Virgin Galactic stock extends win streak after UBS gets back to being bullish

Shares of Virgin Galactic Holdings Inc. shot higher Friday, putting them on track for a sixth straight gain, after UBS analyst Myles Walton returned to his bullish stance on the aerospace and space travel company, saying the recent sharp selloff and the reset of the flight schedule has created “an attractive re-entry point” for investors.

Walton raised his rating to buy, about three months after downgrading the stock to neutral. Meanwhile, he cut his stock price target to $36, which is still 74% above current levels, from $40.

The stock SPCE,

On Thursday, the stock had run up 14.7% after the company confirmed that the next test flight of SpaceShipTwo Unity will be conducted on Saturday. The test flight comes after a maintenance review of VMS Eve, the jet aircraft that will carry SpaceShipTwo to an altitude of 50,000 feet, was completed.

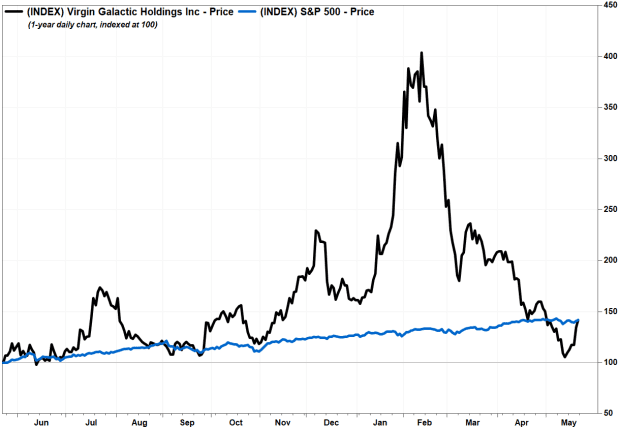

Before the current win streak, the stock had plummeted 73.9% from its Feb. 11 record close of $59.41 through May 13. Walton said concerns over test-flight delays and insider trades, which led to him downgrade the stock on Feb. 9, had pressured the stock.

But with Saturday’s test flight, followed by two test flights this summer and a revenue-generating flight for the Italian Air Force, near-term catalysts are “coming back into sight,” Walton said.

“These lay out a pathway to commercial flight operations in 2022, which are paramount for positive Ebitda [earnings before interest, taxes, depreciation and amortization],” Walton wrote in a note to clients.

And while insiders were active in selling shares over the past couple months, sales seem limited over the near term given that most of the remain insider stakes are in lockup through October.

He said the faster pace of an offering of commercial service by Blue Origin, founded by Amazon.com Inc.’s AMZN,

Blue Origin, which has put a seat on its first suborbital sightseeing flight scheduled for July 20 up for auction, said late Thursday that the highest bid so far was $2.8 million, as MarketWatch’s Nicole Lyn Pesce reported.

Walton said the fact that the auction has generated more than 5,000 bids from more than 130 countries reinforces the economic potential of the space tourism business, which has few competitors.

“Limited investible options to participate in the growing commercial space economy has created a supply/demand dynamic that has had an outsized effect on [Virgin Galactic’s] performance,” Walton wrote. He added that news of a resumption in flights and possible catalysts on the horizon “create and attractive re-entry point for the stock and supports out buy rating.”

The stock has lost 12.6% year to date, but has still rallied 40.9% over the past 12 months. In comparison, the S&P 500 index SPX,