Many investors ‘will be fine’ as inflation climbs. But ‘day-to-day people’? Maybe not, investment manager says

Not everyone can afford to be patient.

It may be “easy for Wall Street and the Fed to say, ‘We are going to wait,’” before moving to head off inflation, said Michelle Connell, president of Portia Capital Management, a Texas-based investment manager. But for working families, single moms and others already scraping by before the pandemic hit, it likely will get harder to sit tight if prices shoot dramatically higher for basic necessities, including food, housing and child care.

Instead, Connell expects many U.S. households facing higher inflation to be forced into taking on more debt, just to get by in the coming months.

“How is it affecting investors? Many will be fine,” Connell told MarketWatch, pointing to significant gains in stocks SPX,

Connell said some of her largest clients are foundations focused on distributing aid to lower-income households, and they’ve already felt the pinch.

“A lot of them are getting hit up for distributions earlier and earlier,” she said. “That’s because a lot of charities are seeing more pressure on them,” particularly as expenses such as child care climbed as day-care centers closed because of the pandemic, which has stretched shoestring household budgets.

Read: Why aren’t Americans happier about the economy? They are paying higher prices for almost everything

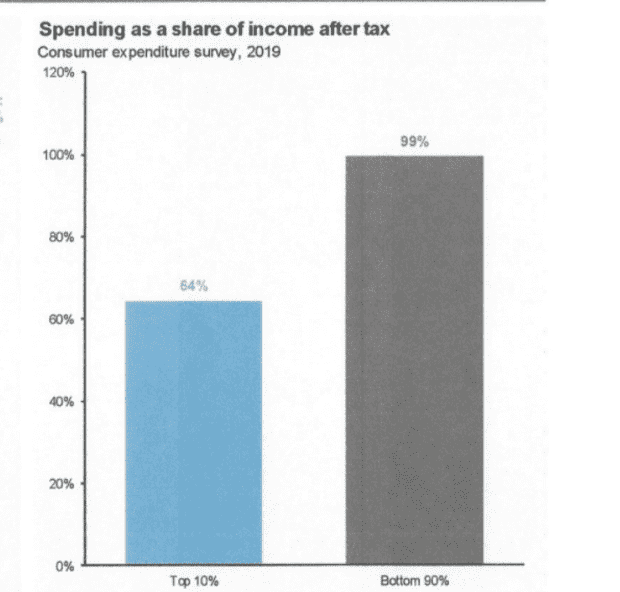

Connell pointed to how the bottom 90% of U.S. households already were spending 99% of their income before the pandemic, which hit low-income workers the hardest.

Income inequality

J.P. Morgan Asset Management

She also estimates that many families have been paying about 10% of their income on child care, for each child. MarketWatch reported earlier in May that almost half of parents expect to take on credit-card debt to pay for summer child care.

“If you just get a slight increase in one of these areas, it will push you over the edge, and you’re having to take on credit to live,” she said of household expenses.

President Joe Biden’s American Families Plan aims to make child care free for lower-income families, while looking to cap the cost at 7% of the income of middle-class households. Fed Chairman Jerome Powell has said he wants to see a robust economic recovery from the COVID crisis, including getting most people who lost work back onto payrolls, before dialing back easy-monetary policies.

Meanwhile, debate has begun to stir among Fed officials around a timeline for considering tapering the central bank’s monthly asset purchases, a development that has yet to rattle the Treasury market.

The 10-year Treasury rate TMUBMUSD10Y,

“It’s going to be interesting when they do start telegraphing when they plan to pull back on bond purchases,” Connell said.

Read next: Why the bond market might not suffer another taper tantrum when the Fed signals it’s ready to move