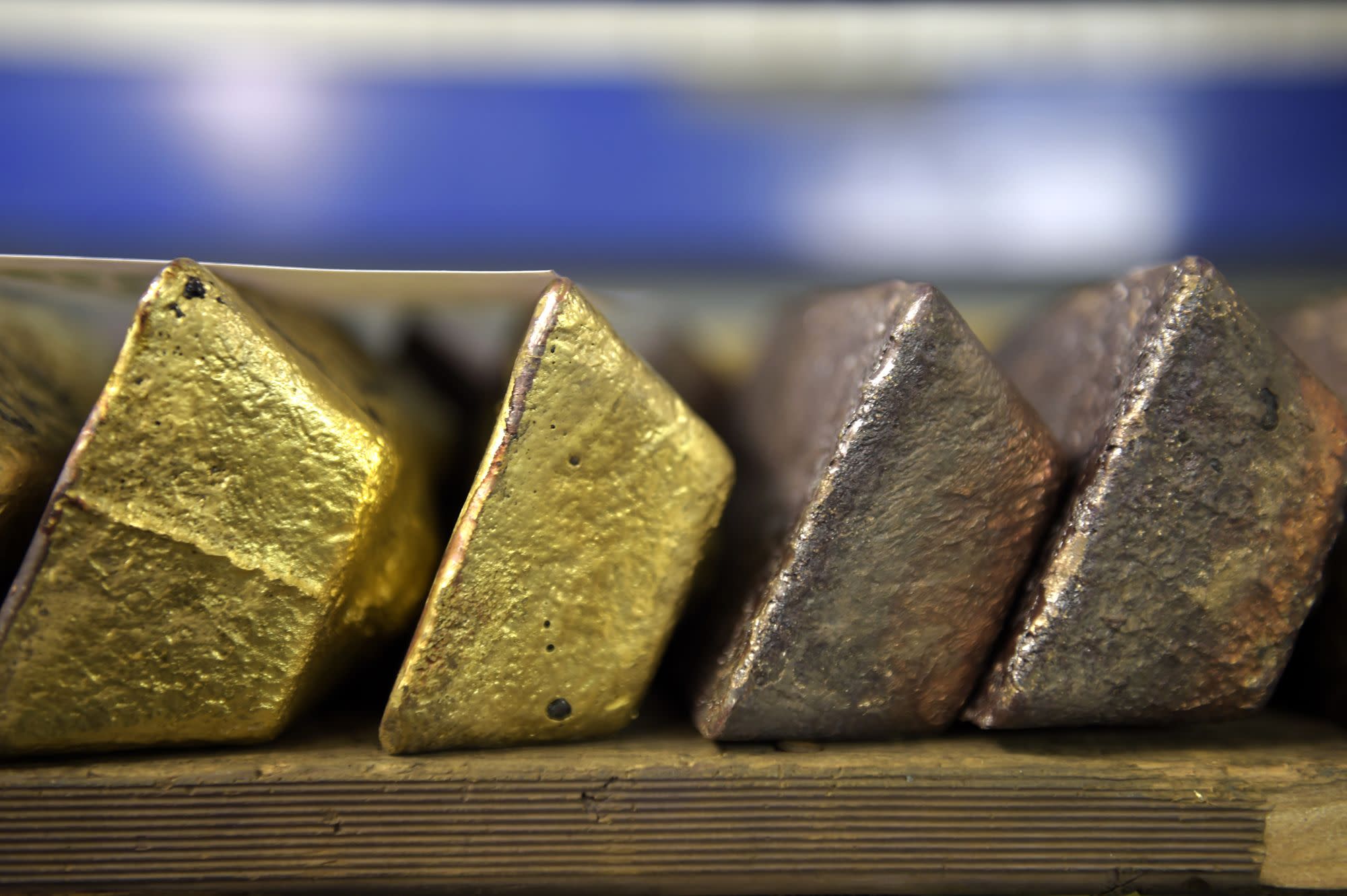

Gold Declines From Three-Month High Ahead of Fed Minutes

(Bloomberg) — Gold slipped from the highest level in more than three months as the dollar strengthened before the release of minutes from the Federal Reserve’s meeting in April.

European stocks and U.S. equity futures dropped on Wednesday amid a broad deterioration in risk appetite. That pushed the dollar higher after four straight days of declines, weighing on bullion. Gold also came under pressure from rising Treasury yields amid growing concerns about inflation.

Fed minutes due later Wednesday may offer more insight into how policy makers view growing price pressures, and any hints of a timeline for tapering stimulus. In Bank of America Corp.’s latest fund manager survey, inflation topped the list of the biggest tail risks, followed by a bond market taper tantrum and asset bubbles, while Covid-19 was in fourth place.

Gold was recently buoyed by falling real bond yields and a weakening dollar, with inflation expectations in the U.S. close to the highest in seven years. That’s revived investor interest in gold, with inflows into bullion-backed exchange-traded funds resuming and hedge funds on the Comex boosting their exposure.

“Gold prices are steadying as Treasury yields may have found a short-term bottom,” said Edward Moya, senior market analyst at Oanda Corp. The outlook for bullion was still bullish, given the monetary policy stances across the world’s two largest economies, he said.

Spot gold declined 0.4% to $1,861.57 an ounce by 10:39 a.m. in London. Prices climbed to $1,875.10 on Tuesday, the highest since January. Silver, platinum and palladium fell. The Bloomberg Dollar Spot Index rose 0.2% after declining 0.3% on Tuesday.

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.