Why trouble may loom for stock market if Cathie Wood’s ARK Innovation ETF fails to bounce

Cathie Wood’s ARK Innovation exchange-traded fund is significantly oversold and due for a bounce, but if it doesn’t get one the popular fund risks suffering a steeper decline that could spell some trouble for the broader market, says one chart watcher.

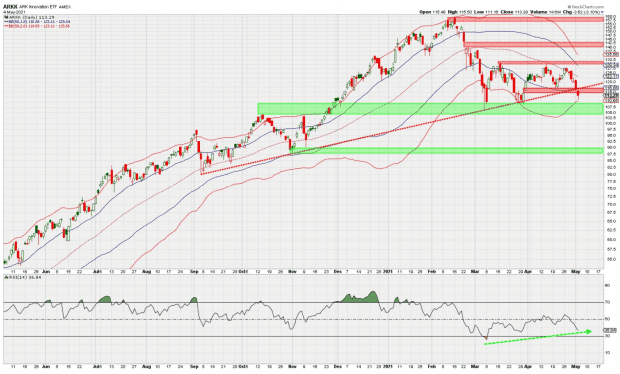

“With the big down day yesterday, ARKK actually violated a trendline that connected some notable lows going back to September, which isn’t ideal,” said technical analyst Andrew Adams, in a note for Saut Strategy on Wednesday. “It now

needs to recover this line quickly or risk breaking down in a possible waterfall decline.” (See chart below)

An attempted bounce on Wednesday fizzled, with the ETF ARKK,

ARKK and other funds focused on previously highflying growth stocks are sitting on huge gains since the pandemic-inspired bear market lows of last March, turning Wood, founder, chief executive and chief investment officer of ARK Investment Management LLC into one of Wall Street’s star stock pickers.

See: The Tom Brady of asset management? People love to hate Cathie Wood, but her funds get results

But more recently, they have come under heavy pressure as investors, betting on a broad U.S. economic reopening and the release of pent-up consumer demand this summer, have favored more cyclically sensitive sectors and value stocks.

A sharp selloff in high-profile tech shares sent the Nasdaq Composite COMP,

Read: Who sparked the tech-stock selloff? Blame the boomers

ARKK remains up nearly 103% over the last 12 months but is down 7.6% this week and more than 10% for the year to date, leaving it more than 30% below its 52-week high shy of $160 in February. Major indexes were mixed Wednesday, with the Nasdaq erasing a modest rise to end with a loss of 0.4% while the Dow rose 0.3% to finish at a record.

Adams was cautiously optimistic about prospects for a bounce.

“Many of the ARK and similar funds that hold high growth stocks are now trading between one and two standard deviations below their 50[-day moving averages] where buyers usually enter,” said technical analyst Andrew Adams in a Wednesday note for Saut Strategy. “I don’t think the market needs to go down any more, so a bounce attempt should occur given all the nearby support levels.”

But if a bounce doesn’t occur, “I think we’ll then have to be a little bit more concerned,” Adams wrote.

ARKK came close to hitting a band two standard deviations below the 50-day moving average on Tuesday, which means it is already oversold and hitting downside extremes, he wrote.

What are the implications for the broader market?

“If the high-growth areas start breaking support and taking the rest of the market down with them, then maybe the 3,980-4,000 zone in the S&P 500 will be retested after all,” Adams wrote. The S&P 500 finished at 4,167.59 on Wednesday, 1% off a record close of 4,211.47 set on April 29.

A test of support in the 3,980-4,000 area would mark a pullback of only 5% to 6%, but given the damage seen in other parts of the market could lead to “some huge losses” elsewhere, he said. “I’d rather avoid that, so for now I think we can use yesterday’s lows as a test to see if that represented a selling climax in much of the market.”