A big market transition is coming. Here’s where investors should steer next, says this strategist.

The COVID-19 delta variant is starting to look like the killjoy of summer.

So far, U.S. stocks haven’t seen a major response, even though Los Angeles is now suggesting masks indoors again. But given how the variant, first identified in India, has marched across some countries, a speed bump or two for the reopening trade over the next few months can’t be ruled out, especially if those cases start to take hold in the U.S.

Onto our call of the day provided by Liz Young, head of investment strategy at SoFi, a mobile-first personal finance company. She says we are headed for a big market transition in the latter half of the year — into calm waters and no big surprises.

“However, I think it’s going to feel like we need to eke out a little bit of return and it might feel hard won,” Young, former director of market strategy at BNY Mellon, told MarketWatch.

Looking back to last year, she said investors got used to big double digit gains in parts of the market as it rebounded, and noted the S&P 500 SPX,

“What I see happening in the second half of this year is that we have to start making this transition from the policy support — which has really gotten us to this point — back to the fundamental and durable strength in the market, in corporations, in the economy. So the data will start to matter,” said Young.

And the market is getting less and less impressed by super strong data, because that’s what it has come to expect.

As for where to invest, she advises thinking in terms of the year and the economic cycle.

“So I think for the rest of this year, we do see rates drift up, meaning the 10-year TMUBMUSD10Y,

As for the cycle, tech is still important because that sector is a “bet on American prosperity for the long term and it’s not going anywhere,” and something she wouldn’t “trade in and out of for the rest of 2021.”

She also sees continued improvement for small-cap stocks, given they were hardest hit in the pandemic and should keep bouncing back, with a healthy initial public offering market acting as a positive catalyst. European stocks, which are behind in that reopening trade, should also be a decent bet later in the year, notably as those indexes are rich in financials, which should benefit if global sovereign yields are headed higher.

Some final advice from Young has to do with trendy investments that have cropped up in the past year or so, such as meme stocks, crypto assets, special-purpose acquisition companies (SPACs), etc.

As she advised in a recent blog post, while it’s OK to invest in trendy assets, they shouldn’t “overwhelm the foundation of a durable portfolio, or cause you to redefine your risk tolerance just to ‘get in the game.’ “

Watching the delta variant and home prices to come

Stock futures are wobbling after fresh records for the S&P 500 SPX,

The S&P CoreLogic Case-Shiller U.S. home price index is ahead, along with consumer confidence.

The U.S. Justice Department is reportedly looking into Google’s GOOGL,

Entertainment group Disney DIS,

More than 10 million people are locked down in Australia, with Brisbane the latest city to impose restrictions as officials battle COVID-19 outbreaks linked to that strain. Good news from Israel though, as even amid surging infections, only one death has been recorded since mid-June. And Abu Dhabi is cutting off the unvaccinated public spaces and schools.

The chart

Our chart of the day sees a breakout from technology stocks ahead. It comes from the blogger behind The Market Ear, who highlights charts from Goldman Sachs and others.

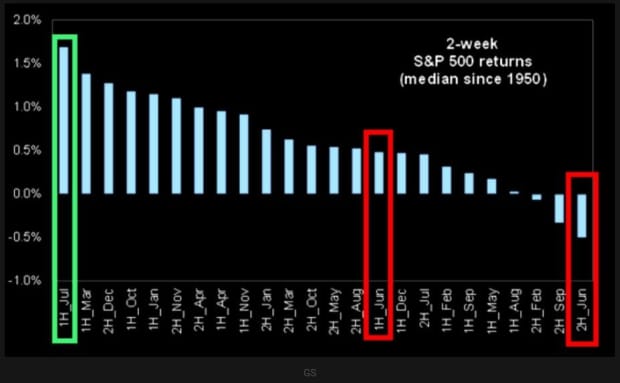

Historically, July’s first two weeks tend to be the year’s best, the blogger notes:

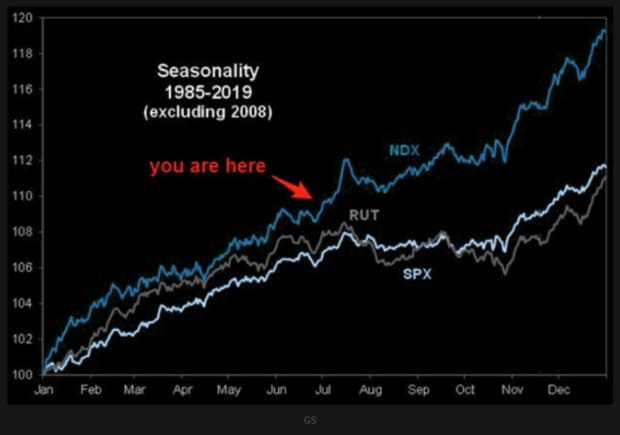

And after that initial two-week period, which the chart shows is just getting started, the Nasdaq tends to keep moving higher, while the S&P 500 and Russell 2000 RUT,

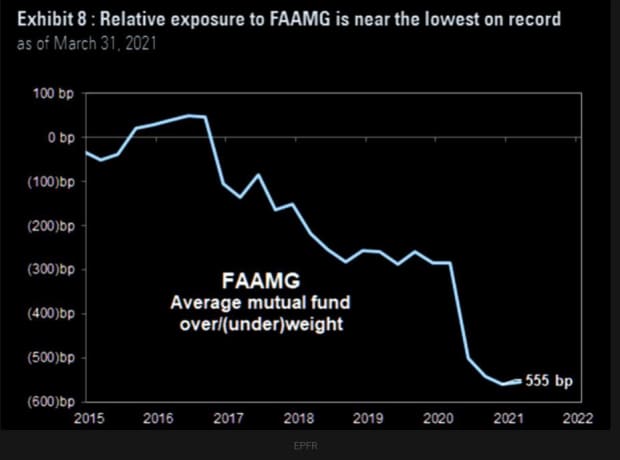

And that’s as relative exposure to tech stocks like Facebook FB,

Random reads

That gripping Euro 2020 soccer championship is producing winners off the pitch as well:

A Picasso painting stolen years ago, showed up in a gorge outside of Athens, Greece.

You needed this weepy, happy lost-and-found pet story.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.