Iron ore price surge as steel rally fires up demand

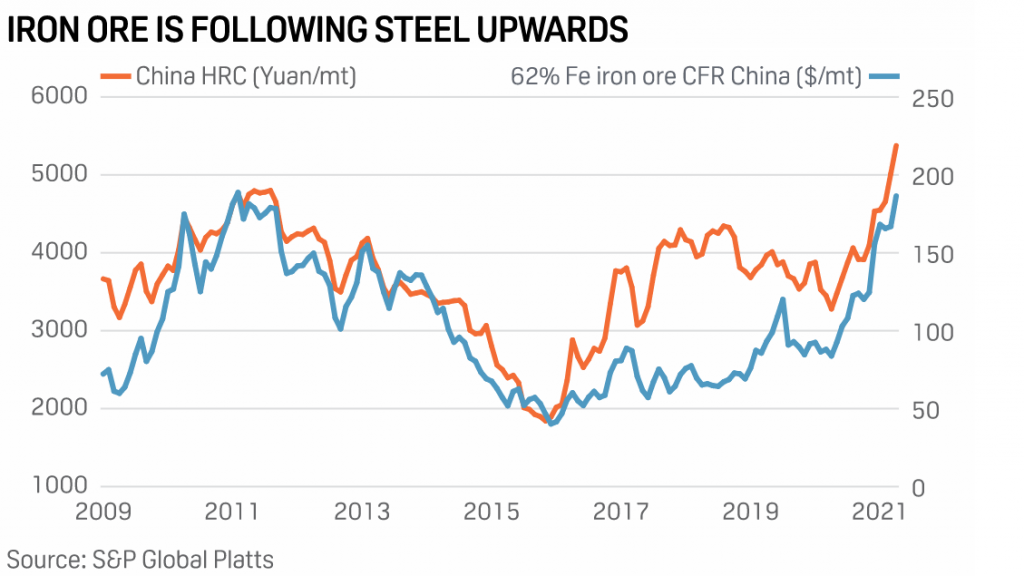

Benchmark 62% Fe fines imported into Northern China (CFR Qingdao) were changing hands for $192.54 a tonne on Wednesday, up 1.95% from the previous day, according to Fastmarkets MB.

“Iron ore prices could go higher in the short-term and exceeding $200 a tonne is definitely possible,” Kim Christie, a senior analyst at consultancy Wood Mackenzie Ltd told Bloomberg.

“It would only take extra supply concerns, or additional strength in Chinese steel production, for prices to get there,”

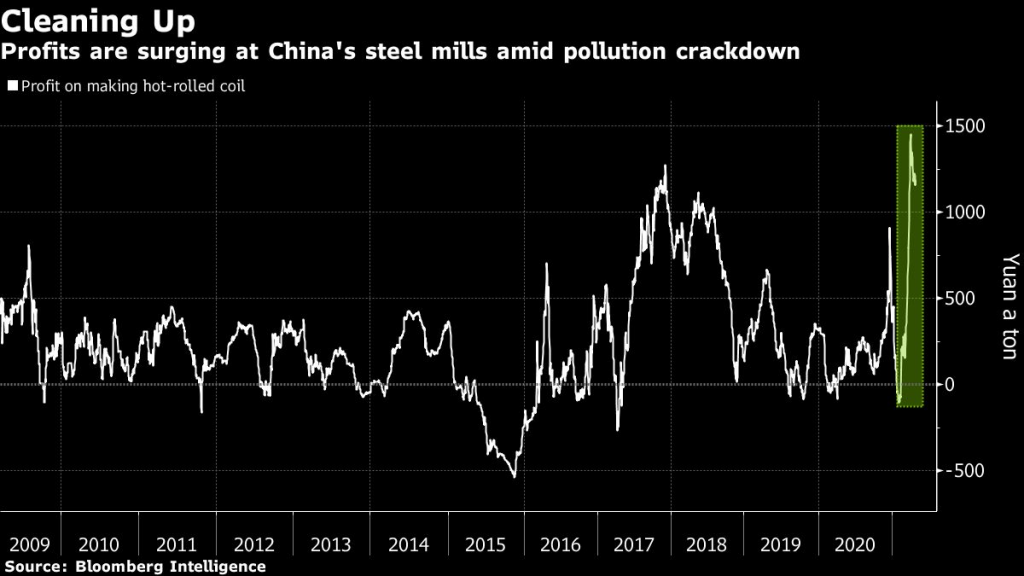

At the heart of spot iron ore’s 14% climb last month, helping drive the supercharged commodities rally has been rising steel prices from Asia to North America. Particular focus has been on China, where the economy has boomed and a swath of measures aimed at cleaning up the world’s biggest steel industry pushed mill profitability to the highest in more than a decade.

“What these high margins do is incentivize mills to build up stocks and to charge more high-grade ore to lift productivity,” Erik Hedborg, principal analyst at CRU Group told Bloomberg.

“We have seen a bit of an ‘additional iron ore demand’ for the purpose of increasing inventories,”

Morgan Stanley has called China’s supply reforms a possible “game changer” for demand for premium ore, with grade differentials unlikely to normalize any time soon.

Citigroup expects benchmark prices to hit $200 within weeks. There will be a deficit of 18 million tonnes during the first three quarters of 2021 amid improved global steel demand and a slight miss in top miners’ shipments. The bank had previously predicted a 1 million-tonne surplus.

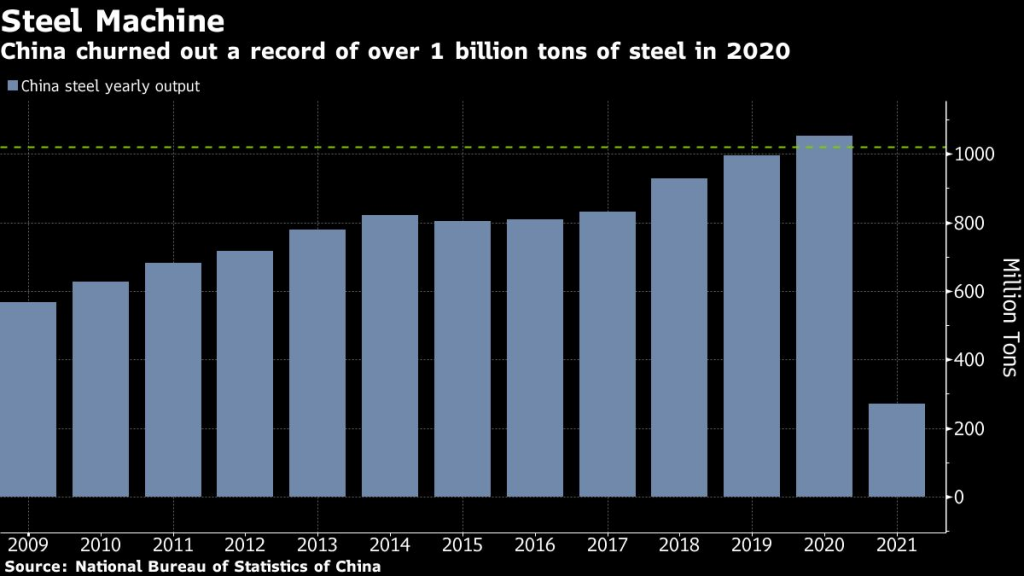

China is on track to make more than 1 billion tonnes of steel for the second year in a row.

The government’s recent changes to rebates on export taxes are also unlikely to be sufficient to deter output, according to Wood Mackenzie’s Christie:

“If China wants to slow steel production, it needs to temper domestic demand. We expect to see additional measures from the government aimed at cooling steel demand, especially in the property sector, and that will likely be the catalyst for a correction in iron ore prices.”

The China Iron and Steel Association said last week that fast-rising iron ore prices are “unreasonable”, that the industry should enhance the exploitation of resources both at home and abroad, and also improve rules for the futures market.

Analysts expect iron ore to ease over the course of the year, citing factors including China’s steel-output measures taking effect and iron ore supply growth accelerating. Still, some market watchers have estimates for the second half of the year that are above $100 a tonne. Citigroup has forecast a drop to that level only under its most bearish scenario, while WoodMac says prices won’t get below that threshold for another 12 months.

“Steel prices could be slightly softer in the second half of 2021 on the back of some downstream resistance to higher prices and tighter credit conditions. This could see iron ore prices climb down from elevated levels of late April,” said S&P Global in a note.

“We do also see fundamentals potentially easing with Brazilian supply lifting as we continue into the year,” said Dim Ariyasinghe, a research analyst at UBS Group AG.

“Ultimately, while there is underlying steel demand and margins are positive, we expect to see continued strength in the iron ore price.”

(With files from Bloomberg)