Iron ore price tops $200 as China-Australia relations break down

“Recently, some Australian Commonwealth Government officials launched a series of measures to disrupt the normal exchanges and cooperation between China and Australia out of Cold War mindset and ideological discrimination,” China’s National Development and Reform Commission (NDRC) said in a statement on the decision.

Bilateral ties were strained in 2018 when Australia became the first country to publicly ban Chinese tech giant Huawei from its 5G network. Relations worsened last year when Australia called for an independent investigation into the origins of the novel coronavirus, prompting trade reprisals from China.

“Specifically in relation to iron ore, at the moment there are relatively few alternatives available to China”

Rio Tinto Chairman Simon Thompson

Australian Trade Minister Dan Tehan said the commission’s decision was disappointing because the economic dialogue was “an important forum for Australia and China to work through issues relevant to our economic partnership.”

Australia is the world’s biggest iron ore supplier and covers about two-thirds of China’s import needs of the raw material.

China, the world’s top steel producer, has imposed a series of trade sanctions on Australian exports ranging from wine to coal.

Iron ore trade has so far been spared, but analysts believe China is looking at ways to reduce its reliance on Australian iron ore.

“China is unlikely to ban imports of Australian commodities which they rely heavily on as it will impact the domestic economy,” Wood Mackenzie senior economist Yanting Zhou told Reuters.

“The government is more likely to raise the administrative cost for importing commodities from Australia if they want to take action.”

“We believe the iron ore trading relationship between Australia and China will remain ring-fenced in relation to current political tensions between the two nations,” said Atilla Widnell, managing director at Singapore-based Navigate Commodities Ptd Ltd.

“This is a co-dependent relationship whereby either party cannot survive without the other.”

“Specifically in relation to iron ore, at the moment there are relatively few alternatives available to China.” Rio Tinto Chairman Simon Thompson said.

Steel prices

Chinese steel futures resumed their record-setting rally on Thursday, after a five-day Labour Day holiday, over demand prospects and helped lift iron ore prices.

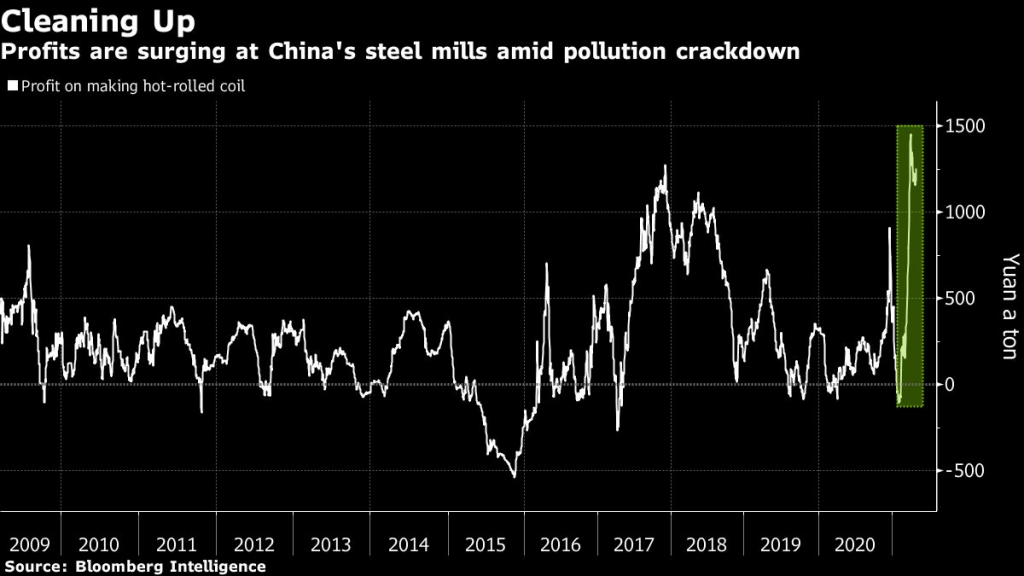

The boom comes as China’s steelmakers keep output rates above 1 billion tons a year, despite a swath of production curbs aimed at reducing carbon emissions and reining in supply.

Erik Hedborg, Principal Analyst, Steel at CRU Group said:

“Recent production cuts in Tangshan have boosted demand for higher-quality ore and prompted mills to build iron ore inventories as their margins are on the rise. Iron ore producers are enjoying exceptionally high margins as well, around two-thirds of seaborne supply only require prices of $50 /dmt to break even.”

Construction steel rebar on the Shanghai Futures Exchange advanced as much as 4.7% to a record 5,672 yuan a tonne.

Hot-rolled coil, which is steel used in car bodies and home appliances, jumped as much as 4% to a record 5,957 yuan a tonne.

Indicating strong downstream demand, inventories of main steel products in China – rebar, wire rods, coils and plates – fell 5% last week from the prior week, while apparent consumption grew 5.3%, data from Mysteel consultancy showed.

“The long-term prospects for metals prices are ‘too good’ and point to higher prices in the next few years,” Commerzbank AG analyst Daniel Briesemann told Bloomberg.

“The decarbonization trends in many countries — which include switching to electric vehicles and expanding wind and solar power — are likely to generate additional demand for metals.”

(With files from Bloomberg and Reuters)