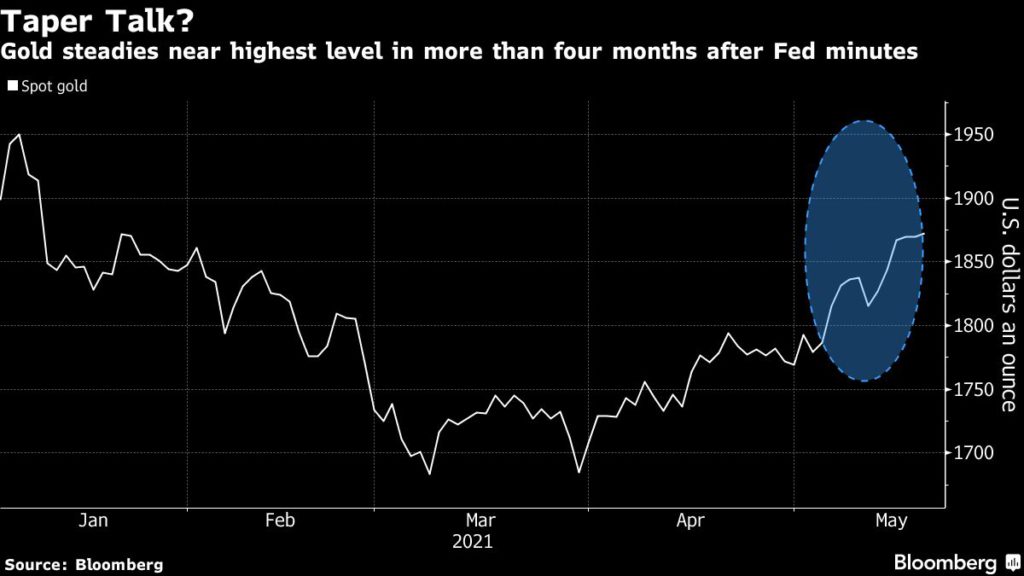

Gold price shakes off tapering concerns from Fed minutes

In a press conference following last month’s meeting, Chair Jerome Powell had said it was premature to start talking about tapering.

After slipping from a four-month high on concerns of Fed’s openness to taper talks, spot gold quickly regained ground, up 0.6% to $1,880.44 an ounce by noon ET Thursday. US gold futures, meanwhile, stayed flat at $1,880.30 an ounce.

[Click here for an interactive chart of gold prices]

Rising inflation expectations and the Fed’s pledge to keep rates low for longer have revived investor interest in gold, with a rebound seen in holdings in bullion-backed exchange-traded funds.

While US policy makers have signaled they intend to maintain an accommodative stance for a prolonged period, any hints of a timeline for paring back exceptional stimulus could weigh on the precious metal.

“The inflation issue is top of mind for gold and silver, given both metals’ reputation as inflation hedges, with the debate being primarily about the question of whether rising prices are transitory or permanent,” Carsten Menke, an analyst at Julius Baer Group Ltd., wrote in a note to Bloomberg. “We firmly believe they will be transitory.”

The extreme price swings in cryptocurrencies on Wednesday may have also helped support bullion. The inherently limited supply of Bitcoin has seen it touted as a replacement for gold, particularly during the metal’s torrid start to the year.

“It appears as though the recent weakness in Bitcoin is seeing some investors shifting to gold,” said Warren Patterson, head of commodities strategy at ING Groep NV in Singapore.

(With files from Bloomberg)