Nikola granted ‘performance’ awards valued at $567 million to executives last year

Nikola Corp. disclosed Wednesday that it granted stock awards to executives in 2020 with a combined value of about $567 million, intended as an “incentive for future performance.”

The awards included $159.0 million worth of stock to Founder Trevor Milton, who shocked investors when he resigned as executive chairman in September 2020, as the electric truck maker faced regulatory probes amid short-seller claims that Milton made numerous false statements.

In the 2020 proxy statement filed with the Securities and Exchange Commission, Nikola said Chief Executive Mark Russell’s total compensation in 2020 was $159.20 million, up from $6.56 million in 2019. The 2020 compensation included a base salary of $173,077 and stock awards of $159.03 million, compared with a salary of $250,866 and option awards valued at $6.31 million a year ago.

The company NKLA,

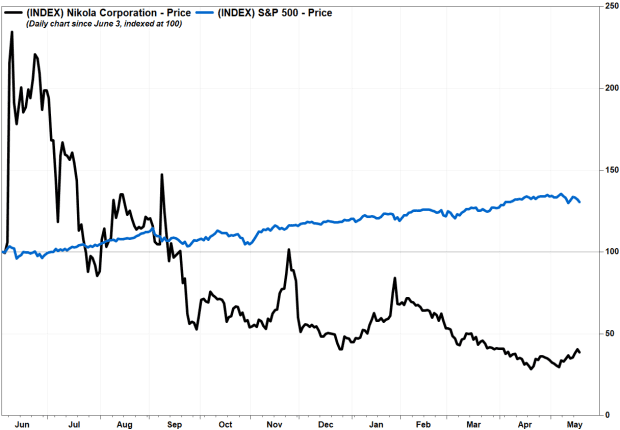

The payouts were made in a year in which Nikola went public in June after a merger with special-purpose acquisition company (SPAC), or “blank check company” VectoIQ Acquisition Corp., the company announced a $2.0 billion equity investment by General Motors Co. GM,

The company recorded a net loss that widened to $397.7 million on revenue that dropped to $95,000 in 2020, after a loss of $105.5 million on revenue of $482,000 in 2019.

In the 2020 proxy, the company said the stock awards represented the fair value of restricted stock unit awards and market-based performance restricted stock unit awards computed as of the grant date of the awards, rather than amounts paid to the individual.

The grant dates for the awards for Russell, Milton, Brady, Worthen and Pike were all June 3, the day the merger with VectoIQ was completed. For Koziner, the grant dates were Aug. 17 and Dec. 22.

“The one-time 2020 Performance Award is intended to compensate our named executive officers over its three-year term and will become vested as to all shares subject to it only if our share price increases to $55 during the three-year performance period,” the company said. “This award was designed to be an incentive for future performance that would take many years, if at all, to be achieved,” the company added.

For Milton’s award, the company said it had entered into a separation agreement which resulted in a modification of his time-based restricted stock units, and cancellation of all market-based performance restricted stock units.

Since Nikola went public, the stock rose to a closing high of $79.73 on June 9, 2020, then tumbled to close out 2020 at $15.26. The stock fell 5.5% in morning trading Wednesday, giving Nikola a market capitalization of $5.12 billion. It has shed 14.8% so far this year, and has traded with in a closing range of $28.58 on Jan. 27 and $9.65 on April 20.

In comparison, EV leader Tesla Inc.’s stock TSLA,