10-year Treasury yield falls below 1.5%, hits lowest rate since early March ahead of inflation report

Yields for the 10 and 30-year U.S. Treasurys Wednesday slid to their lowest levels in at least three months, ahead the U.S. May consumer-price index report due Thursday that could further help to shape expectations for policy at the Federal Reserve’s meeting next week.

The European Central Bank also will deliver a policy update on Thursday that could be watched for how it shapes the Fed’s thinking.

How Treasurys are performing

- The 10-year Treasury note yield TMUBMUSD10Y,

1.483% was at 1.489%, down 3.8 basis points and hitting the lowest level since March 3, Dow Jones Market Data show. - The 30-year Treasury bond TMUBMUSD30Y,

2.158% was at 2.168%, off 4 basis points from a day ago, and reaching its lowest level since Feb. 19. - The 2-year Treasury note TMUBMUSD02Y,

0.164% was yielding 0.155%, up 0.4 basis point.

What’s driving debt market?

For U.S. government debt markets the May reading of the U.S. consumer-price index due on Thursday morning is expected to be the main event of the week. The headline consumer price index is expected to rise by an outsized 0.5% in May and 4.8% for the year. A hotter-than-expected April CPI reading, which showed prices rose 4.2% year-over-year, briefly rattled markets last month.

Since then, inflation jitters have waned, but the CPI data is expected to provide an important test. Signs of unchecked inflation that is sustained could prompt the Fed to quickly halt its easy-money policies and more rapidly scale back its $120 million-a-month asset-purchase program that was installed to help stabilize financial markets during the worst of the coronavirus pandemic in 2020.

Meanwhile, a Wednesday auction of $38 billion in 10-year Treasury notes was described as “excellent,” and saw solid bids and heady demand, shrugging off concerns of rising inflation expectations and an important report on consumer prices due on Thursday.

In Europe, investors are betting that the ECB won’t slow the pace of its pandemic emergency bond purchases. Traders will be looking closely for clues about eurozone monetary policy plans and the potential for that to inform the Fed.

See: The ECB decision is coming. Here’s what analysts expect.

What strategists are saying

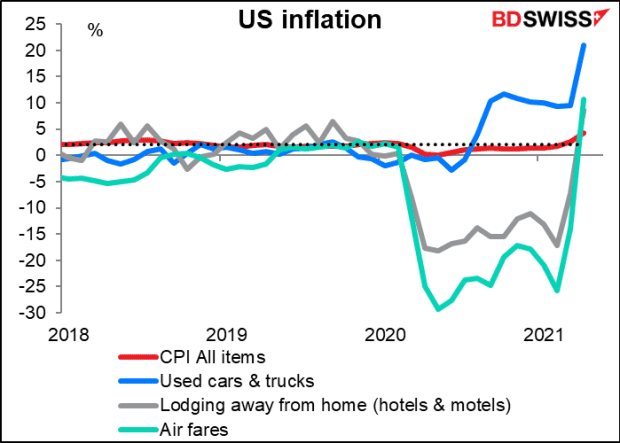

“So far though the story that [the Fed has] been telling seems to be largely correct: the higher inflation is mostly due to temporary supply/demand imbalances that occurred as the economy reopens and people go out and spend their stimulus payments. The poster boy for this phenomenon is used cars & trucks (blue line), writes Marshall Gittler, head of investment research at BDSwiss Group.