These ‘panic events’ could soon spell relief for stock markets, says top strategist Thomas Lee

Hold on tight for another bumpy ride on Wednesday. A big reading on U.S. consumer price inflation has topped analysts forecasts, and stock futures are selling off.

Tech futures are getting hit the hardest as investors ponder the possibility of higher rates. The dip buyers pulled the Nasdaq Composite back from the brink on Tuesday, while the Dow Jones Industrial Average DJIA,

But could the worst soon be over?

Providing our call of the day, Fundstrat Global Advisors’ founder Thomas Lee zeroes in on a couple of “panic events” that he believes could signal market capitulation. That occurs when investors dump their holdings, often driven by a correction, leading to a potential bottom for stocks.

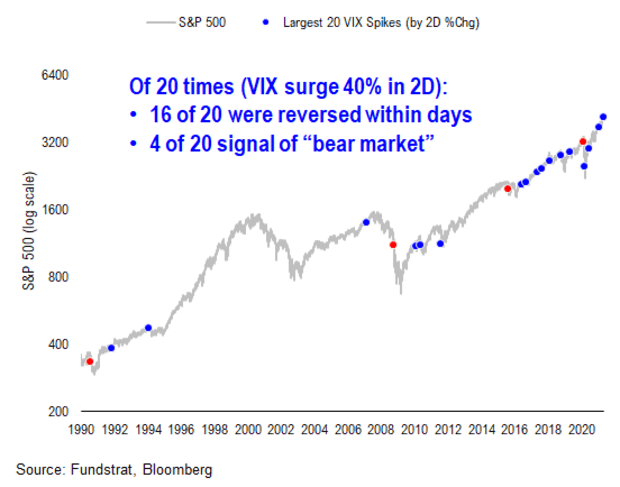

In a note to clients that published on Wednesday, Lee explained those events, starting with a 40% surge over two days for the Cboe Volatility Index, or the VIX VIX,

Based on similar instances of VIX spikes since 1990, “unless we are entering a recession, the VIX spike is simply a panic/reset. And this washes out investor sentiment,” said Lee.

His data show that since 1990, the S&P 500 has experienced four bear-market instances and 16 bull-market instances when the VIX has seen a similar two-day surge. The median forward return in those bullish follow-ups has been 1.6%, 6% and 8.7% on a one, three and six-month basis.

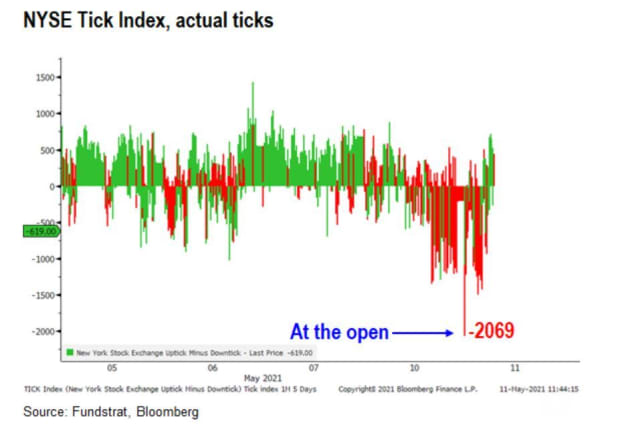

The second “panic event” also happened on Tuesday, when the NYSE Tick index, which compares the number of stocks moving up versus down, collapsed to its worst reading since 1999, dropping 2,069 points, said Lee.

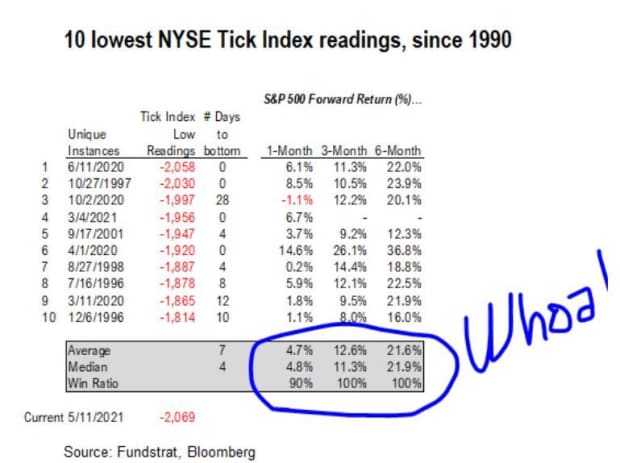

He said all nine other worst TICK readings took place during bull-market periods, with the exception of 2001, though he doesn’t think markets are repeating that year, given stocks were already in a downtrend two years before that.

Here, he highlights (circled in blue) what happens after those low TICK readings:

“While many investors might view [Tuesday’s] plunge and the surge in the VIX as a negative sign, it might surprise you but these are actually bullish signals. Foremost, keep in mind that bull markets ‘ride an escalator, and fall down an elevator,’ meaning, in a bull market, stocks rise steadily and then plunge suddenly. Thus, a VIX surge and massive negative NYSE tick reading is positive,” said Lee.

If a capitulation is en route, he said, investors should rotate out of tech and into so-called “epicenter recommended areas,” referring to economically sensitive companies.

Here are 10 from his list of dozens such stocks: Advance Auto Parts AAP,

Read: ‘No doubt…that we are in a raging mania in all assets’, says Stanley Druckenmiller

Ugly inflation surprise and ether surges

April consumer prices rose a bigger-than-expected 0.*%, while core annual prices hit a 13-year high of 4.2% from 2.6%. U.S. stock futures ES00,

Days after a cyberattack, the Colonial Pipeline fuel outage continues to cause misery for U.S. drivers. The U.S. Energy Department says it is trying to help:

Digital currency ether ETHUSD,

Despite poor results in western trials, China’s Sinovac COVID-19 vaccine has eliminated the coronavirus that causes the disease among more than 25,000 Indonesian health workers. A new report says the pandemic was a “preventable disaster.”

There has been no let up in the attacks on the Gaza Strip, which is turning into the worst outbreak of violence since 2014.

Rep. Liz Cheney warned former President Donald Trump and his Republican supporters are trying to “undermine our democracy,” ahead of a vote that may strip her of a leadership post.

Random read

The newest U.S. chess master is 10 years old.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.