrency market is still growing at 113% a year, which is double that of the internet from 1990 to 2000. So this is the fastest pace of adoption of any technology in history.”

Another reason for believers to hang on is that Pal sees “rocket fuel” for digital assets via a long-awaited U.S. exchange-traded fund that he expects to be announced by September. Once that happens, “the whole crypto market will lift as prices go higher due to new sources of demand from RIA’s [registered investment advisers] and asset managers,” he said.

“So the issue for regular investors is there is no way for them to access cryptocurrencies without setting up a new wallet and accounts on an exchange that they’re not familiar with. And most registered investment advisers don’t have a mandate to buy crypto,” said Pal.

Current choices are slim, including crypto platform Coinbase COIN,

Elsewhere, Mike Novogratz, chief executive of digital merchant bank Galaxy Digital and a big cryptocurrency investor, told Bloomberg TV on Monday that weeks of consolidation lie ahead for bitcoin, keeping the crypto stuck between $40,000 and $50,000. He also believes, though, the “next catalyst is the ETF.”

Read: Is a new ‘crypto’ fund the long-awaited bitcoin ETF in disguise

And: This new ETF gets you access to the backbone of the crypto world

Walmart earnings and a ‘big short’

Ahead of fresh economic indicators — building permits and housing starts or new residential construction projects — stock futures ES00,

In the retail space, Walmart WMT,

The investment firm behind Michael Burry, famous for predicting the mortgage crisis, has made a bearish bet against Tesla. Meanwhile, California’s Department of Motor Vehicles has put the electric-car company’s fully autonomous driving option under review.

E-commerce giant Amazon AMZN,

Warren Buffett’s Berkshire Hathaway BRK.A,

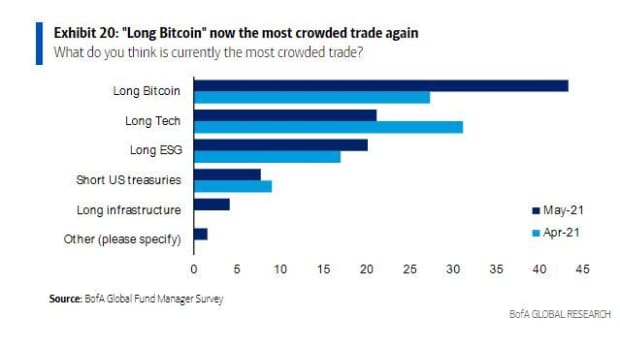

The chart

Bank of America’s monthly fund manager survey shows many think the bullish bitcoin call is very crowded.

Random read

The first nuclear explosion and a rare quasicrystal.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.