Americans rely heavily on 401(k)s plans when it comes funding their retirement.

As of 2020, around 60 million workers across the U.S. used the tax-advantaged accounts to save for their future.

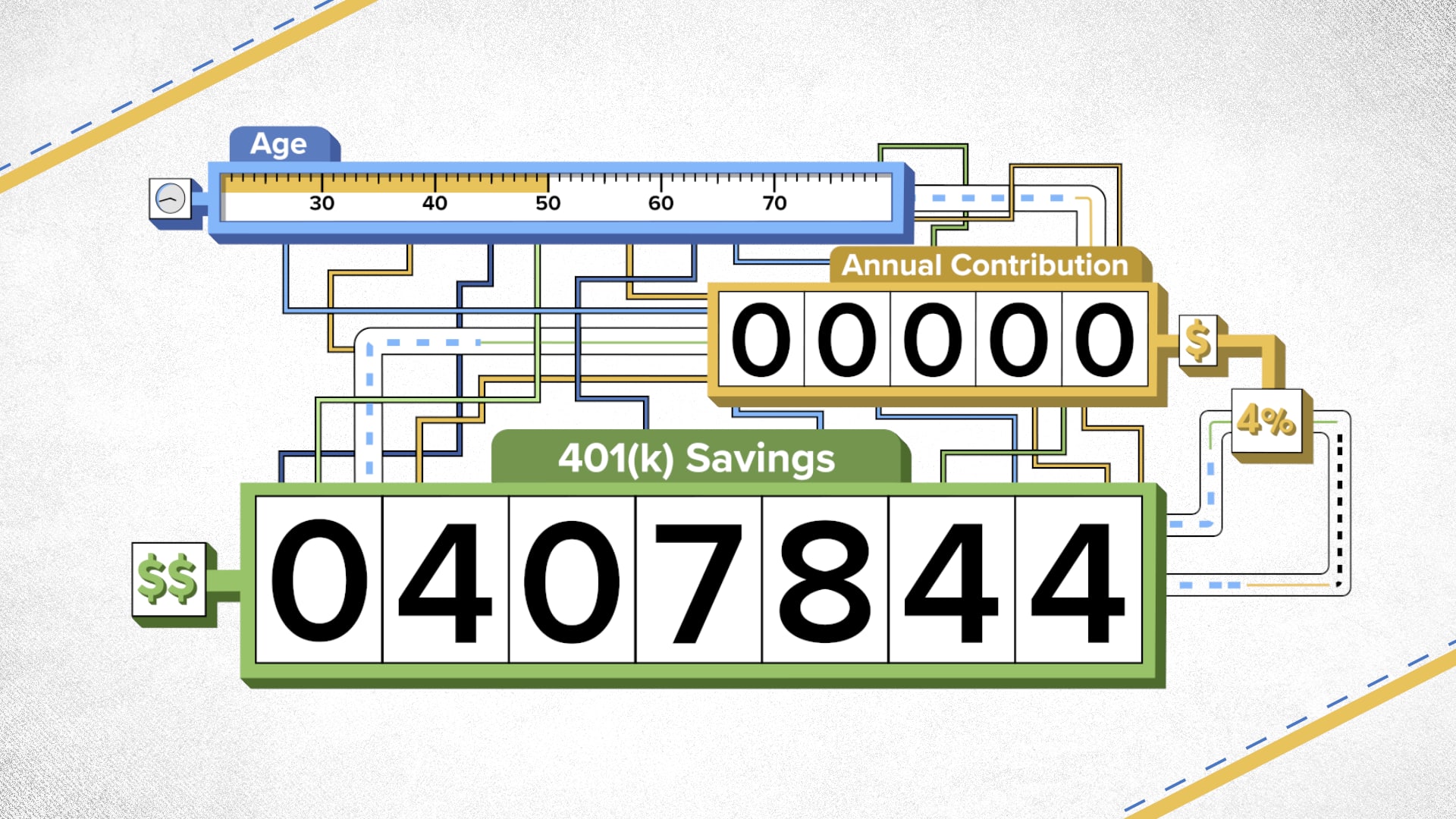

Most people can contribute up to $19,500 to their 401(k) in 2021, but the limit can change from year-to-year to keep up with inflation.

Investing nearly $20,000 per year will equal a lot of money when it comes time to retire decades in the future.

Here’s a case study.

CNBC crunched the numbers, and we can tell you how much you will have for retirement if you max out your 401(k) during your 20s.

Check out this video for a full breakdown.

More from Invest in You:

How Walmart and other big companies are trying to recruit more teenage employees

Americans are more in debt than ever and experts say ‘money disorders’ may be to blame

How much money do you need to retire? Start with $1.7 million

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.