As millennials begin to turn 40 in 2021, CNBC Make It has launched Middle-Aged Millennials, a series exploring how the oldest members of this generation have grown into adulthood amid the backdrop of the Great Recession and the Covid-19 pandemic, student loans, stagnant wages and rising costs of living.

Millennials have a reputation for being values-driven in their approach to their money and their careers.

That includes their investing habits: Millennials spurred the growth of sustainable investing throughout the 2010s — investors contributed $51.1 billion to sustainable funds in 2020, compared with less than $5 billion five years ago — according to industry reports. Now, every generation wants in.

“Nine times out of 10 if you ask people, ‘Do you want to invest in a way that leaves a positive mark,’ they will say yes,'” says Harlin Singh, head of sustainable investments at Citi Private Bank.

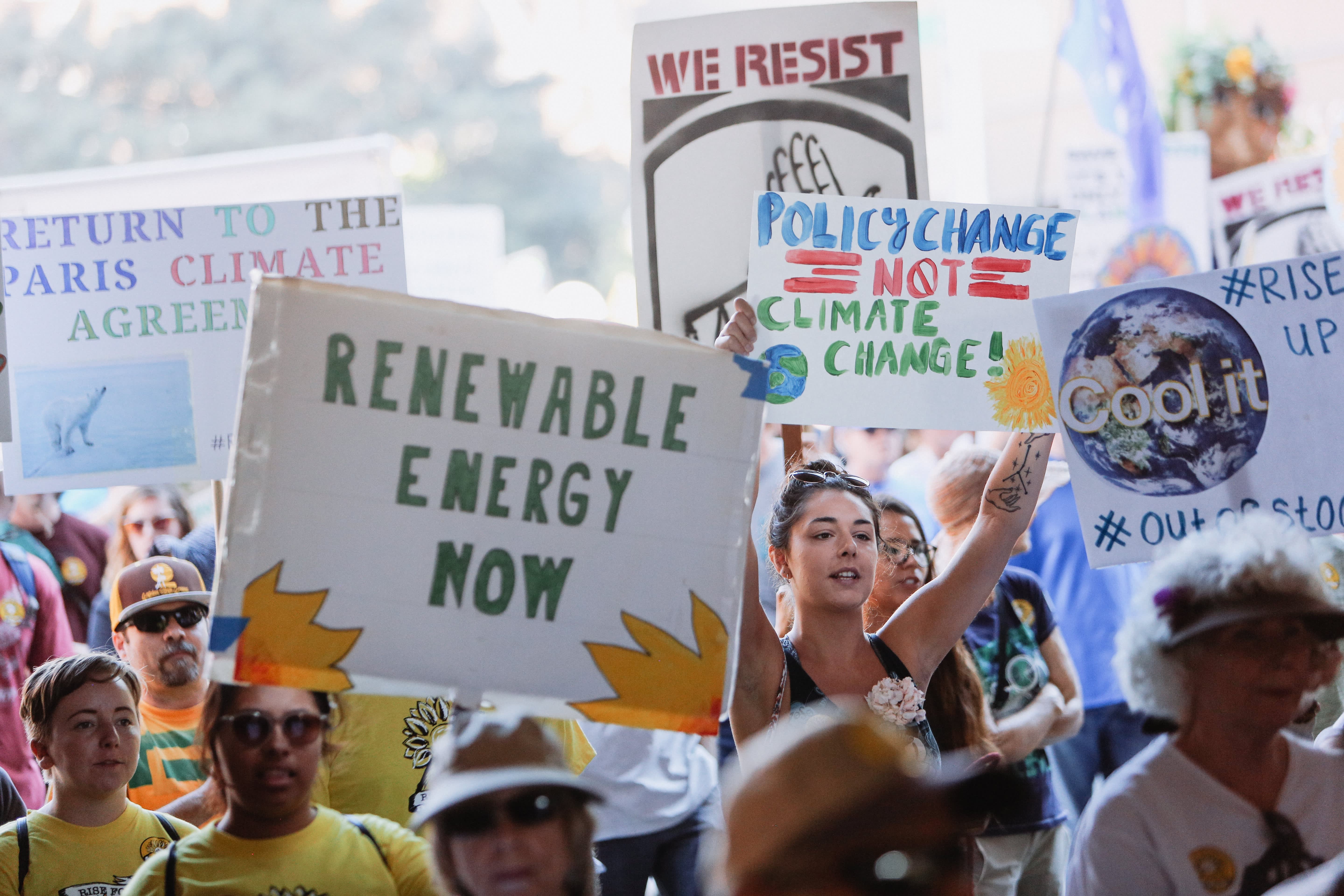

Sustainable investing, or the use of environmental, social and governance factors in determining which companies and industries you want in your portfolio — and which you don’t — can apply to many social and political issues. Worries about climate change, in particular, are a big reason for its growth, according to investment research firm Morningstar.

And 76% of older millennials think climate change poses a serious threat to society, according to a survey conducted by The Harris Poll on behalf of CNBC Make It in March that surveyed 1,000 U.S. adults ages 33 to 40 on a variety of topics.

About one-third of millennials often or exclusively use investments that take ESG factors into account, compared with 19% of Gen Z, 16% of Gen X and 2% of baby boomers, according to the poll.

But the difference in adoption is not because other generations aren’t interested in sustainability or investing in line with their morals: A 2019 report from Morningstar found that 72% of the U.S. population “expressed at least a moderate interest in sustainable investing,” and the preference didn’t change significantly between generations.

Rather, the difference in asset allocation between the generations can be attributed to availability and access, says Bill McManus, managing director of applied insights at Hartford Funds, a Pennsylvania-based asset manager.

While the first sustainable mutual fund launched in the 1970s, according to Morningstar, millennials hit their prime investing years at the same time that ESG investment options became more plentiful than ever. In 2019, almost 500 actively managed U.S. funds added ESG criteria to their prospectuses. Older generations didn’t benefit from that wealth of options and easy access when they were starting out.

Millennials have also grown up with information about sustainable funds available via a simple Google search, and their portfolios are also more “nimble,” meaning they likely don’t have as much invested yet as older investors. It has been easier for them to invest sustainably from the jump.

“People of every generation have been passionate about issues. Go back to the ’60s, there was intense focus on social injustice issues,” McManus says. “But now we have the ability to align our investments with things that are important to us.”

With millennials set to inherit approximately $30 trillion over the next few decades, according to a report from MSCI Inc., an investment research firm, the financial industry and corporate America are expected to continue to create more and better sustainable investing options to appeal to them and their bank accounts.

McManus says growing awareness of the harm caused by climate change and increased attention paid to politics over the past few years have led to wider acceptance of ESG investing, irrespective of age. The Covid pandemic, too, has been a wake-up call for many people in every generation, he says, as it shined a light on many existing injustices in society.

But it’s not just about morals, says Citi’s Singh. Given the very real consequences of climate change on businesses and their bottom lines, for example, taking ESG factors into account is just smart long-term investing, she says.

“All investors within the next couple of years will be considering, at the bare minimum, climate risks in their portfolios,” says Singh. It’s “a trend that’s here to stay.”

CNBC Make It will be publishing more stories in the Middle-Aged Millennials series around student loans, employment, wealth, diversity and health. If you’re an older millennial (ages 33 to 40), share your story with us for a chance to be featured in a future installment.

Don’t miss:

Check out: Meet the middle-aged millennial: Homeowner, debt-burdened and turning 40