Bitcoin’s 40% crash ‘does feel like capitulation,’ says crypto specialist, but here’s where the next crucial support level stands

Crypto markets have shifted from buy, buy to bye, bye bitcoin, in a nanosecond, and technicians say that the digital asset may have more room to fall in the near term as a monthslong bullish trend unravels.

Prices for the world’s most popular digital asset had broken below a number of levels viewed as support for the asset, including $42,000.

See: Crypto winter? Bitcoin lurches to lowest level in months and alts like dogecoin sink 48% from peak

At last check, bitcoin BTCUSD,

Check out: Bitcoin tumbles further below $40,000 after China issues crypto warning

Katie Stockton, founder and managing partner of Fairlead Strategies, said that bitcoin and the broader crypto complex is seeing one of its worst selling stretches since March 2020, with bitcoin down 40% from its April high.

She estimates that the next support for bitcoin may be around $34,000. She told MarketWatch that that level is based on a 50% retracement of the uptrend for bitcoin that began in March 2020.

Galaxy Digital GLXY,

“It does feel like capitulation this morning,” he said.

“But it’s not going to bounce right back…it’s going to consolidate,” Novogratz said.

The slump for bitcoin comes after the People’s Bank of China was seen warning against using digital coins as payment.

The correction playing out in crypto also saw Ether ETHUSD,

The crypto crash also came as futures for the Dow Jones Industrial Average YM00,

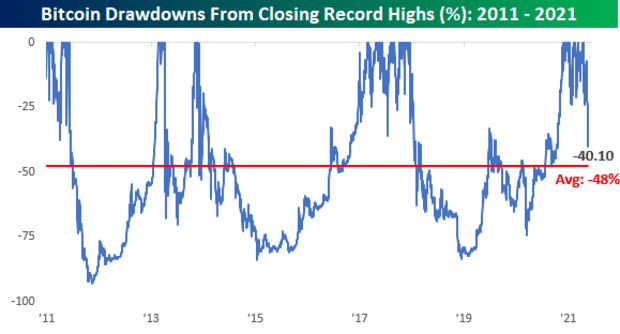

Despite the pain being endured by the crypto community, analysts at Bespoke Investment Group note that a 40% slide is fairly mundane by bitcoin standards.

“That’s steep no matter how you look at it, but would you believe that over the last 10 years, bitcoin’s average drawdown from a record high on any given day is close to 50%, and on 69% of all trading days during this span bitcoin has been down more than 40% from its record high? (see attached chart):