AMC Entertainment’s stock surge ripples through these ETFs

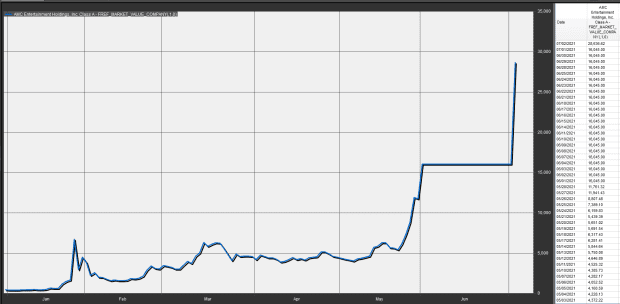

Shares of AMC Entertainment Holdings are locked in an unprecedented year-to-date rally that has the movie chain’s shares up over 2,300% in 2021, and the surge has a batch of exchange-traded funds on for the, wild stratospheric ride.

The SoFi Social 50 ETF SFYF,

AMC Entertainment AMC,

AMC’s stock was about 15% of the ETF to start Wednesday and had been around 5.5% originally, according to ETF.com.

The ETF rebalances monthly but the surge in AMC highlights the challenges that the social-media driven asset can play on funds and other investments.

Meanwhile, Invesco Dynamic Leisure and Entertainment ETF PEJ,

The Invesco Dynamic Leisure’s fund, which was up almost 8% Wednesday, had found itself at the start of the day with an AMC weighting of more than 10% but the surge is also likely driving the weighting even further. Booking Holdings Inc. BKNG,

Meanwhile, the VanEck Vectors Social Sentiment ETF BUZZ,

Meanwhile, the broader, non-meme market was trading flat, with the Dow Jones Industrial Average DJIA,

AMC’s big surge on Wednesday comes as the company said it was launching AMC Investor Connect to put it in direct communication with its “extraordinary base of enthusiastic and passionate individual shareholders,” to keep them up to date about company information, and to provide them with special offers.

That move comes as AMC’s retail shareholder base has grown to more than three million over the last several months, and owned more than 80% of the company’s shares outstanding.

AMC and GameStop have been favorites among individual investors on social-media platforms like Reddit and Discord. Those companies are among the batch of so-called meme stocks that soared during a frenzied rally in January. Meme assets are those that move on social media sentiment rather than financial fundamentals.