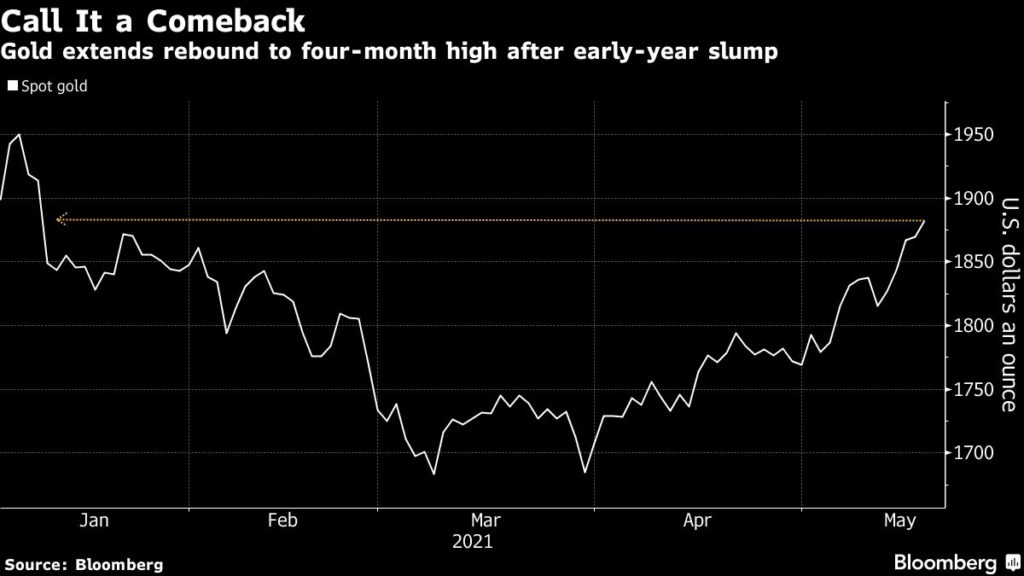

Gold price rises to 4-month high as investors fly to safety

[Click here for an interactive chart of gold prices]

Meanwhile, US equities fell on concern about faster inflation and covid-19 flareups in some nations. Technology stocks extended a slide as Bitcoin’s plunge sent cryptocurrency-linked assets lower.

Yields on 10-year treasuries were steady after giving up early gains, while the US dollar index held close to a near three-month low, making gold more attractive for holders of other currencies.

Gold has been buoyed by the combination of falling real bond yields and a weakening dollar, with inflation expectations rising in the US.

That has revived investor interest in bullion, which is seen as a hedge against inflation, with holdings in gold-backed exchange-traded funds rebounding over the past few weeks.

Gold prices have risen about $190 – or more than 11% – after falling to a nine-month low in early March.

“It’s flight to safety, that’s helping gold,” Bob Haberkorn, senior market strategist at RJO Futures, told Bloomberg.

“Bitcoin is down – it feels that the safety trade that was in crypto is probably coming to gold this morning. Equities are also down,” he added.

Investors are now awaiting the Federal Reserve minutes due later in the day, which may offer more insight into how US policy makers view growing price pressures.

“Gold surged aggressively since the start of the week around the narrative that we could see inflation pick-up in an environment where the Fed is resistant to tightening,” DailyFX currency strategist Ilya Spivak told Reuters.

(With files from Bloomberg and Reuters)