Amazon is the world’s most valuable brand, but Alibaba and Facebook have better financials

Amazon.com has continued to grow at an excellent pace as it has branched out into new categories of products and services — but it isn’t the only company doing so.

Just in time for Prime Day, Amazon.com Inc. AMZN,

The top 10 companies on the list include four of the five “FAANG” stocks. The entire FAANG group is Facebook Inc. FB,

Only Netflix among the FAANGs was lower on the list, with a 24th-place ranking. Not bad.

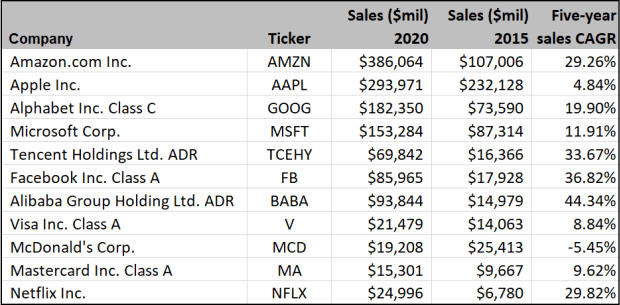

Here’s a look at how well the 10 most valuable brands (plus Netflix) have grown sales and free cash flow over the past five full calendar years.

Sales growth

For rapidly growing companies, investors typically don’t focus on earnings because the companies aren’t emphasizing profits. Key numbers for investors might include subscribers or other units, but one thing they all have in common is revenue.

Leaving the list of 10 most valuable brands in the order determined by Kantar BrandZ (and adding Netflix at the bottom), here are compound annual growth rates (CAGR) for sales over the past five full calendar years:

The raw numbers in this article are all in U.S. dollars.

Alibaba Group Holding Ltd. BABA,

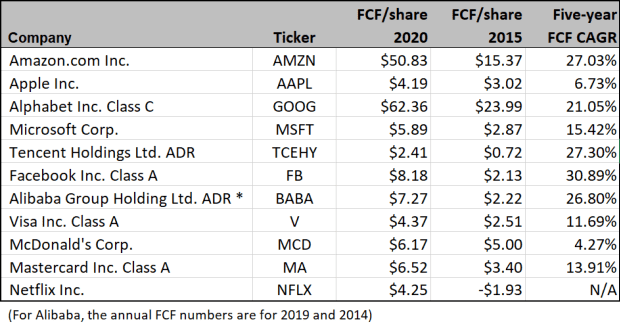

Free cash flow

Free cash flow is a company’s remaining cash flow after planned capital expenditures. It is an important number for investors because this is money that can be used for expansion or acquisitions. It can also be used to buy back shares and raise dividends.

Leaving the group of 11 companies in the same order, here are CAGR for free cash flow per share from calendar 2015 through 2020, except for Alibaba, for which the available annual numbers go from 2014 through 2019:

For free cash flow per share, Facebook is the five-year winner, with a CAGR of 30.89%. Once again, Apple and McDonald’s are in the single digits.

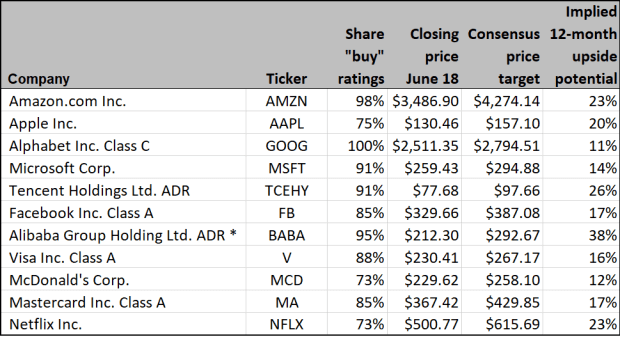

Wall Street’s love

Analysts working for brokerage firms base their ratings on their estimates for sales and earnings growth. They set 12-month price targets. That may be a short time frame, especially if you consider how rapidly most of these companies have been growing, and that any stock can have a bad year.

For this group of 11 valuable brands, Wall Street’s opinion is overwhelmingly positive.

Here’s a summary of Wall Street analyst’s ratings and price targets for this group of 11 stocks:

You should do your own research before considering any stock for investment, to form your own opinion of how well a company might compete over the next five or 10 years.

Don’t miss: Thhe largest player in this overlooked stock sector has a dividend yield of 9.7%