Merkel’s Twilight Months Cloud German Crisis Rebound: Eco Week

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The Germany economy is enduring a moment of flux as it tries to shake off the coronavirus crisis, just as the era of Chancellor Angela Merkel draws to a close.

In just four months on Wednesday, voters will choose a new government in an election that augurs a turning point as she leaves a political void after 16 years in office — accompanied by a sense of unfinished business in retooling the continent’s growth engine.

The task that will now pass to Merkel’s successor, who must confront the challenge of how to re-engineer Europe’s biggest economy and reap the opportunities of the post-crisis world, without losing its edge.

While the pandemic may be a catalyst for change, the job still won’t be easy.

Firstly, the country’s recovery must still fully take hold, with data due this week to show the extent of economic damage caused during lockdowns at the start of the year. At least business confidence on Tuesday may keep increasing above pre-crisis levels.

The shape of the next coalition might then determine how quickly Germany resumes its usual fiscal rectitude. Too fast a retrenchment of support could hurt the rebound, a risk highlighted by the International Monetary Fund last week.

Finance Minister Olaf Scholz, Merkel’s Social Democrat partner in government, may share his view on that in a conversation with Bloomberg on Tuesday. An INSA poll published Sunday showed support for his party inched up by 1 percentage point while staying firmly in third place.

The new government will need to deploy both imagination and drive to rethink a growth model founded on high-end manufacturing, in a global economy where the greatest prosperity is generated in even more lucrative areas such as technology.

Germany’s business backbone has enormous potential, as showcased by BioNTech SE, whose innovative vaccine was the first in the western world to be approved for use. But even with such winners on board, the race to forge a successful future will be fierce.

What Bloomberg Economics Says:

“Germany’s Ifo survey will provide more clues about how the economy is faring. The economic picture has been weighed down by extended restrictions on public life. The outlook is brighter amid expectations of a robust recovery spurred by pent-up demand as curbs ease following a pick up in the country’s vaccination program.”

–For full preview, click here

Elsewhere, Group of Seven finance chiefs hold a virtual meeting and central banks in Indonesia, Nigeria, Kenya and New Zealand set rates.

Click here for what happened last week and below is our wrap of what is coming up in the global economy.

U.S.

In the U.S., investors will be watching April data on personal spending, durable goods orders and home sales to gauge the strength of the recovery at the start of the second quarter.

Several policy makers at the Federal Reserve are also set to speak — including board member Lael Brainard. She’s scheduled to speak at a cryptocurrency conference, which will be in the spotlight after the market’s wild ride in recent days.

For more, read Bloomberg Economics’ full Week Ahead for the U.S.

Asia

Bank of Japan Governor Haruhiko Kuroda and board member Hitoshi Suzuki will give their latest views on the pandemic recovery in speeches on Monday and Wednesday. Tokyo CPI data is due later in the week as Japan continues to see weakness in prices despite the global upturn in inflation.

Bank Indonesia meets Tuesday with no change to its monetary settings expected. New Zealand’s central bank is also expected to keep rates and QE settings unchanged on Wednesday with Governor Adrian Orr likely to insist policy will remain stimulatory for a prolonged period even as the economic outlook improves.

South Korea’s central bank meets Thursday with price growth above 2% for the first time in two-and-a-half years. The BOK will update its forecasts and likely stand pat on policy as it continues to monitor ongoing improvement in the economy.

China’s central bank said Sunday it will maintain the exchange rate of the yuan at “basically stable” levels after recent comments by its officials who suggested the currency be allowed to appreciate and authorities should eventually let up on controlling it.

For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

In a week shortened across much of the continent by a holiday on Monday, the most significant reports due aside from German data range from euro-region economic confidence to a final reading of French gross domestic product for the first quarter.

Several central bank officials will speak around Europe, including at a conference on Tuesday that features Riksbank Governor Stefan Ingves and European Central Bank Chief Economist Philip Lane. Meanwhile Silvana Tenreyro and Gertjan Vlieghe of the Bank of England’s Monetary Policy Committee are scheduled to deliver speeches too.

Hungary on Tuesday will probably keep its interest rates unchanged before becoming the first central bank in the European Union’s east to start monetary tightening next month to tame surging inflation. The same day, Czech and Slovak policy makers discuss the pros and cons of adopting the euro.

Turning to Africa, data on Sunday showed Nigeria’s economic growth quickened in the first quarter as oil output started to recover and manufacturing production increased for the first time in a year.

On Tuesday, the nation’s central bank is expected to keep its key rate unchanged, even with inflation at double the top of its target range, as it seeks to spur an economic recovery. Meanwhile, monetary authorities in Kenya and Angola are also expected to hold on Wednesday and Friday.

Turkey reports foreign tourist arrivals for April on Monday. Hopes are dimming for a summer revival in tourism that would bring in much-needed foreign currency and support the lira as concerns grow about the central bank’s diminished reserves.

For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

As is the case elsewhere worldwide, inflation is very much back in focus in Latin America. Look for Mexico’s biweekly reading to show a year-on-year decline, damping some concern about central bank tightening. Deputy Governor Irene Espinosa has ruled out further easing and said Banxico might raise its key rate even before the Fed.

In Brazil, forecasts see the mid-month reading of the benchmark inflation index pushing past 7%, well over target, followed by reports on the country’s broadest measure of inflation as well as wholesale prices.

On Wednesday, Mexico posts first-quarter output data, with the minutes of the central bank’s last meeting set for Thursday publication.

Brazilian and Mexican unemployment figures respectively may be little changed and still well off pre-pandemic levels.

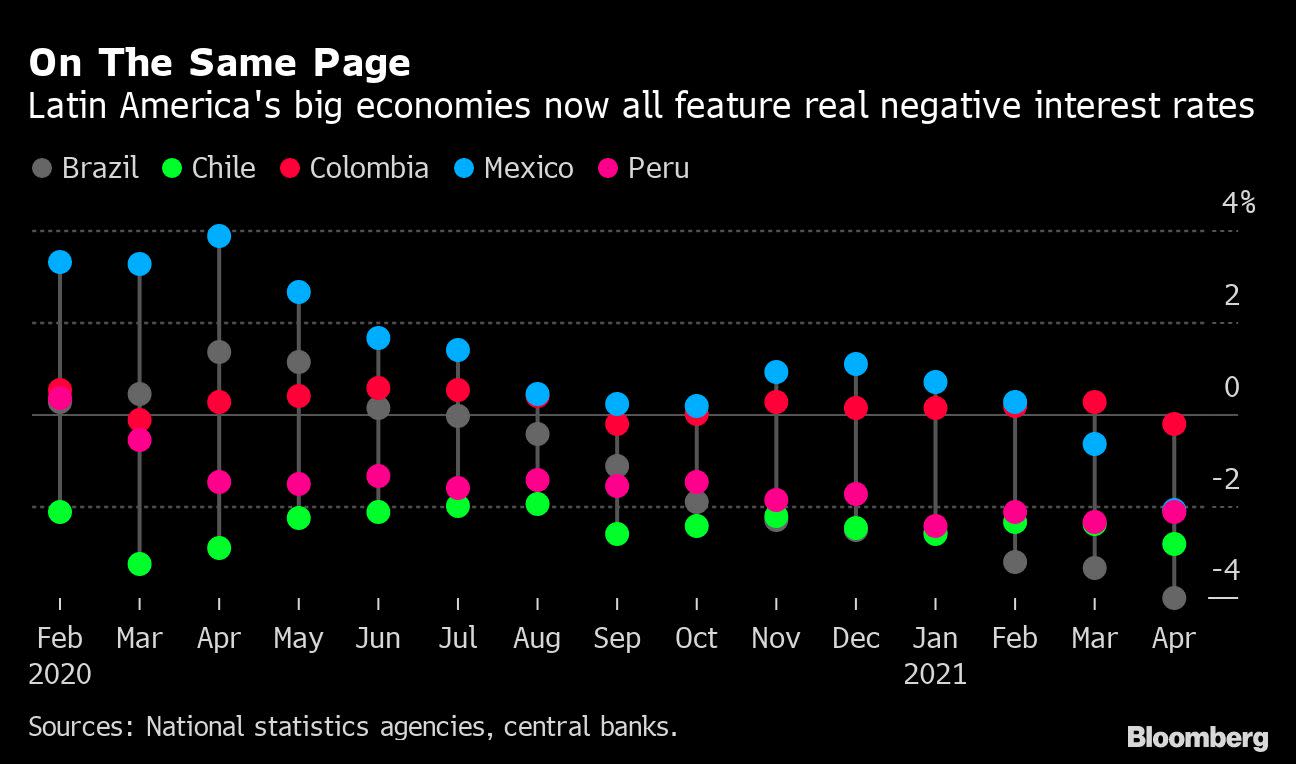

On Friday, Colombia’s central bank will all but certainly keep its key rate at a record-low 1.75%. With the country’s 1.95% inflation print for April, the region’s five big economies now all feature negative inflation-adjusted interest rates.

For more, read Bloomberg Economics’ full Week Ahead for Latin America

(Updates with Nigerian GDP in EMEA section. Earlier versions corrected Merkel’s time in office and the period until the German vote.)

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.