Gold: It’s not just for crazies

If you were thinking of adding a bit of gold bullion to your retirement portfolio, now might be a good time to do it. Inflation expectations have surged to their highest levels since before the Lehman Brothers collapse. Government bonds are so expensive that when you deduct taxes and inflation that you are actually paying Uncle Sam for the privilege of lending him money. And meanwhile bullion is looking by some measures remarkably cheap.

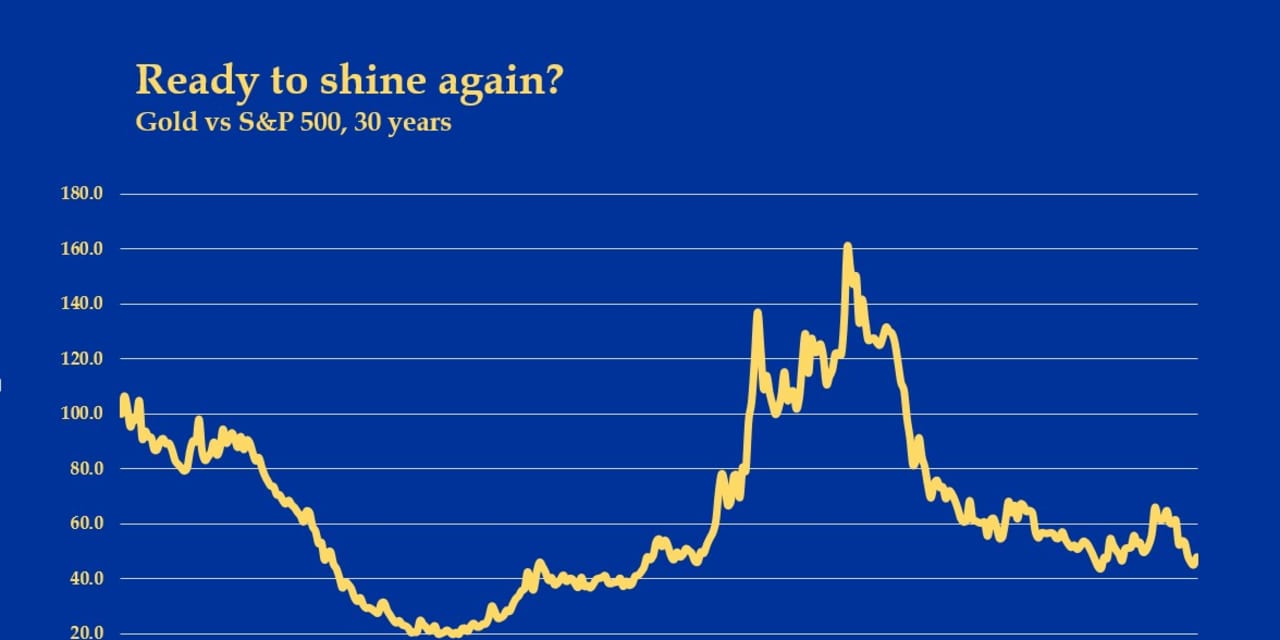

The chart above shows the gold price in relation to the S&P 500 stock market index SPX,

Is there a case for gold? There is, but you won’t hear it from most financial advisers. These days it is seen as something of an oddball investment — an old-fashioned relic from the world before banks. It also doesn’t help that it attracts its fair share of loons.

But others vouch for it as well.

The late, great money manager Charles de Vaulx, kept about 5% to 10% of his clients’ portfolio in gold bullion. “We’re not fanatics,” he joked when we first met over a decade ago. But, he said, gold was potentially a very good diversifier, and might protect the portfolio against inflation and even deflation.

Ray Dalio, the hedge fund tycoon, allocates 7.5% of his famous “All Weather Portfolio” to gold bullion, alongside the more usual stocks, bonds and industrial commodities. The Personal Assets Trust PNL,

It’s about as simple a portfolio as you can imagine: 67% in a global ETF such as Vanguard Total World Stock Index Fund VT,

OK, some may argue gold is a weird investment. It generates no income and has no utility. It produces nothing. Like the lilies of the field, it toils not, neither does it spin.

But viewed as a currency it makes some sense. Dollar bills aren’t productive either. Gold is a currency not controlled by any government or central bank—for better or worse. It’s still the best guarantee of financial privacy as well. As I’ve said before, if Michael Cohen had made his secret payoffs with American Eagle gold coins instead of cash or checks, he wouldn’t have ended up in the big house.

Unlike ‘cryptocurrencies,’ gold has been around for a long time, the price doesn’t tend to rise or fall 10% in a day—oh, and transactions don’t use much energy.

The biggest appeal of gold in a portfolio is that it has a good chance of holding up when stocks and bonds are losing money. For example, I ran the numbers for the 1970s: Gold beat inflation in seven years out of 10. And over the past 50 years, since the federal government stopped fixing the gold price and let it trade freely, gold has earned a median return in any given year of about 2.5% above the rate of inflation. Most important: It’s had a low correlation with other assets. It’s zigged when stocks and bonds have zagged.

What Wall Street doesn’t want to say is that today’s portfolio of stocks and bonds look great by the record of the past 40 years. Since the early 80s both have gone up and up, and on the few occasions when stocks went down, bonds went up even more.

But what if the future doesn’t look like the past 40 years? At other points in history stocks and bonds have both lost value together. That’s what happened in the late 1930s and 1940s, and again in the 1960s and 1970s.

Inflation isn’t certain. Let’s even say it’s not probable. But it’s certainly possible. As stocks and bonds are both at risk, it isn’t crazy to think about things that might help.

Treasury inflation-protected securities are the obvious bet. They didn’t even exist in the 1970s. But at this point, the post-inflation yields are either minute or even negative. So while they’re effective insurance, they’re expensive.

Gold, naturally, is another option. How much should anyone buy? As the examples earlier suggest, conventional wisdom is that with gold, a little goes a long way and 5% to 10% of a portfolio is enough. Adam Strauss, a portfolio manager at Pekin Hardy Strauss in Chicago and a longstanding gold bug recommends at least 10%. His preferred vehicles are Sprott Physical Gold Trust PHYS,

Crazy? We’ll see.